News & Insights

Economy at a glance

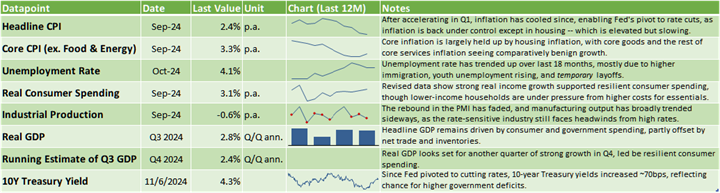

Figure 1: Key Indicators and Trends

The Fed joins global pivot to cutting rates, reducing headwinds to US economy

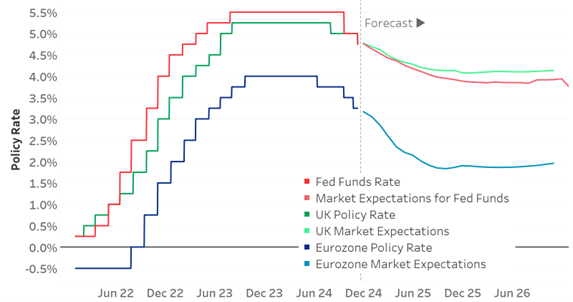

Q4 marks a pivot point for the economy. With the Fed’s preferred inflation rate (PCE) now at 2.1% and the unemployment rate rising above 4% on slowing demand for labor, its “Dual Mandate” of full employment and low inflation would seem to be as close as it gets to the “Goldilocks” zone. The Fed cut rates in September for the first time since 2020 and again early this month (Figure 2, red line). With these cuts, the Fed joined other major central banks, like the European Central Bank (blue line) and Bank of England (green line), that were already cutting rates as their own inflation and economies cooled.

Markets currently expect the Fed to get the fed funds rate just below 4% over the next 12 months, a drop of 1.5% in total. That’s good news.

Figure 2: Fed Joins Global Pivot to Rate Cuts

As of November 7, 2024; Sources: FactSet, Federal Reserve, and Nasdaq Economic Research

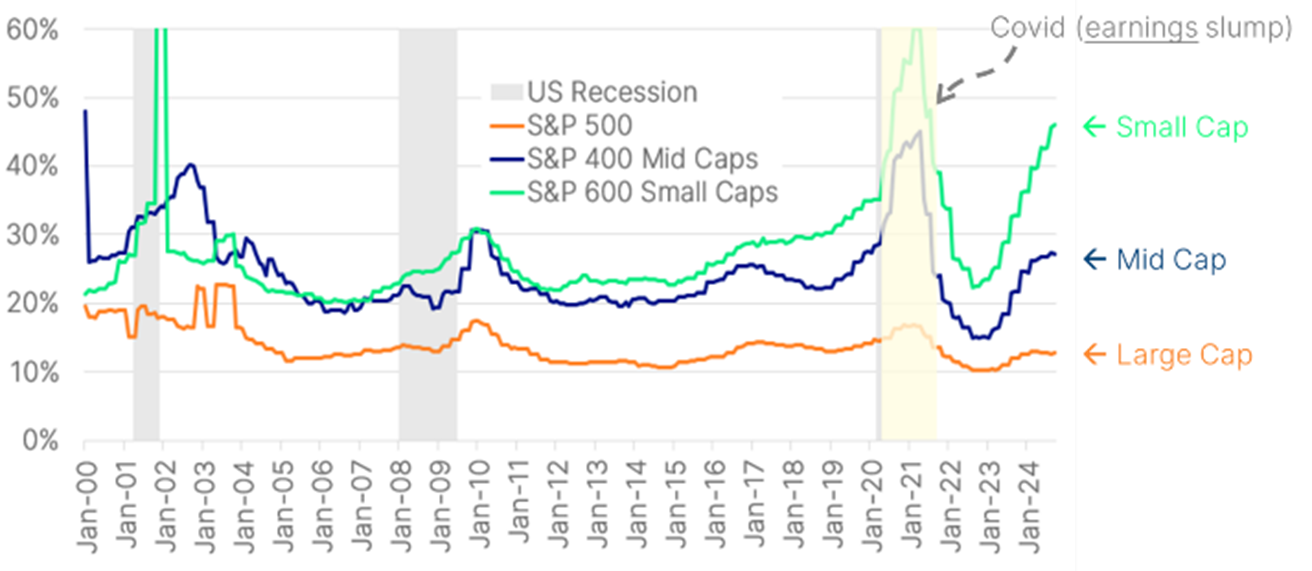

Lower rates are good news for small companies

Many homeowners, as well as large cap companies, have been less affected by higher rates than normal – after they locked in long-term fixed financing during the Fed’s zero interest rate period in Covid.

However, data shows fewer small companies were able to take advantage of those low rates. Data also shows that half of small business debt and nearly 40% of small cap debt are floating rates. That’s compared to just 7% for large caps.

Not surprisingly, the Fed’s higher interest rates have squeezed margins at smaller companies much more than at larger companies. In fact, the ratio of interest expense to earnings for U.S. small caps has more than doubled, from around 20% to over 45% (Figure 3, green line). This is also the highest the ratio has been this century, aside from a spikes caused by falling earnings during recessions. That makes falling interest rates good news for small companies. For those needing to refinance in 2026-2028, the expected reduction of 150 basis-points can’t come fast enough.

By comparison, mid-caps (blue line) and large caps (orange line), have seen much smaller increases in interest costs.

Figure 3: Interest Expense Share of Earnings Doubled for Small Caps in 2 Years

Sources: FactSet and Nasdaq Economic Research

Higher wages have reduced hiring, weakening the labor market

Many smaller companies also report being affected by higher wage costs. This was initially caused by post-Covid labor shortages and the “Great Resignation” seeing workers opt for higher paying jobs, but more recently by “inflation catchup” wage increases, especially in more skilled and higher paying roles.

High rates and wages have played a role in the earnings recession experienced by small caps over the past two years. Data indicates that small businesses have adjusted their hiring strategies to levels that are among the lowest since 2016 (Figure 4, blue line). Given that small businesses make up almost half of all U.S. employment, the overall national hiring rate has also declined, reaching its lowest point since 2013 (green line).

With inflation now near the target range, the weakening in the labor market is why the Fed pivoted to cutting rates. Fed Chair, Jerome Powell said, “We do not seek or welcome further cooling in labor market conditions,” during his Jackson Hole speech in August. In effect, with inflation largely under control, the Fed is now focusing on the other half of its dual mandate: full employment.

Figure 4: Hiring Plans & Hiring Rate Peaks with Fed Pivot to Rate Hikes

Sources: FactSet, BLS, NFIB, and Nasdaq Economic Research

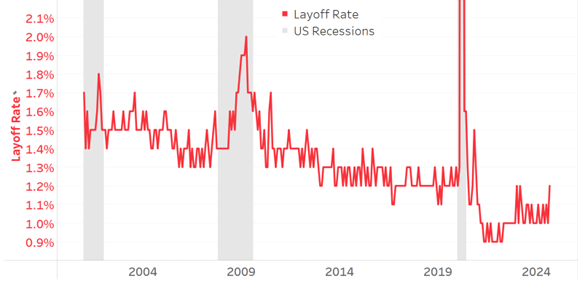

Low layoffs keeping labor market reasonably healthy

Although hiring has decelerated and unemployment is beginning to increase, the labor market is not entering a cycle of layoffs that reduce spending and lead to further layoffs, often resulting in a recession. Instead, the rate of layoffs continues to be close to the lowest it has been in the past twenty-five years (Figure 5).

Figure 5: Layoff Rate Near Historic Lows

Sources: FactSet, BLS, and Nasdaq Economic Research

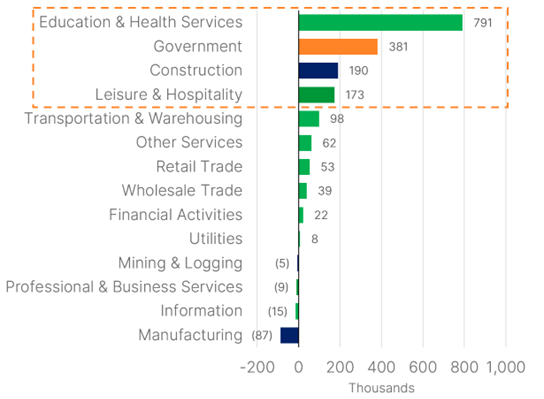

Looking at where job gains have come this year (Figure 6), we see that despite the manufacturing slowdown, the sector has barely reduced its workforce – a sign that finding the right worker for a job remains difficult.

The data also shows some sectors are still playing catch up from Covid-era job losses, including Education, Health Services, Leisure and Hospitality, and Construction. Construction has also benefited from the CHIPS Act and Inflation Reduction Act subsidizing chip factory building, along with the lack of existing home supply boosting demand for new homes.

Figure 6: YTD Job Gains (Thousands)

Sources: BLS and Nasdaq Economic Research

The higher unemployment rate over the last 18 months is instead due largely to people joining (and rejoining) the labor force, which should have a positive impact on spending over time.

The US economy remains uneven but strong

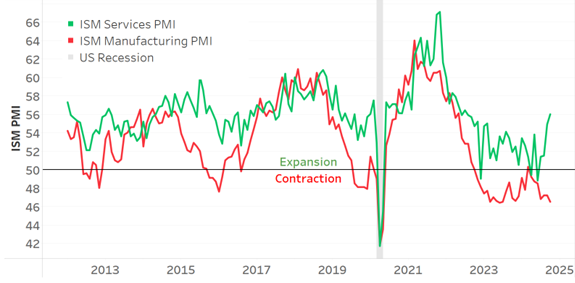

ISM PMI surveys confirm two things. First, post-Covid recovery in the US has slowed significantly. Second, the recovery also remains uneven with:

- Manufacturing PMI in contraction (below 50) for 23 of the past 24 months (Figure 7, red line)

- Services PMI in expansion for 21 of the past 24 months (green line)

However, because the Services sector is 6x larger than the Manufacturing sector, the US economy overall has weathered higher rates well.

Figure 7: Services Continues to Drive Economy as Manufacturing Contracts

Sources: FactSet, ISM, and NBER

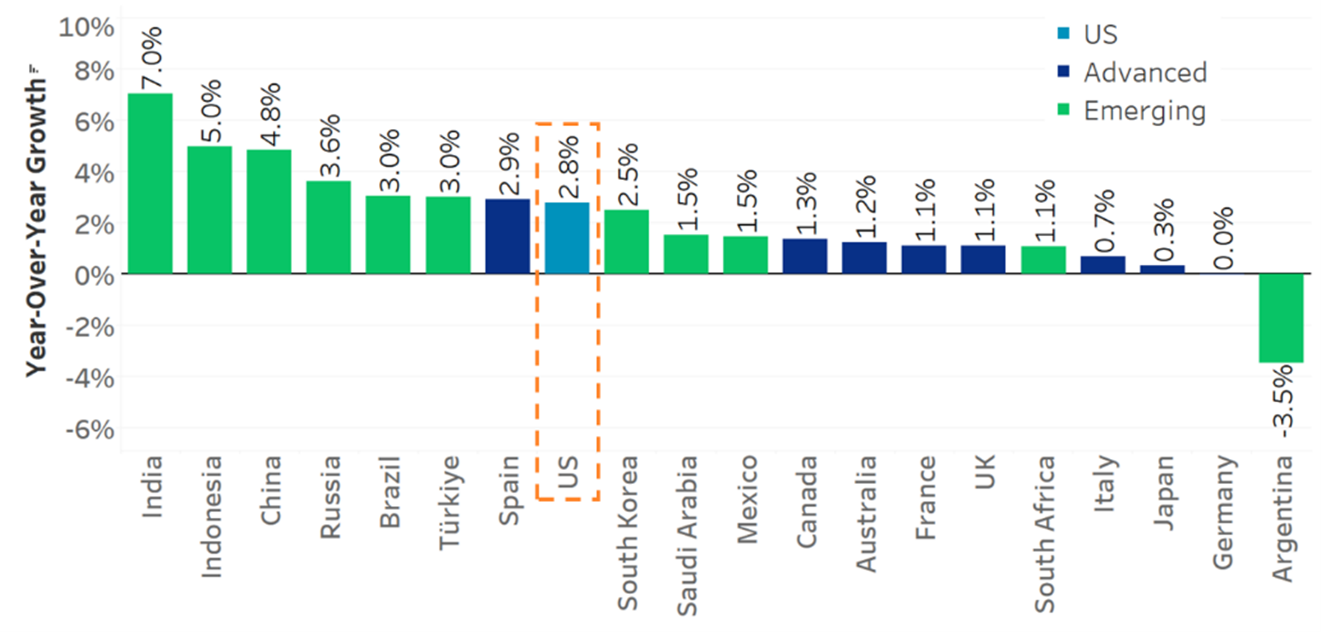

US among the strongest economies in the world

The US economy remains one of the strongest in the world. GDP is on track to grow 2.8% this year thanks mostly to US consumer spending (Figure 8) – helped by rising wages, as previously noted.

With the Fed’s pivot to cutting rates, smaller companies are set to benefit – given their exposure to floating rate debt – which will help boost the labor market and keep the economy in expansion. We may also see a recovery in manufacturing, if we follow how the UK has changed after their rates started to fall.

Given all this, a soft landing still looks likely, with the economy on pace for another year of solid growth. We will be watching the labor market to see if the pace of rate cuts might be faster or slower than the market currently expects. For now, the temperature in the economy seems to be just right.

Figure 8: 2024 Real GDP Growth Estimates

As of October 2024. Sources: IMF World Economic Outlook

5 Questions Board Members Should Ask Now

- How are we thinking about debt refinancing plans?

- Which parts of our business are the most rate sensitive and likely to benefit from Fed’s pivot?

- Are there any investments or growth opportunities we’ve put off that become feasible at lower rates?

- As consumers become more price sensitive, how do we maintain our margin if we can’t raise prices?

- What are our exposures to geopolitical risks and how can we mitigate them?

- How resilient are our supply chains to disruption?

To receive an exclusive video with further insights from Nasdaq’s Chief Economist and Senior Director of Economic Research, join the Nasdaq Center for Board Excellence. For the latest market insights, explore the Nasdaq Center for Board Excellence Resource Library and subscribe to Market Makers.

Latest articles

This data feed is not available at this time.