There has been lots of speculation around a potential initial public offering (IPO) from Klarna, which according to TechCrunch is the highest valued private fintech in Europe. The Swedish buy now pay later (BNPL) company is live in over 20 countries, and in May 2021 reported 90 million global active users, and 2 million transactions a day.

So will Klarna IPO? We don’t know. But what we can tell you is that based on our web traffic alternative data the company’s online performance is looking robust.

Key Takeaways

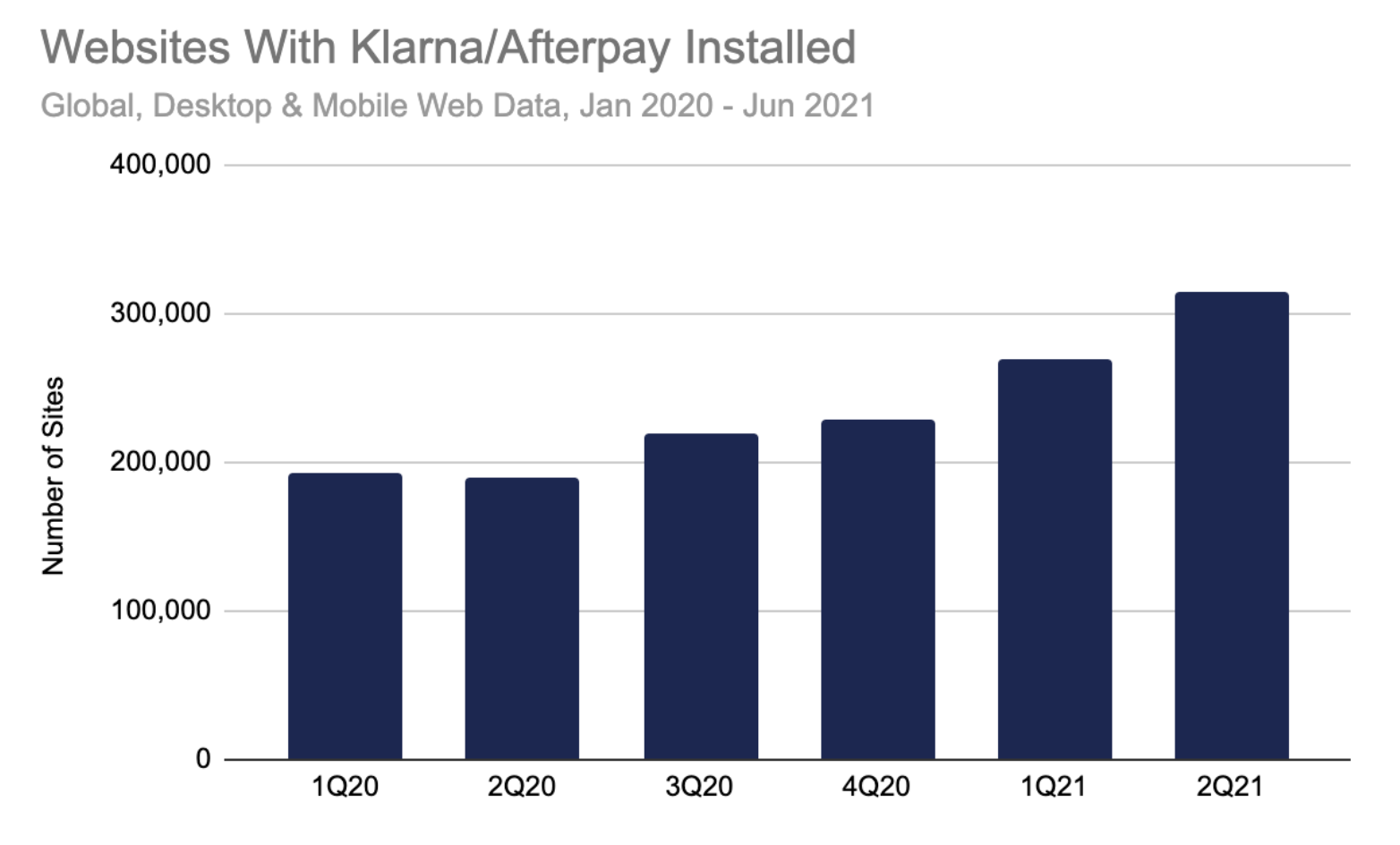

- The number of websites globally with BNPL solutions installed is growing

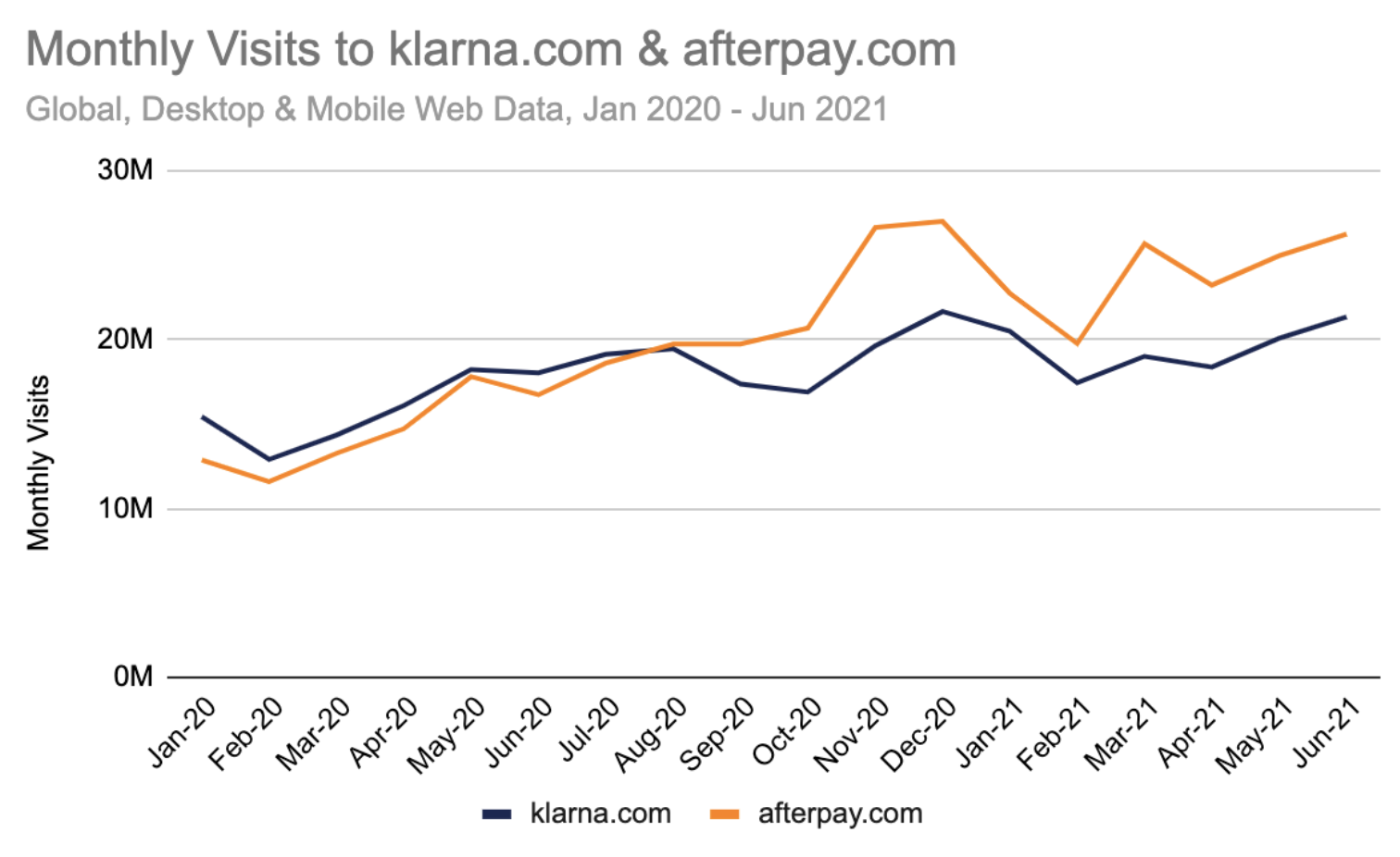

- Monthly visits to BNPL solution websites are also on the rise

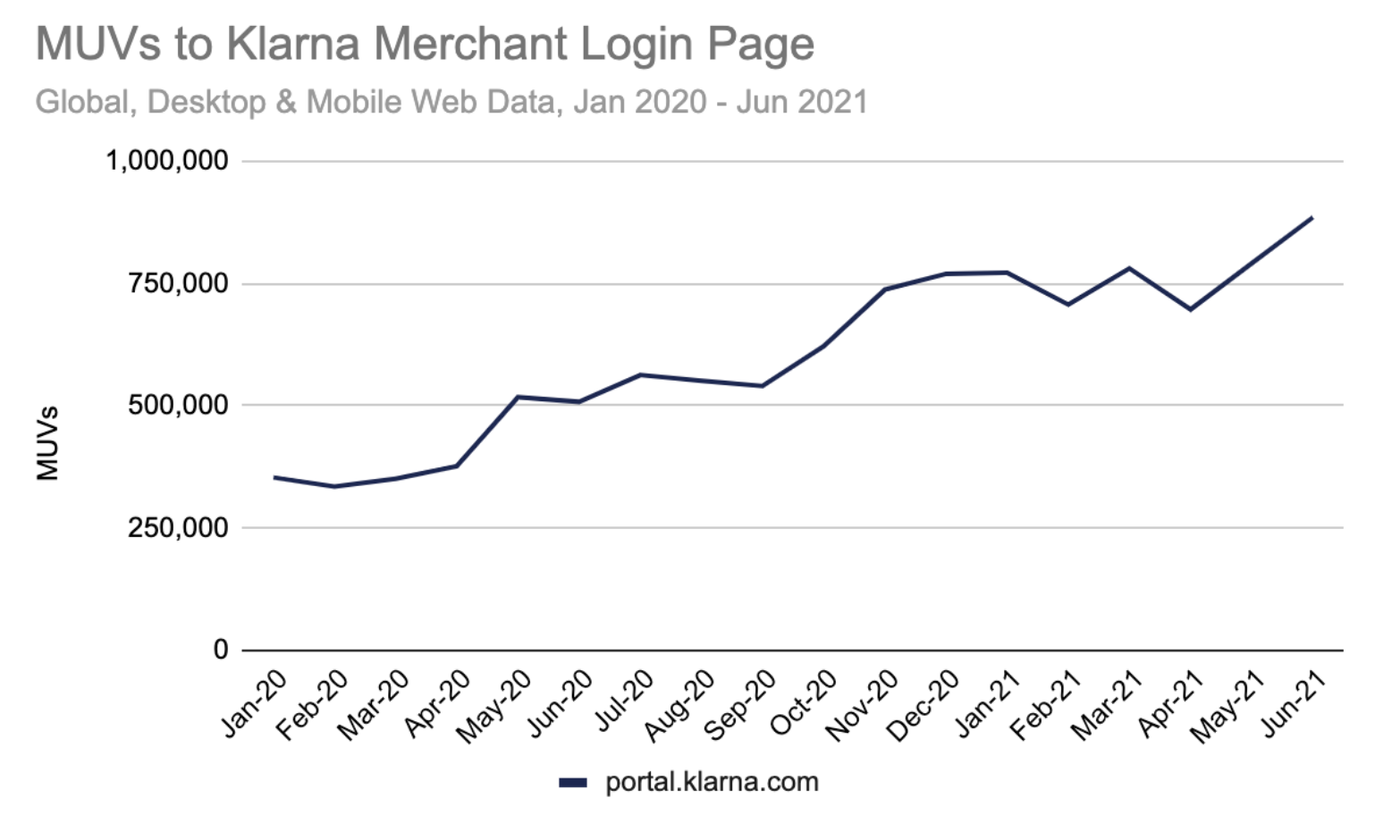

- Monthly unique visitors (MUVs) to Klarna’s merchant login page is seeing strong growth

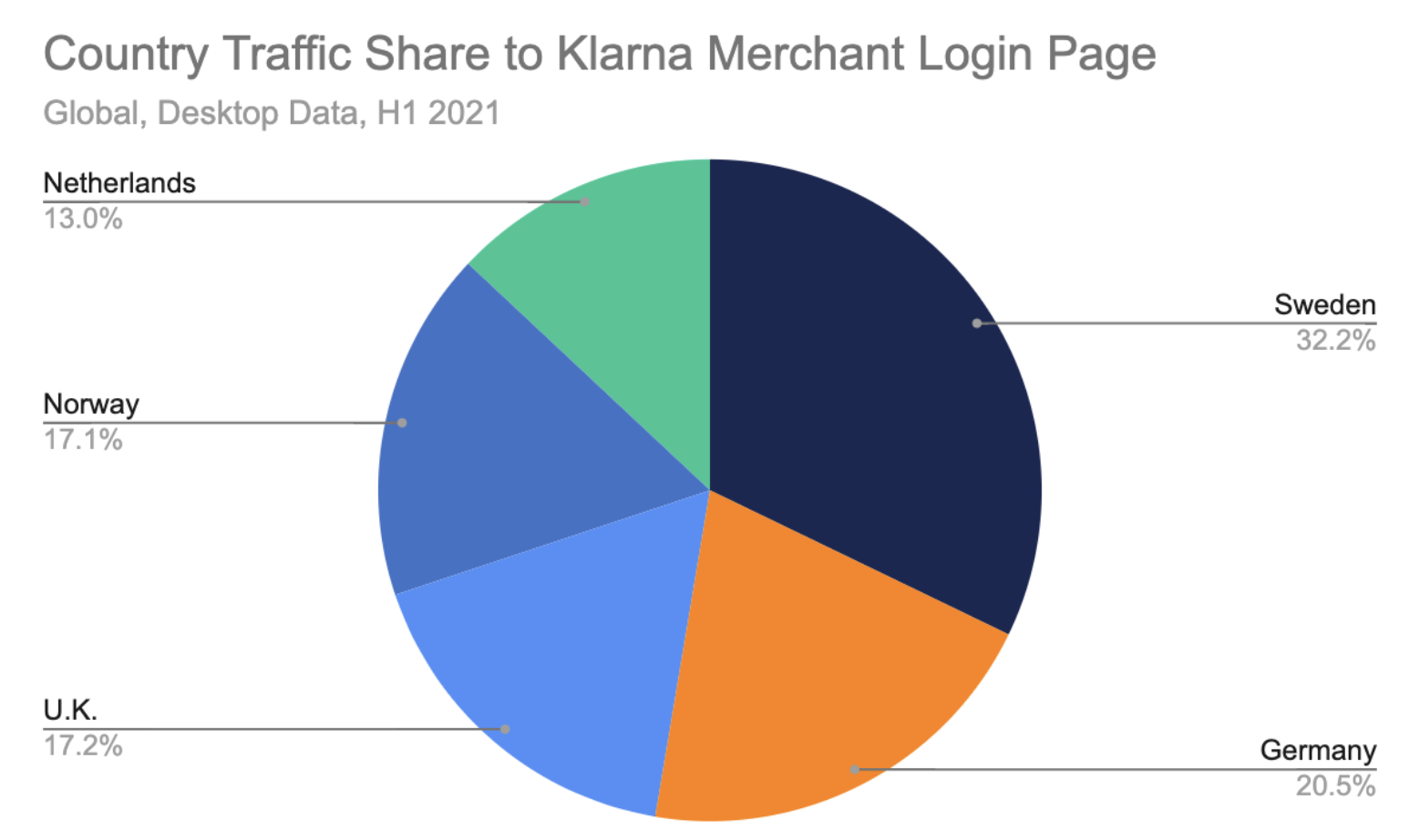

- Sweden accounts for most of the traffic to Klarna’s merchant login page, but most visitors are returning users, not new

Be ready for any IPO - get started with Similarweb today!

The BNPL market

Klarna operates in an expanding market, signaling high growth potential. This is a great signal ahead of a potential Klarna IPO.

The number of websites globally with either Klarna or Afterpay installed, is increasing. In 2Q21 this growth represented 16.8% quarter-over-quarter (QoQ), and 65.5% year-over-year (YoY).

This booming market is further supported by the improving reach of BNPL solutions, signaled by an upward traffic trend to both klarna.com and afterpay.com, globally.

Accelerating merchant user growth

Merchants are an important part of Klarna’s business model, with revenue coming from an initial setup fee, monthly fee, and a commission fee on transactions.

The number of merchants using Klarna is on the rise, indicated by an increasing number of monthly unique visitors (MUVs) to Klarna’s merchant login page, portal.klarna.com. We also note a particularly significant uptick in 2Q21.

Early adoption from Swedish merchants

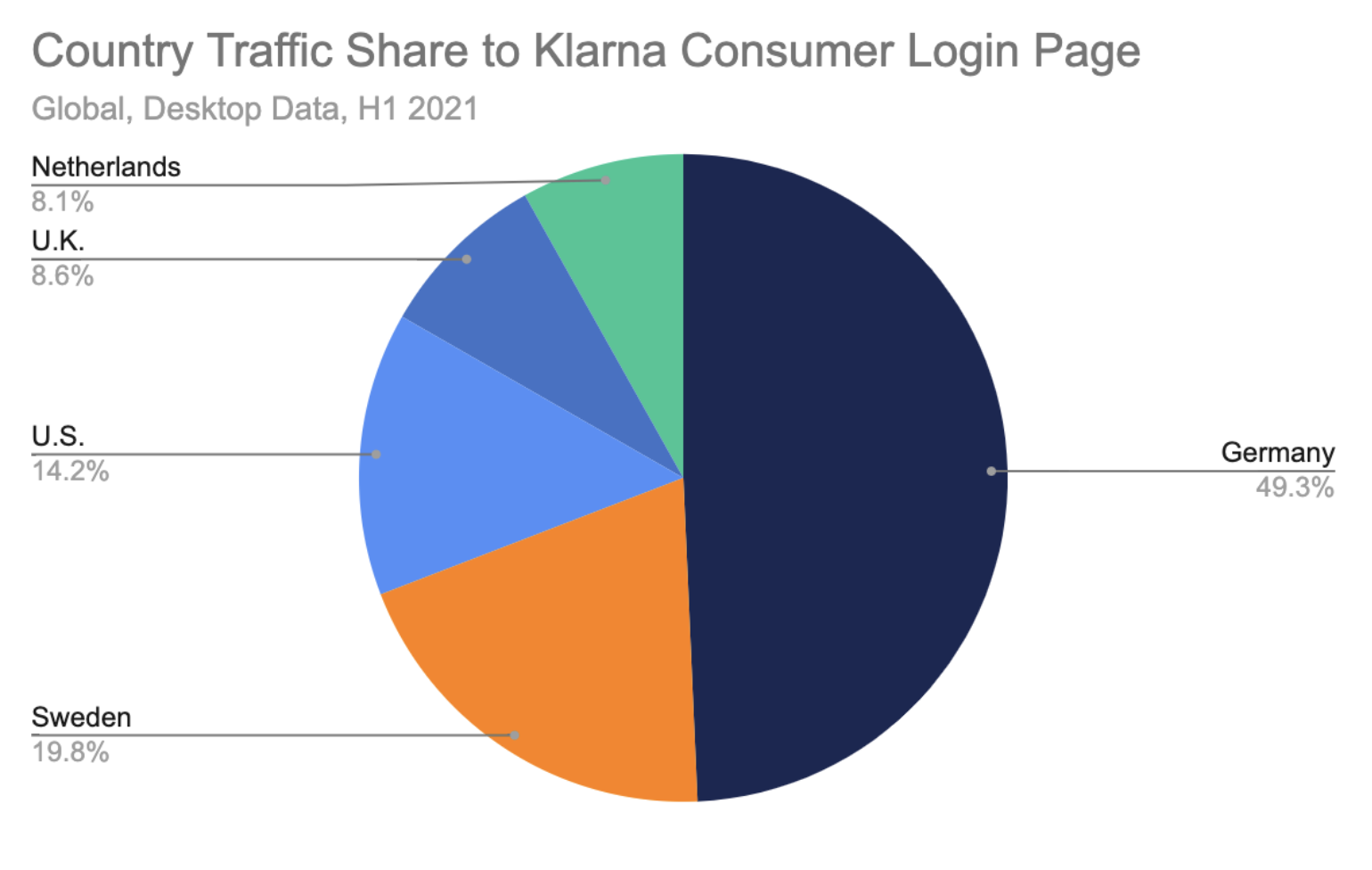

Leading the adoption of Klarna by merchants is Sweden, with the largest share of traffic (25%) to the merchant login page coming from its native country.

Looking at new vs returning visitors to Klarna’s merchant login page in Sweden, most are returning users of Klarna. Following the early adoption in the region, the company now needs to focus its efforts on other markets in order to continue its growth trajectory.

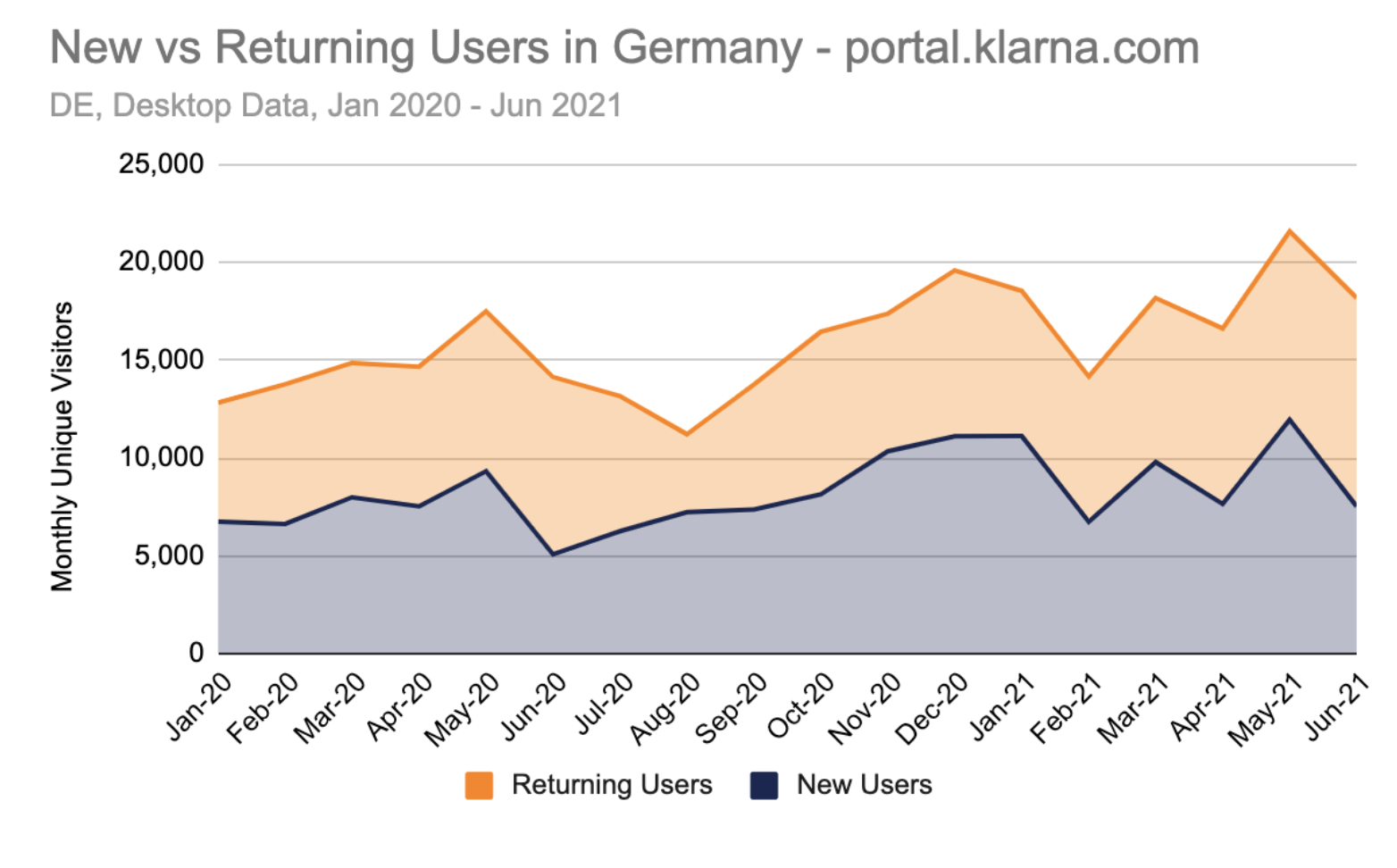

And we can see that Klarna is indeed focusing efforts on its international expansion, displayed by a much more equal split between new and returning users to Klarna’s merchant login page in Germany.

Number of consumers using Klarna is also increasing

Consumers are also a revenue driver, through late payment charges for Klarna’s pay after delivery and BNPL services.

The number of consumers using these services is on the rise, indicated by an upward trend in monthly unique visitors (MUVs) to Klarna’s consumer login page, app.klarna.com, globally.

German consumers leading the way

At present Germany is the most important country for Klarna’s consumer facing products. 42.5% of traffic to app.klarna.com came from the region in 1H1, representing only a 0.5 ppt drop in the traffic share coming from the region, YoY.

Germany continuing to attract new consumer users

In Germany, Klarna is doing well at consistently attracting new private users each month. We can see that roughly 50% of users visiting the login page are new users.

To summarize

The BNPL market is growing, providing lots of growth opportunity for a company like Klarna. The web traffic data shows that the company is already capitalizing on these opportunities particularly in Europe. However there is lots more room to grow. Watch this space.

Be ready for any IPO - get started with Similarweb today!

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.