Kinross Gold Corporation KGC recently announced that it has entered into an agreement with Great Bear Resources to acquire all the issued and outstanding shares of Great Bear.

Per the deal, Kinross will buy Great Bear’s flagship Dixie project located in the popular Red Lake mining district in Ontario, Canada. The Dixie project is one of the most exciting recent gold discoveries worldwide and the extensive drilling results have shown the characteristics of a top-tier deposit.

Per the terms, Kinross has agreed to an upfront payment of roughly $1.4 billion (C$1.8 billion), reflecting C$29 per Great Bear’s common share on a fully-diluted basis. The upfront payment, at the election of Great Bear shareholders, will be payable in cash and Kinross common shares, on a pro-rata basis, up to a maximum of 75% cash and 40% Kinross shares on a fully diluted basis.

The deal also includes a payment of the contingent consideration in the form of contingent value rights, which may be exchanged for 0.1330 of a Kinross share per Great Bear’s common share. This provides further potential consideration of roughly $46 million (C$58.2 million) based on the closing price of a Kinross share on the Toronto Stock Exchange on Dec 7, 2021. The contingent consideration will be payable in relation to Kinross’ public declaration of the commercial production at the Dixie project, given that at least 8.5 million gold ounces of measured and indicated mineral resources are disclosed.

The Dixie project has excellent potential to become a top-tier deposit that could support a large, long-life mine complex and boost Kinross’ long-term production outlook. It also has significant exploration upside potential.

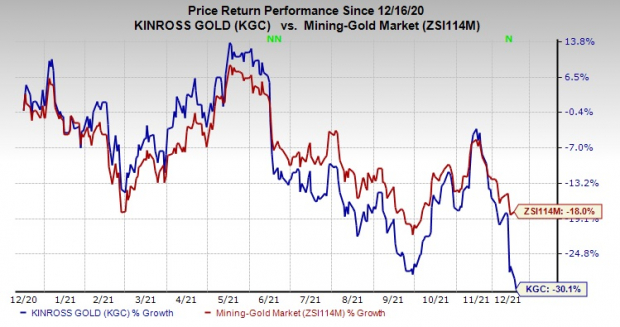

Shares of KGC have declined 30.1% in the past year compared with the industry’s decrease of 18%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Kinross, on its lastearnings call stated that it expects to produce 2.1 million (+/- 5%) gold equivalent ounces for 2021. It expects to meet its revised production cost of sales guidance to $830 per gold equivalent ounce.

All-in sustaining cost per ounce for 2021 is projected at $1,110. Capital expenditures are predicted at around $900 million (+/- 5%) for this year.

In 2022 and 2023, Kinross expects the annual production to increase to 2.7 and 2.9 million gold equivalent ounces, respectively.

Zacks Rank & Key Picks

Kinross currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Celanese Corporation CE, The Chemours Company CC and AdvanSix Inc. ASIX.

Celanese has an expected earnings growth rate of 139.5% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 8.7% upward in the past 60 days.

Celanese beat the Zacks Consensus Estimate for earnings in each of the last four quarters, with a trailing four-quarter earnings surprise of roughly 12.7%, on average. The stock has surged around 22.7% in a year. CE currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in all the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 34.2%, on average. It has rallied 17.5% in a year. CC currently holds a Zacks Rank #2.

AdvanSix has a projected earnings growth rate of 194.5% for the current year. The Zacks Consensus Estimate for earnings for the current year has been revised 5.9% upward over the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 46.9%. ASIX has rallied 119.6% in a year. It currently carries a Zacks Rank #1.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Celanese Corporation (CE): Free Stock Analysis Report

The Chemours Company (CC): Free Stock Analysis Report

AdvanSix (ASIX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.