Lazydays Holdings, Inc. LAZY recently announced its expansion in Wilmington, OH with the opening of Lazydays RV of Wilmington. The new location opening is a stepping stone for the company’s expansion initiative into the Northeast region. The Ohio location will act as a prime destination of sales and service needs for all the recreational vehicles (RV) occupants or operators in that area.

The new greenfield location of Lazydays RV consists of a modern indoor showroom and space to display more than 250 new and used RVs for sale. The facility space is of more than 12 acres. It houses the service department, comprising 20 service bays, which will deliver retail and warranty service work.

It also features a body shop/collision center, equipped with a 60ft paint booth. Furthermore, the inventory to the new location will be supplied by the following RV manufacturers — Tiffin, Thor, Forest River, Coachmen, East To West and Cruiser.

Lazydays’ Expansion Initiatives

Lazydays is focusing on continuous expansion in the prime markets through dealership acquisitions and greenfield locations. Since January 2020, the company has expanded its location reach from seven to 21 as of June 2023.

Lazydays has completed three acquisitions so far this year. On Aug 8, 2023, the company acquired Century RV in Longmont, CO, renaming the store as Lazydays RV of Denver at Longmont. This acquisition strengthened the market hold of Lazydays RV in Denver and about $50 million revenues annually are expected from this store.

On Jul 25, 2023, it acquired Buddy Gregg RVs & Motor Homes in Knoxville, TN. This acquisition offsets the loss incurred from the closing of its Maryville store. The store is renamed Lazydays RV of Knoxville at Turkey Creek and is expected to deliver $40 million of revenues, annually. Furthermore, on Feb 16, 2023, it acquired Findlay RV in Las Vegas, NV which is expected to deliver annual revenues of $40 million.

Moving ahead, the company expects to open additional greenfield locations, including Fort Pierce, FL and Surprise, AZ. The company believes that expansion of its current dealership facilities will generate incremental revenue opportunities in the coming period.

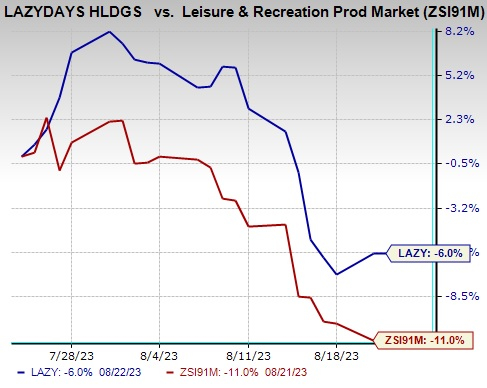

Image Source: Zacks Investment Research

Shares of LAZY have declined 6% in the past month compared with the Zacks Leisure and Recreation Products industry’s 11% decrease.

Zacks Rank

Lazydays currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks from the Consumer Discretionary sector are Royal Caribbean Cruises Ltd. RCL, Live Nation Entertainment, Inc. LYV and Strategic Education, Inc. STRA.

Royal Caribbean presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

RCL has a trailing four-quarter earnings surprise of 28.5%, on average. The stock has gained 154.8% in the past year. The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates growth of 54.5% and 180.3%, respectively, from the year-ago period’s levels.

Live Nation presently sports a Zacks Rank of 1. LYV has a trailing four-quarter earnings surprise of 34.6%, on average. The stock has declined 9.6% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS indicates a growth of 21% and 57.8%, respectively, from the year-ago period’s levels.

Strategic Education currently sports a Zacks Rank of 1. STRA has a trailing four-quarter earnings surprise of 12.1%, on average. Shares of the company have increased 13.8% in the past year.

The Zacks Consensus Estimate for STRA’s 2023 sales and EPS indicates a rise of 4.9% and 27.9%, respectively, from the year-ago period’s levels.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

LAZYDAYS HOLDINGS, INC. (LAZY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.