This article is part of the LatAm Tech Weekly Series, written by Julia De Luca and powered by Nasdaq. Through Nasdaq’s global network, we partner with Latin American companies to support their entire business lifecycle to elevate their brand and access the global markets. Learn more about Latin American Listings here.

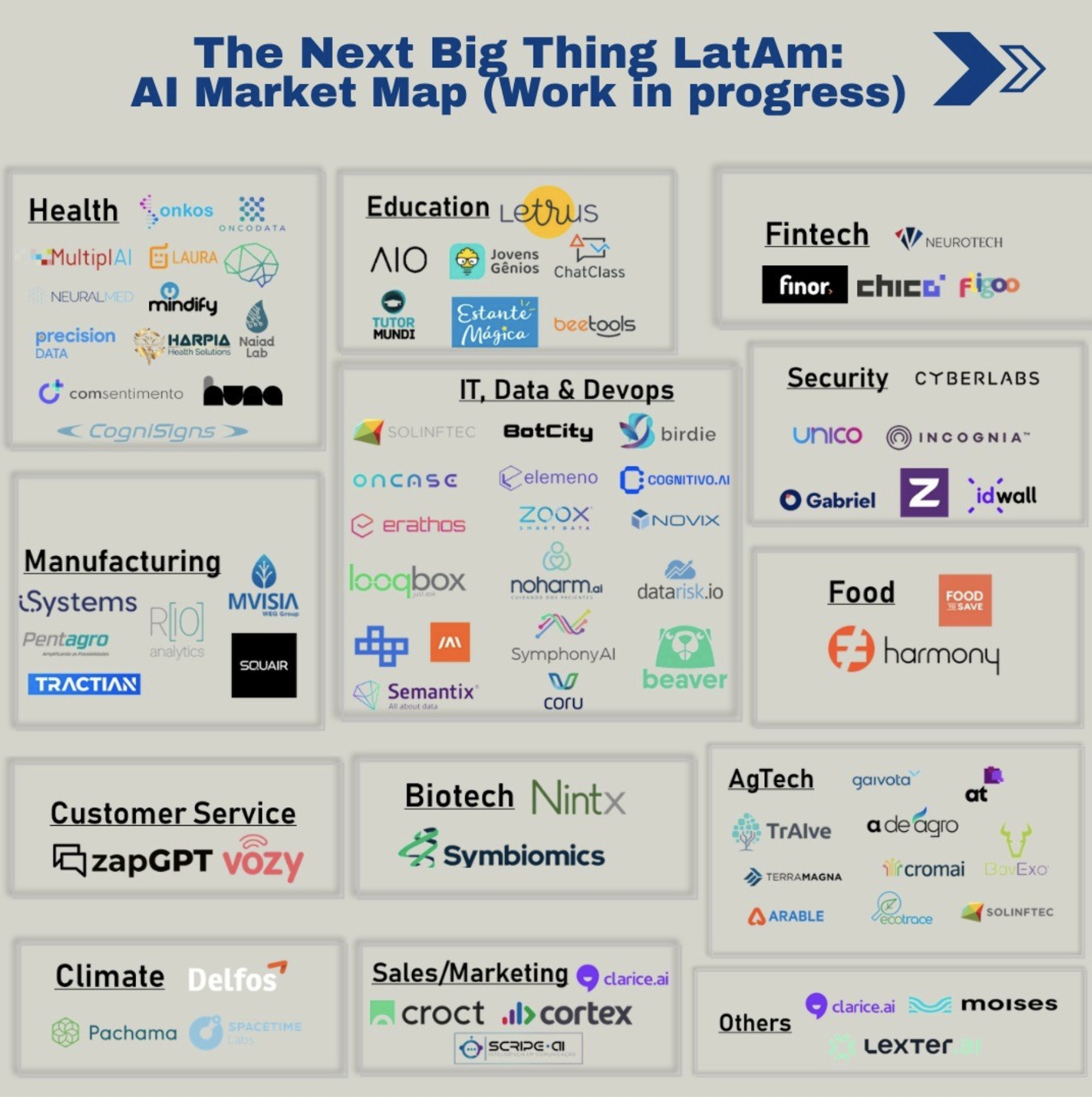

The Next Big Thing Deep Dive is one of my big personal projects for 2023. Together with Lucas Abreu, venture capital investor at Astella, every month we will be sending out a detailed report on one of the themes covered in our The Next Big Thing LatAm 2023 report released in the end of last year. We started out with AI - and the positive feedback exceeded our expectations. One of the interesting things that we did was the first LatAm Market Map on AI startups. After we released the report, several companies reached out wanting to be included. We therefore decided to update it for the benefit of the ecosystem! Note that this is a work in progress. If you think we are missing a company, feel free to reach out.

Thanks for reading LatAm Tech Weekly Subscribe for free to receive new posts and support my work.

Later this month we will be sending out a deep dive on Creators (topic picked by you on a poll I did a couple of weeks ago). Look out!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

On to the usual market update: yes, we are already in March. Time is flying by. After a good start to the year, global markets had mixed performance in February as inflation numbers started picking up again. The reality is that after years of favorable investments and a stable macroeconomic environment that led to increasingly higher valuations and faster revenue expansion, VC-backed companies now have to reckon with the new reality. A recent report by Pitchbook showed how revenue growth has decreased across the board in every sector:

It is true that deteriorating economic conditions impacted all sectors, but fintech startups saw the greatest decrease. From November to December 2022, there was a ~25% drop in revenue growth. In ecommerce was similar - while in 2021 these companies saw their sales grow by 84% in 2021, last year it was only 6%. Healthcare is proving to be the only sector not severely affected by the changing economic environment as healthtechs grew revenue on average by 23% and 22% in 2021 and 2022, respectively.

Finally, everyone in the industry is discussing how some of the valuations practiced in 2021 were unrealistic. There are growing concerns as to how long each startup will be able to “grow into their 2021 valuation”. With that, Pitchbook also released a Valuation Calculator: How fast does your startup need to grow?

How long it will take startups to catch up to their previous price depends essentially on four factors:

-

ARR at the time of the previous funding round

-

The revenue multiple of the previous round

-

A revenue multiple they could realistically fetch in the current environment

-

The current growth rate

Want to try it? Click here!

Monday

-

Brazilian Nuvini announced a merger with Nasdaq listed SPAC from Mercato Partners. Combined the newly established “Nuvini Group” will be worth BRL 1.6bn.

-

Saverin’s B Capital opens office in Miami, with an AUM of USD2.1bn. According to an interview with Bloomberg Línea, they will look to invest in LatAm tech startups as well, avoiding the AI hype and taking advantage of the down rounds.

-

The drop in venture capital investment in Latin America has left dozens of companies a step away from becoming unicorns. Who are the “Soonicorns”? Addi (Colombian fintech); Covalto (Mexican Fintech), Kueski (Mexican fintech); Xepelin (Chile Fintech), Frubana (Colombian, logistics), Kubo Financeiro (Mexican fintech), La Haus (Mexican proptech), Kovi (Brazilian logistics), Alice (Brazilian healthech), Dr. Consulta (Brazilian healthtech).

-

FinanZero, online credit marketplace based in Brazil, announced it has reached 40 million loan applications made through its platform to date.

The startup enables users to find and apply for the best deals on personal loans, carequity, and house equity from the 72 financial institutions (including major banks) that offer credit through the marketplace.

-

The “international PIX” project aims to include 60 countries to enable easy transfers internationally. The project was created by the Bank Of International Settlements (BIS) and is called “Nexus”. More to come on this theme.

-

Moni, startup from Argentina that provides financial services to consumers by offering various lending services such as loans, mortgages, credit cards, prepaid cards, and more, raised a USD 1.6mm undisclosed round with investors such as BACS Banco de Credito y Securitizacion, Banco de Servicios y Transacciones, Banco de Valores and First Capital Markets.

Tuesday

-

Brazilian HRTech Gupy announced the acquisition of Pulses, the largest employee success platform in Brazil. With Pulses, organizations will have access to a continuous listening platform, including real-time visibility into employee experience, sentiment, and productivity, to help drive engagement and improve organizational performance. This was an important milestone for Gupy as it continues its path to become the largest HRTech in the region.

-

The telecom provider TIM announced a partnership with Brazilian Upload Ventures creating a USD50mm dedicated fund focused on 5G. TIM will invest USD50mm, and the fund aims to raise another USD200mm. The objective is to invest in around 8 to 10 companies with a check of USD20mm-USD25mm. Upload’s main partners include Mario Moraes, Carlos Simonsen, Rodrigo Baer and Marco Camaji.

-

SoftBank announced it will focus its investments in Latin America on startups that are already in their portfolio, in order to help finance M&A amid a decline in the value of companies. About 50% of the capital will be invested in companies in which the group has an interest.

-

Brothers Thadeu and Felipe Diz - founders of Zee.Dog- joined forces with entrepeneur César Villares, co-Founder of Go4it Capital & 4M (Investment holding that has in this portfolio brands such as Strava, Fazenda Futuro, Sorare, Dazn, Better Drinks) to create CamelFarm Capital. The new global fund of BRL 100mm will focus on investing in Consumer Goods companies.

-

Chilean startup Rocktruck announced its first international move to expand its corporate logistics and e-commerce model. The 100% corporate delivery company has initiated activities in Peru, together with one of the largest retailers in the country, along with the opening of offices in Colombia.

-

Cubo Itau announced Bayer as its new partner in the healthtech vertical.

-

Mercado Libre partners with the Chilean startup Checkados due to the increase in online car sales in their platform. Checkeados will become an official store within MELI. The startup has more than 12,000 active posts and more than 400 vendors in the industry, making it one of the leading automobile portals in Chile.

Wednesday

-

Lavoro becomes the first retailer of agricultural inputs in Latin America to be listed on a US stock exchange, under the ticker LVRO at Nasdaq. The debut is the end of a long negotiation process with The Production Board (TPB), an investment firm focused on startups on food production, sustainability and technology. The transaction will take place through TPB Acquisition Corporation I, a SPAC of the TPB group. Bell ceremony took place on Friday.

-

CRM Bonus, Brazilian gift back platform invested by Riverwood, announced its new CFO: Guilherme Cervieri. Guilherme was VP at Unico IDTech and now will be responsible for M&As and the structuring of a possible IPO at CRM Bonus.

-

Brazilian Foxbit launched a platform called Foxbit Pro, which will focus on traders who operate cryptocurrencies on a daily basis. The system will offer 330 different tokens to trade with a global order book. To ensure greater liquidity than in traditional systems, the platform will provide access to 570 international order books.

-

After the success of its three initial phases, Open Finance in Brazil enters a new phase. Now, brazilians will be able to share their data with other entities thus allowing for new products and services - such as FX, insurance and pension plans.

-

IFood conducted a layoff of 355 employees (6.3% of the company’s total staff). The adjustment was made due to the current macro scenario, according to the company.

-

Nubank debuted this Wednesday its loyalty program through its own native cryptocurrency. Nucoin will function as a reward for customers deemed to be the most engaged on their platform. Customers will receive a fixed amount of Nucoins for every BRL 1 spent with debit and/or credit cards, in addition to a discount on the purchase of cryptocurrencies available on the platform.

-

Rankmi, independent platform that allows managers worldwide to measure and develop their leadership skills based in Chile, announced a Series A of USD 48mm with Softabank LatAm Fund.

Thursday

-

VTEX reported its 4Q2022 results. GMV continued to expand well in 4Q22, up 29% YoY. It was the company’s first profitable quarter ever (according to non-GAAP EBIT and FCF). This sends a positive sign that the company is on track to reach sustainable profitability by 4Q23. Its updated P&L breakdown also shows a very relevant operating margin evolution for existing stores (from 15% in 2021 to 22% in 2022).

-

After announcing their own new payment solution in Colombia, Belvo officially released its new open finance payment initiation solution for Pix in Brazil. This launch comes shortly after Belvo received authorization from the Brazilian Central Bank to become a payment initiation operator under the country's Open finance regulations. Instead of copy-pasting or scanning Pix codes, with open finance users can initiate Pix transactions directly through their bank accounts, with improved safety and fewer steps.

-

Tribal, B2B payment platform for SMBs originally from the Silicon Valley decided to leave the country after a little more than one year.

Friday

-

Mexican VivaWell, startup that offers a preventive and personalized health prevention and wellness platform for health insurance for corporations and individuals, announced a seed round of USD 1.6mm with undisclosed investors.

-

aMORA, Brazilian real estate platform that uses technology to help Brazilians in the process of buying their properties, announced a seed round of USD10.9mm with Goodwater capital. The company also raised USD 7.7mm in a debt round with CY Capital.

-

Loft conducted a layoff of 340 people (15% of the organization). Taking into account the 4 layoffs conducted by the company, total staff decreased by 50%. Loft aimes to breakeven by the end of the year.

-

Magazine Luiza announced a partnership with Mercado Bitcoin. By the end of this semester, clients of the Magalu fintech arm will be able to invest in crypto through MagaluPay.

-

Brazilian MindMiners, market analysis platform based on interaction in a proprietary social network, announced an undisclosed round of USD 0.6mm with Naia Capital.

-

Brazilian Bilipay, platform that specializes in providing financial services, announced a debt round of USD6.7mm with SRM Ventures.

What did I learn from readers?

Alessio Alionco, founder and CEO at Pipefy, sent over a very interesting article called Decoupling and Reckoning, by Elad Gil. It is a great summary of what I have been referring to every week in the newsletter. Very worth the read for those who like tech and want to understand what has happened in the recent past – and what to expect going forward. I have done a TL;DR version below for my readers. Hope you like it!

- During the last few years low interest rates and money printing led to a funding bubble in private technology. This led to an overhang of companies that either (1) lived without product market fit and survived well past their natural expiration point, or (2) hired way ahead of progress and burned large sums.

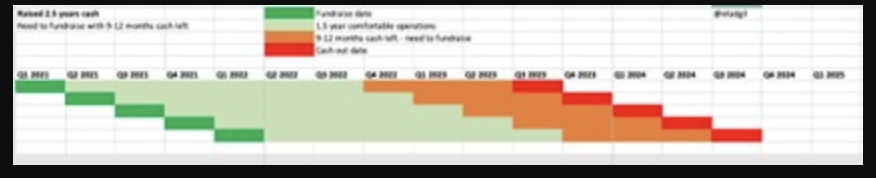

- Companies will probably start running out of cash in the end of 2023, since several companies raised 2-4 years of runway in 2021. Note that generally, a company needs to fundraise when it still has 9-12 months of cash left.

Assuming that the company raised 2.5 years of cash in 2021:

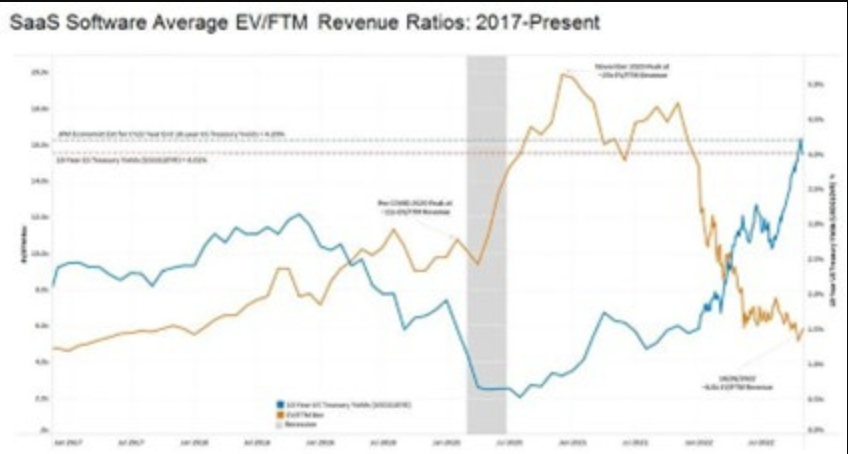

Multiples in the COVID era were the anomaly, not the 14 years prior. We are not going back to 2020-2021 valuation multiples (or anything close to it) until the next bubble.

Irrespective of recession or not, software demand is softening. Part of this is driven by overbuild and over purchase of software during the COVID era when many “digital transformations” were undertaken, capital was cheap and spending was not very ROI driven. With cost of capital going up and much corporate belt tightening, software spend is likely to continue to slow.

If your company has good underlying economics, can grow at a good rate, and is not dramatically overvalued, this could be a golden period for you as you soak up amazing talent and land great customers. If not there are 3 possible outcomes:

1. Shut Downs

2. M&A

3. Keep going (& in some cases re-setting valuation to realign incentives)

Other important observation:

- Growth rate impacts how long a company may be “stuck” relative to valuation. For example a company that raised at 50X ARR growing 20% will take 9 years to grow into its valuation. Resetting valuation may, in a subset of cases, be a way to realign these things for all shareholders. Everyone forgets that Facebook did a down round, and Square IPO’d under its last private round valuation, only to later grow well past it.

What am I reading?

-

Itau BBA (Thiago Kapulskis): ChatGPT and Generative AI Just Hype, or an Internet and Tech Disruptor?

-

The Information: How Thrive Capital founder Josh Kushner is building a VC empire

What am I listening to?

-

Fintech Leaders – Conversation with Bruno Balduccini, Pinheiro Neto Partner, on how Brazil become a global fintech leader and what other countries can learn from their success.

-

A16z Podcast: Creators, Creativity and Technology with Bob Iger

Quote of the week:

“Doublethink means the power of holding two contradictory beliefs in one’s mind simultaneously, and accepting both of them.” - George Orwell, 1984

Originally published on my Substack.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.