Lumen Technologies, Inc.’s LUMN shares have slipped 13.7% in the past month compared with the S&P 500 composite and sub-industry’s decline of 4.1% and 8.5%, respectively.

Price Performance

Image Source: Zacks Investment Research

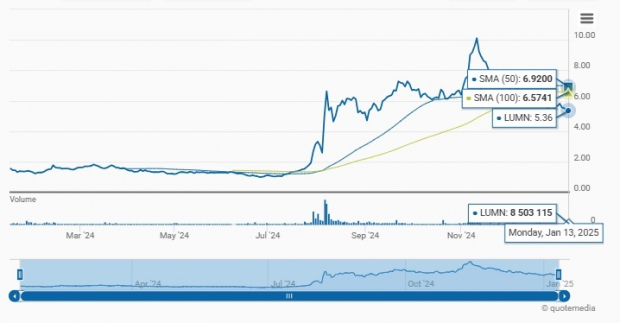

Closing at $5.36 as of yesterday’s trading session, LUMN stock is currently trading 48.1% below its 52-week high of $10.33 attained on Nov. 11, 2024.

After a sharp rally (up 237%) over the past year, is the recent price decline a normal market correction or suggests troubles ahead? The stock’s recent volatility raises questions about its future trajectory. Let’s discuss the stock’s pros and cons and explore whether this dip signals caution or opportunity for investors.

Legacy Business Woes & Higher Costs Concerns for LUMN

Lumen continues to witness weakness in the legacy business. In the third quarter of 2024, Lumen’s total revenues declined 11.5% year over year to $3,211 million. This decline was due to the negative impact of divestitures, commercial agreements and the sale of the CDN business. As Lumen shifts toward newer growth products like fiber and cloud-based offerings, the secular headwinds in the legacy business will continue to prove a strain on the top-line expansion, at least in the near term.

Incremental costs in expanding new business will likely prove a drag on the margins. For 2024, Lumen continues to expect adjusted EBITDA in the band of $3.9-$4 billion and capital expenditures to be between $3.1 billion and $3.3 billion. Lumen added that given the overall business trends and initial cost impacts from the incremental Private Connectivity Fabric (“PCF”) sales, it expects 2024 EBITDA at the low end of the guided range.

The company continues to expect 2025 EBITDA to be below the levels of 2024, owing to the investments in transformation costs, along with higher startup costs for PCF sales and legacy revenue declines. Lumen expects EBITDA to significantly rebound in 2026 and register growth thereafter.

LUMN’s Worrisome Debt Load

LUMN has a debt-laden balance sheet. As of Sept. 30, 2024, the company had $2.64 billion in cash and cash equivalents with $18.142 billion of long-term debt compared with the respective figures of $1.495 billion and $18.411 billion as of June 30, 2024.

Unchanged Estimate Revision for LUMN

Analysts have kept earnings estimates for LUMN for 2024 and 2025 unchanged over the past 60 days.

Image Source: Zacks Investment Research

Moreover, the stock is trading below its 50-day and 100-day moving averages, implying that analysts have a bearish sentiment regarding the stock and it is likely to underperform in the near term.

Image Source: Zacks Investment Research

PCF Deals is an Encouraging Development for LUMN

Increasing demand for Lumen's PCF solutions amid rapid AI proliferation has been emerging as an encouraging development. Lumen has secured an additional $3 billion in incremental PCF deals, bringing the total to $8 billion in new PCF sales since June 2024. As AI surmounts various spheres, large companies across various industries urgently seek fiber capacity, which is becoming highly valuable and potentially scarce.

Lumen has inked deals with various tech giants, such as Microsoft MSFT, Amazon AMZN, Google Cloud and Meta Platforms META, to provide network capabilities for AI innovation.

Lumen raised its free cash flow guidance for 2024, driven by higher cash flows associated with PCF sales growth. For 2024, free cash flow is anticipated to be between $1.2 billion and $1.4 billion. Earlier, the company expected free cash flow in the range of $1-$1.2 billion.

Lumen’s strong network capabilities, integrated hosting and network solutions are likely to promote growth in the cloud business. Its managed and cloud services are key differentiators from other players in the market. Lumen highlighted that it has more than 400 customers currently using its Network-as-a-Service (NaaS) services. Earlier in the year it had launched two new NaaS solutions with private connections, Lumen Ethernet On-Demand and Lumen IP-VPN (Internet Protocol Virtual Private Network) On-Demand. These solutions are designed to provide users with private cloud connections and augmented data safety and security.

Lumen’s Momentum in Quantum Fiber Business

Continued investments in Quantum Fiber and enterprise business are positive. Lumen anticipates witnessing healthy momentum in the Quantum business in the upcoming quarters. The company added 43,000 Quantum Fiber subscribers, taking the count to 1 million in the reported quarter. In the third quarter, the company added 131,000 Fiber broadband-enabled locations. As of Sept. 30, 2024, the total enabled locations in the retained states were 4 million. The company is targeting to achieve 500,000 enabled locations in 2024.

LUMN’s Ambitious Cost Cut Plans

Lumen continues to progress with its turnaround and is striving to boost operational efficiency. The company is anticipating $1 billion in cost savings by the end of 2027 through planned infrastructure simplification across the network, product portfolio and IT. It is looking to integrate the network across all four different architectures by engineering them into one simplified, standardized network fabric. This integration will also aid in product portfolio simplification. Management expects to significantly reduce the product count from thousands of product codes to a target of nearly 300.

LUMN’s Compelling Valuation

From a valuation perspective, LUMN is trading at a massive discount. Going by its trailing 12-month price-to-sales ratio, it is trading at a multiple of 0.4, much below the industry’s ratio of 9.71.

Image Source: Zacks Investment Research

How to Strategize LUMN Stock?

Though opportunities presented by the rapid proliferation of AI are positive, tight competition in the AI space could prove to be an impediment. Massive debt load and pressured top line remain concerns despite discounted valuation.

Lumen is trading below the 50-day and 100-day moving averages, implying that analysts retain a bearish sentiment for the stock. Consequently, it might not be a prudent investment decision to bet on the stock at the moment, which carries a Zacks Rank #3 (Hold). For new investors, waiting for a better entry point could offer a more attractive opportunity to invest in this stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Lumen Technologies, Inc. (LUMN) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.