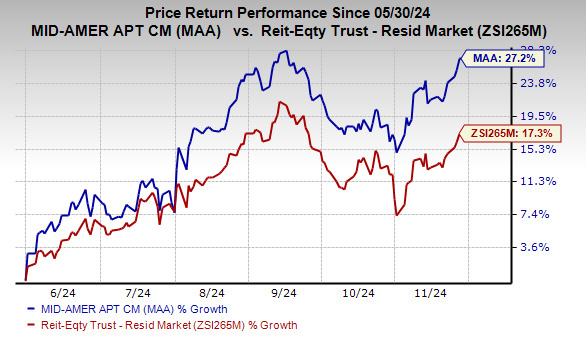

Shares of Mid-America Apartment MAA, which is commonly known as MAA, have rallied 27.2% in the past six months, outperforming the industry's growth of 17.3%.

This residential real estate investment trust (REIT), engaged in owning, acquiring, operating and selectively developing apartment communities, primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States, is poised to gain from the favorable in-migration trends of jobs and households in these submarkets.

Last month, this Zacks Rank #3 (Hold) company reported third-quarter 2024 core funds from operations (FFO) per share of $2.21, which surpassed the Zacks Consensus Estimate of $2.18. However, the reported figure fell 3.5% year over year.

Image Source: Zacks Investment Research

Let us decipher the possible factors behind the surge in the stock price.

Mid-America Apartment gains from its well-diversified Sun Belt-focused portfolio. The favorable in-migration trends of jobs and households in these submarkets keep renter demand up. Also, the high pricing of single-family ownership units in a still elevated interest rate environment continues to drive the demand for rental apartments. Due to this, MAA is expected to continue maintaining a high level of occupancy in the upcoming period.

This Sunbelt-focused apartment REIT opts for opportunistic investments to maintain the right product mix and raise the number of apartment communities in dynamic markets. As of the end of the third quarter of 2024, it had eight communities under development. Amid the growing demand for apartment housing across its Sunbelt markets, the company’s focus on its development pipeline is a strategic fit.

MAA continues to implement its three internal investment programs — interior redevelopment, property repositioning projects and Smart Home installations. The programs will help the company capture the upside potential in rent growth, generate accretive returns and boost earnings from its existing asset base.

MAA enjoys a solid balance sheet, with low leverage and ample availability under its revolving credit facility. As of Sept. 30, 2024, MAA had $805.7 million of combined cash and available capacity under its unsecured revolving credit facility. It also has a low Net Debt/Adjusted EBITDAre ratio of 3.9. In the third quarter of 2024, it generated 95.8% unencumbered net operating income, providing the scope for tapping additional secured debt capital if required. Hence, the company is well-positioned to bank on growth opportunities.

Solid dividend payouts are arguably the biggest enticements for REIT shareholders, and MAA remains committed to that. In the last five years, MAA has increased its dividend seven times, and its five-year annualized dividend growth rate is 10.48%. Backed by healthy operating fundamentals, its dividend distribution becomes sustainable.

Risks Likely to Affect MAA’s Positive Trend

Competition in the residential real estate market with various housing alternatives like manufactured housing, condominiums and the new and existing home markets is concerning. This affects the company’s power to raise the rent or increase occupancy, as well as leads to aggressive pricing for acquisitions.

Although MAA’s robust development and redevelopment pipeline is encouraging for long-term growth, supply-chain constraints could lead to cost overruns. This is likely to weigh on the company’s profitability.

Stocks to Consider

Some better-ranked stocks from the residential REIT sector are Equity Lifestyle Properties ELS and Independence Realty Trust IRT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Equity Lifestyle’s 2024 FFO per share is pegged at $2.92, suggesting year-over-year growth of 6.2%.

The Zacks Consensus Estimate for Independence Realty Trust’s 2024 FFO per share stands at $1.14, indicating a marginal decrease from the year-ago reported figure.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpMid-America Apartment Communities, Inc. (MAA) : Free Stock Analysis Report

Equity Lifestyle Properties, Inc. (ELS) : Free Stock Analysis Report

Independence Realty Trust, Inc. (IRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.