M-ELO: The Final Hour of Trading

By Andrew Oppenheimer, Associate Vice President

Since launching in 2017, Nasdaq’s Midpoint Extended Life Order (M-ELO) has been at the forefront of a new wave of order-type innovation. It has reliably provided market participants with evolved performance under a variety of market conditions and within many differing strategies. In a recent series of articles, analysts at Burton-Taylor international consulting analyzed the evolution of mid-point orders and highlighted the growing number of use cases of these new order types as well as the extent to which Nasdaq’s M-ELO has outperformed other midpoint offerings in a variety of market conditions and trading scenarios.

As part of an ongoing initiative at Nasdaq to highlight the various benefits of utilizing purpose-built order types, such as M-ELO, under a variety of trading circumstances, it is worth taking a deeper dive into the efficacy of midpoint orders – not in terms of how they are implemented, but rather, when.

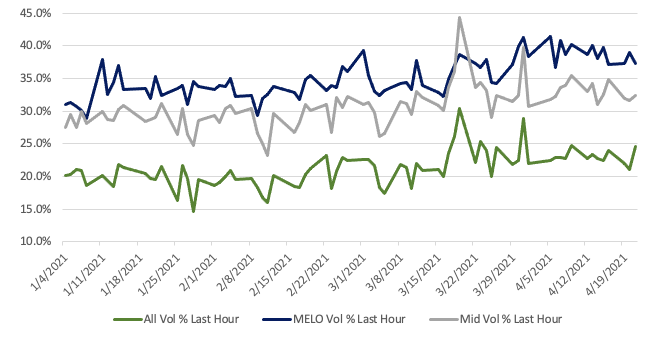

Historically speaking, trading volume distribution over the course of a given trading day is biased towards the open and close. In particular, the final hour of trading leading into the closing auction has had an outsized concentration compared to other intra-day intervals. Looking to 2021 year-to-date volume within the Nasdaq ecosystem, an average of 21.2% of total volume was traded within the final hour of trading and peaked over 30% just this past March (Exhibit 1).

Exhibit 1: Nasdaq Volume Analysis (Final hour of trading)

A natural consequence of the concentrated trading during the closing hour is a significant uptick in volatility. For traders and algos placing limit orders, this can be of particular concern in their desire to shield themselves from being adversely selected. M-ELO was designed to protect investors from fast-moving market conditions, and so it makes sense that 35% of total M-ELO volume occurred during the final hour of trading on average for 2021.

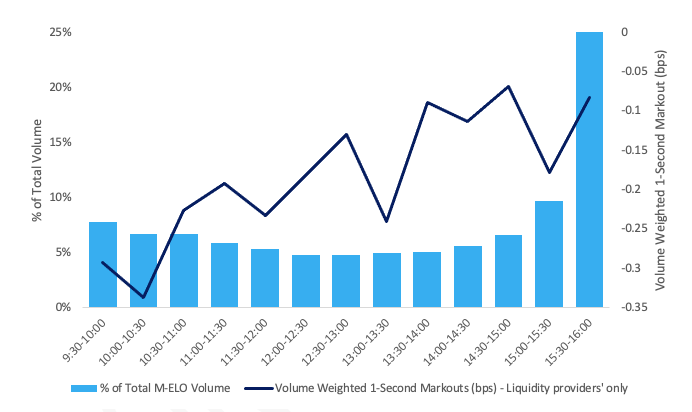

Exhibit 2 takes a closer look at how M-ELO performs during this crucial trading hour for the period between March 1 -31, 2021, when volume was most concentrated. What is encouraging for users of M-ELO is a clear inverse relationship between per-share markouts and volume concentration heading into the closing auction. For traders utilizing M-ELO during the final hour of trading in which price fluctuations are at their most severe, M-ELO benefited users with an average per-share markout of just .075 basis points. In other words, M-ELO worked best when traders needed it most.

Exhibit 2: M-ELO Intraday Volume Distribution and Per-Share Markout (1-second)

The growth momentum of M-ELO among market participants within the Nasdaq ecosystem, coupled with the significantly improved performance of the order type since reducing the resting period from 0.5 seconds to 10 milliseconds last year, speaks to a wider trend reshaping the U.S. equities trading landscape. While other venues are just now catching on to the shift towards holistic execution quality for investors and away from a myopic focus on speed, Nasdaq has long been a market leader in order quality innovation and finding new ways of matching like-minded investors.

Achieving this takes a combination of vision and a willingness to continue to improve on what is already successful. Given the significant outperformance of M-ELO against comparable midpoint order-types since reworking the resting time, clients can rely on Nasdaq to continue to improve upon its purpose-built solutions such that they always deliver the performance required regardless of how or when an order is executed.