MACD Indicator

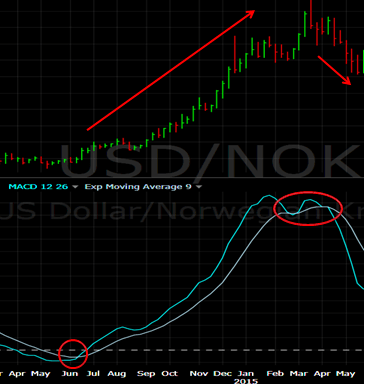

The MACD indicator stands for Moving Average Convergence Divergence. The way it is calculated is by taking the 26-day exponential moving average and subtracting the 12-day exponential moving average. A 9-day exponential moving average is then plotted on top of the MACD and can be a trigger for a buy or sell signal.

One way that a MACD indicator can be used is to signal when a trend has been formed, which happens when the faster and the slower moving averages crossover.

Be careful of the lag that can be associated with the MACD though, since it's based off historical moving averages.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.