10-year rates keep rising this week without very clear driver

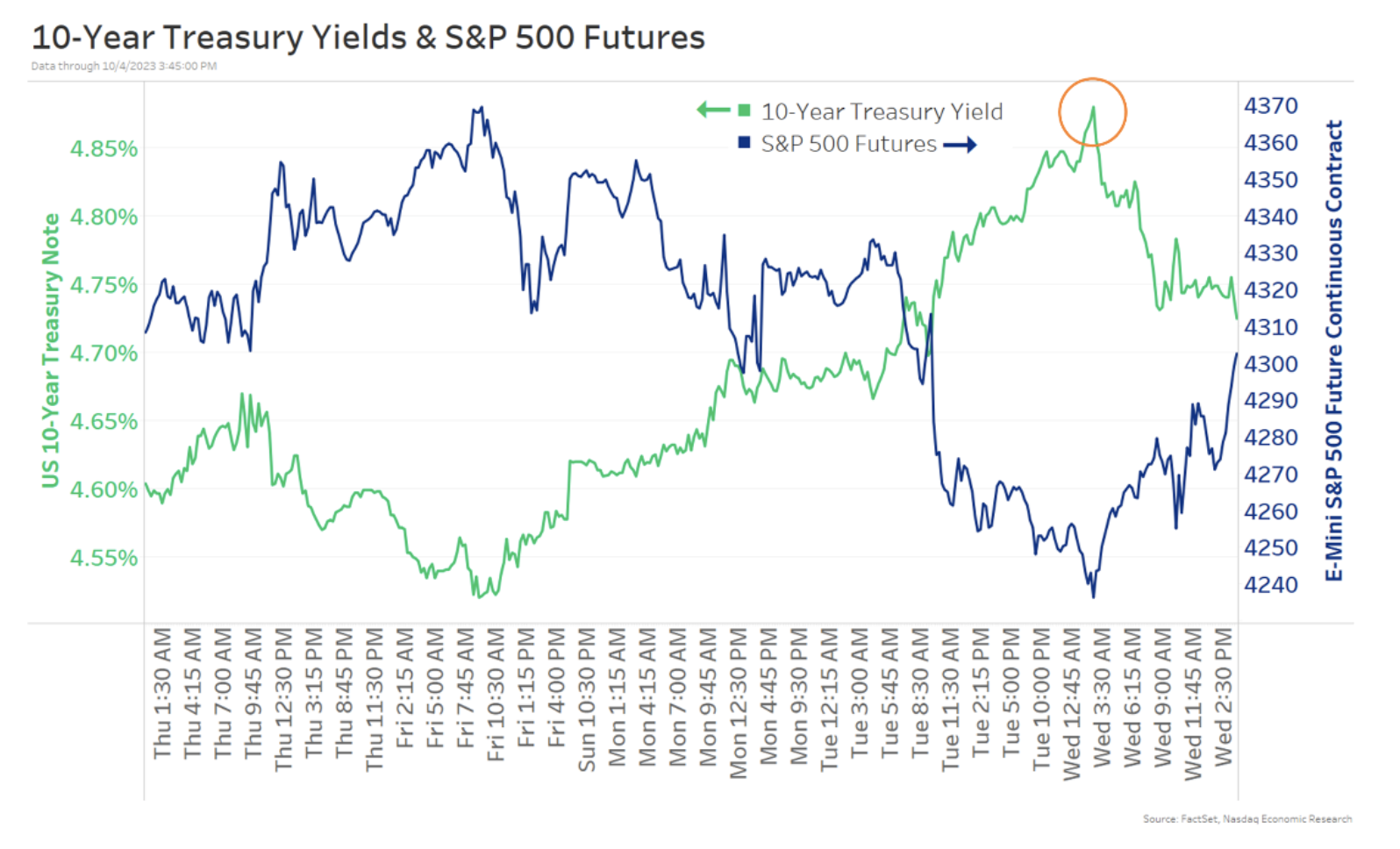

Last Friday, we wrote about 10-year rates rising 50bps in September to 4.6%. This week, they got as high as 4.9% (orange circle).

And with rates rising as much as this, stocks valuations have been affected – with the market falling each time rates increased recently (blue line).

Trouble is, it’s not totally clear why

Importantly, there hasn’t been much new economic data that has been impactful – let alone a sign of economic strength persisting or increasing.

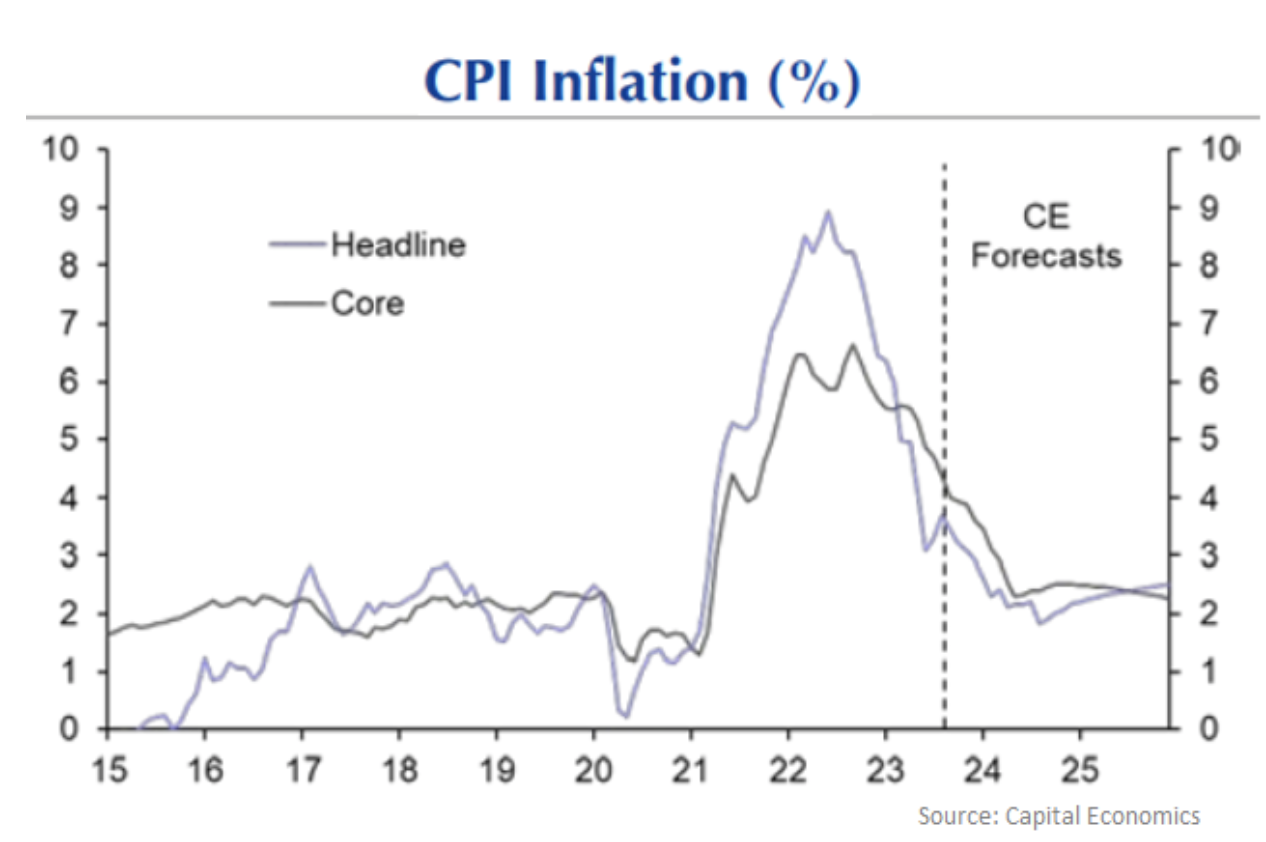

Nothing about inflation has changed since Friday (when core PCE inflation saw its smallest monthly increase since 2020). In fact, the former Fed Chair (and current Treasury Secretary) Janet Yellen recently questioned whether higher for longer rates will be necessary, given the disinflation we’ve seen.

And Capital Economics estimates inflation will keep slowing from here (chart below), nearing the Fed’s target next year.

That is a key excuse for the Fed to let rates fall soon.

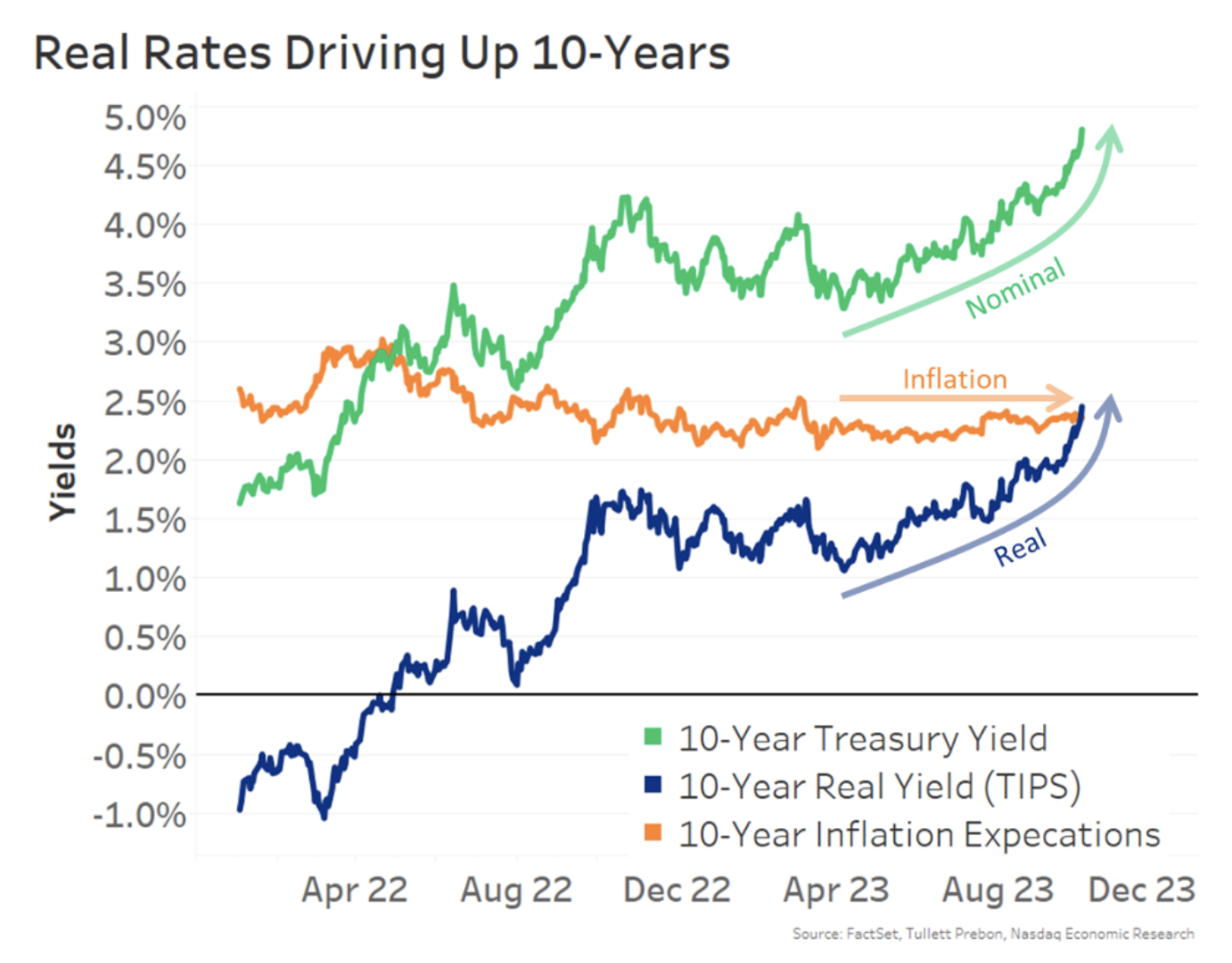

Real rates rising in recent months on soft landing hopes

In fact, real 10 year rates are already well above expected long-term inflation. Since April, inflation expectations have been mostly unchanged, at around 2.5%.

That means “real” (after inflation returns) rates have gone from negative (-1.0%) in 2022, to almost +2.5%.

That’s partly because the economy is strong. In the last few months, there’s been plenty of strong economic data (low unemployment, resilient consumer spending, upward revisions to business investment). That in turn means we don’t need negative real rates any more to avoid a recession.

Since Friday, though? Nothing major.

In fact, 2.5% real rates seem unsustainable (unless you’re a major AI optimist), given the demographics most western economies are facing. An aging population means lower labor force growth, which means less output, as well as lower demand for new homes and whitegoods (major appliances) – leading to a generally slower economy. We wrote about this here.

So what’s going on?

One theory is that maybe the Fed unwinding their balance sheet has affected bond supply and demand.

On the demand side, Fed QT means the Fed is no longer buying long-term bonds, removing a major source of Treasury demand – that had been pushing bond prices up (and yields down).

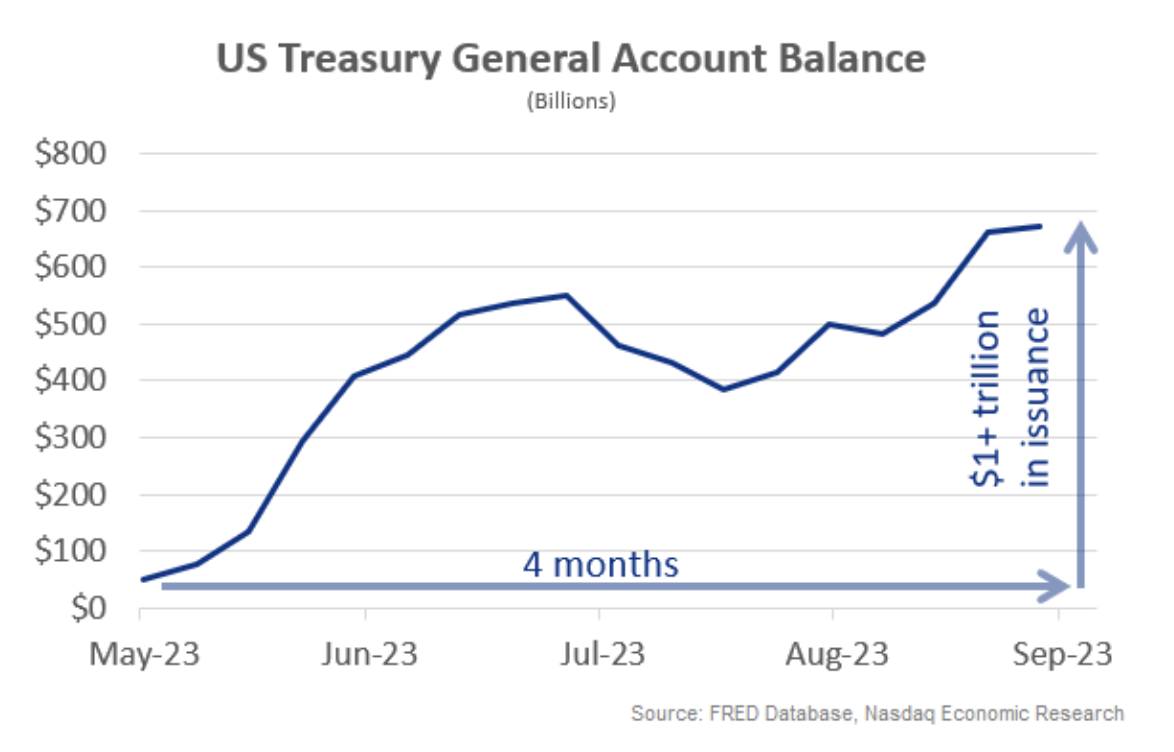

At the same time, the Federal deficit means the Treasury needed to borrow a lot of money to fund the government. It does that by issuing bonds. Data suggests well over $1 trillion in Treasuries have been issued since the debt ceiling was suspended, pushing its account balance from $49 billion to $672 billion in just four months (chart below).

Lower demand and more supply both cause bond prices to fall. And when bond prices fall, rates rise (as the bond will still return it’s “face value” on maturity).

Despite the logic of this, it may not be a huge factor, especially this week, since Treasury auctions have gone smoothly in recent months.

It’s politics?

Another theory is that the debt ceiling and now the government spending bill debacle have dented confidence that the government can tackle our long-term debt problems.

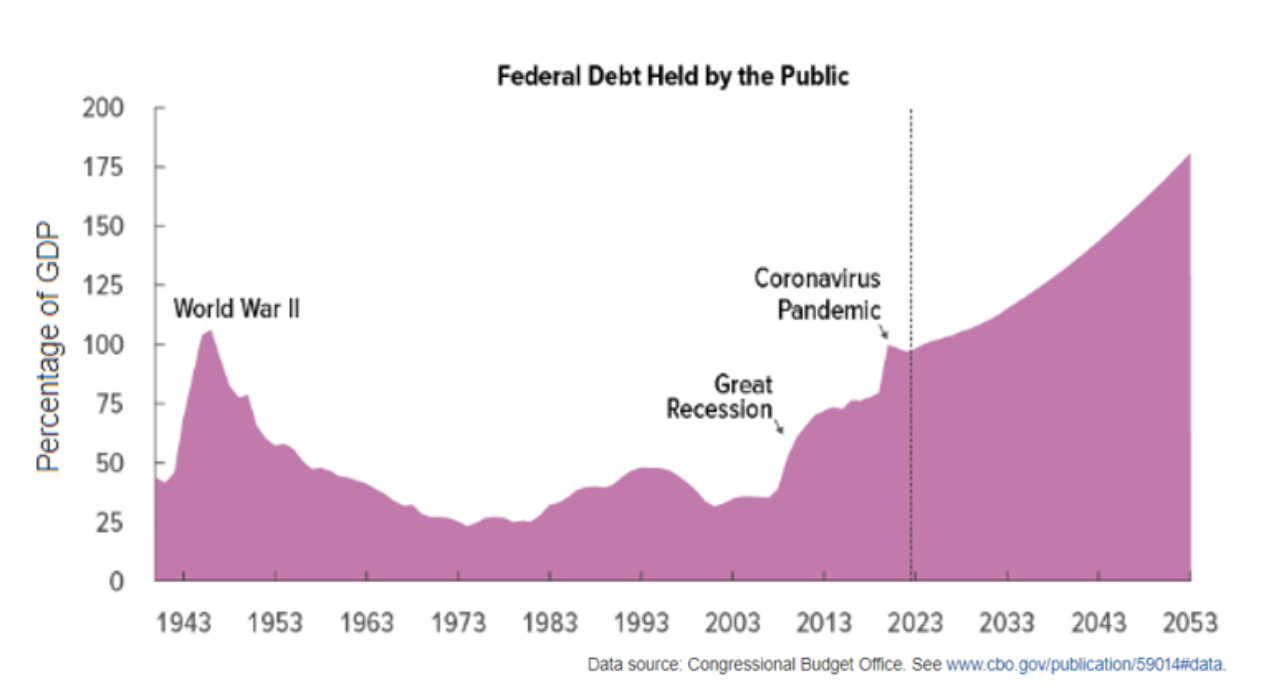

It’s true that the US debt-to-GDP ratio is expected to grow from about 100% now to 180% by 2053 (chart below), increasing the amount of money just servicing debt (as a share of GDP) from 2.5% to 6.7%. That means even more of our taxes will be required just to pay the interest.

Rational investors should require the US to pay higher interest to compensate for increased risk of default. But this is a large change considering the US economy remains strong – and seemingly financially strong enough to pay its debts. And in reality, rates fell slightly after the ouster of McCarthy as House Speaker.

Maybe it’s just a market overreaction?

Here are the facts

- Unemployment is rising

- Wages and quits are falling

- Inflation is trending lower

- Core inflation is already below the Fed funds rate (the positive real rates we saw earlier)

So the economy is clearly cooling.

Plus, if inflation keeps falling, the Fed will need to cut just to keep real rates unchanged. And if we get a recession, the Fed would need to cuts rates even more quickly.

In short, it’s hard to see why long rates are up so much this week.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2023. Nasdaq, Inc. All Rights Reserved.