Shares of Legend Biotech Corporation LEGN rose 14.2% on Oct 18 after management announced preliminary sales figures for its multiple myeloma therapy, Carvykti (ciltacabtagene autoleucel), for third-quarter 2022. The therapy has been developed in partnership with J&J JNJ.

Per an SEC filing by LEGN, Carvykti generated preliminary revenues of around $55 million in net trade sales. Carvykti, a B cell maturation antigen (BCMA) CAR-T therapy, was approved by the FDA for treating relapsed or refractory multiple myeloma in February 2022.

Carvykti has been developed as part of an exclusive worldwide license and collaboration agreement entered in 2017 with Janssen Biotech, a J&J company, to develop and market Carvykti. Per the agreement, J&J is responsible for marketing the therapy, while Legend Biotech will record collaboration revenues from J&J.

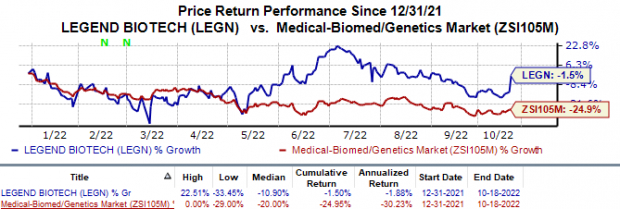

In the year so far, Legend Biotech’s shares have declined 1.5% compared with the industry’s 25.0% slump.

Image Source: Zacks Investment Research

Earlier this May, Carvykti was also granted conditional marketing authorization for relapsed or refractory multiple myeloma in the European Union.

Carvykti is also Legend Biotech’s first marketed therapy. The strong sales for a recently approved therapy like Carvykti will provide Legend Biotech with a stable stream of revenues, thereby allowing management to develop its other pipeline candidates targeting hematological malignancies and solid tumors.

Please note that the figures released by LEGN are preliminary and unaudited. Final results will be issued upon completion of its closing procedures and may vary from these preliminary estimates. The $55 million preliminary sales figure for Carvykti has been provided by J&J and is yet to be verified by Legend Biotech.

Carvykti faces stiff competition from Abecma, an FDA-approved CAR-T cell therapy for multiple myeloma developed by bluebird bio BLUE in collaboration with Bristol Myers BMY. Per the terms of collaboration, Bristol Myers has exclusive rights to market Abecma and in return, bluebird was eligible to receive royalties. Following bluebird’s separation of its oncology business into a new separate entity with effect from November 2021, the royalties receivable on Abecma product sales along with Bristol Myers partnership were transferred to the new entity as well.

Legend Biotech Corporation Sponsored ADR Price

Legend Biotech Corporation Sponsored ADR price | Legend Biotech Corporation Sponsored ADR Quote

Zacks Rank

Legend Biotech currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

bluebird bio, Inc. (BLUE): Free Stock Analysis Report

Legend Biotech Corporation Sponsored ADR (LEGN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.