LPL Financial Holdings LPLA is expected to witness a persistent rise in operating expenses. Also, the volatile performance of capital markets will likely hurt its commission revenues.

LPLA has steadily recorded a rise in operating expenses over the past several years. The metric has witnessed at a compound annual growth rate (CAGR) of 14.6% over the past five years (2017-2022), with the trend persisting in the first quarter of 2023.

Expenses are expected to keep rising as the company continues to increase headcounts and compensation and benefits costs. This, along with strategic acquisitions and steps taken to upgrade technology is expected to keep expenses elevated. We anticipate total expenses to witness a CAGR of 9.2% over the next three years ending 2025.

A substantial portion of LPL Financial's revenues comes from commissions, which comprised 25% of total revenues in the first quarter of 2023. The performance of capital markets has been volatile over the past few years. While the company’s commission revenues increased in 2021, the same witnessed a decline in 2022. While we project commission revenues to increase 9.7% and 8.4% in 2023 and 2024, respectively, the same is likely to be negatively impacted in the future if there is a slowdown in market activities.

As of Mar 31, 2023, goodwill and net intangible assets accounted for 25.6% of total assets. The goodwill and intangible assets on LPL Financial’s balance sheet are subject to annual impairment reviews. Several factors may initiate the impairment of the book value of such assets, due to which their value may have to be written down. This is likely to adversely affect the company’s financials.

Further, analysts are pessimistic about the stock’s earnings prospects. The Zacks Consensus Estimate for LPLA's 2023 and 2024 earnings has been revised 1.3% and 2.6% downward, respectively, over the last seven days. The company currently carries a Zacks Rank #4 (Sell).

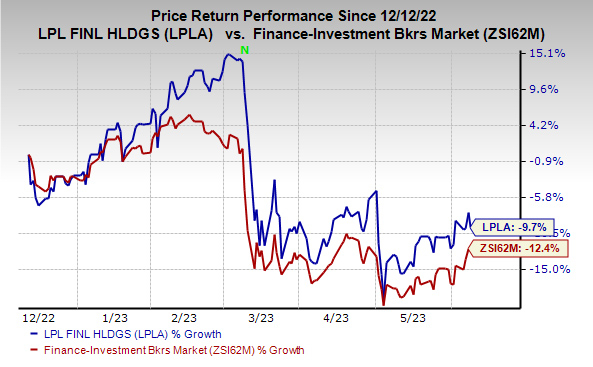

In the past six months, shares of LPLA have fallen 9.7% compared with the industry's 12.4% decline.

Image Source: Zacks Investment Research

Despite the above-mentioned headwinds, LPLA is well placed to grow organically and inorganically. Its advisory revenue growth is likely to continue in the near term, driven by the company's recruiting efforts, strategic acquisitions and solid advisor productivity. Also, due to the solid capital position, the company is expected to continue to be able to sustain capital deployments.

Finance Stocks Worth a Look

A couple of better-ranked stocks from the finance space are HomeTrust Banshares, Inc. HTBI and JPMorgan Chase & Co. JPM.

The Zacks Consensus Estimate for HomeTrust Banshares’s current-year earnings has been revised 7.7% upward over the past 60 days. Its shares have gained 20% in the past month. Currently, HTBI sports a Zacks Rank #1 (Strong Buy).

JPMorgan also currently sports a Zacks Rank #1. The consensus mark for the company's 2023 earnings has been revised marginally upward over the past seven days. In the past six months, JPM shares have rallied 4.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

HomeTrust Bancshares, Inc. (HTBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.