Fintel reports that on May 1, 2023, Keybanc maintained coverage of Match Group Inc. - (NASDAQ:MTCH) with a Overweight recommendation.

Analyst Price Forecast Suggests 66.82% Upside

As of April 24, 2023, the average one-year price target for Match Group Inc. - is 61.55. The forecasts range from a low of 40.40 to a high of $99.75. The average price target represents an increase of 66.82% from its latest reported closing price of 36.90.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Match Group Inc. - is 3,513MM, an increase of 10.17%. The projected annual non-GAAP EPS is 2.10.

What is the Fund Sentiment?

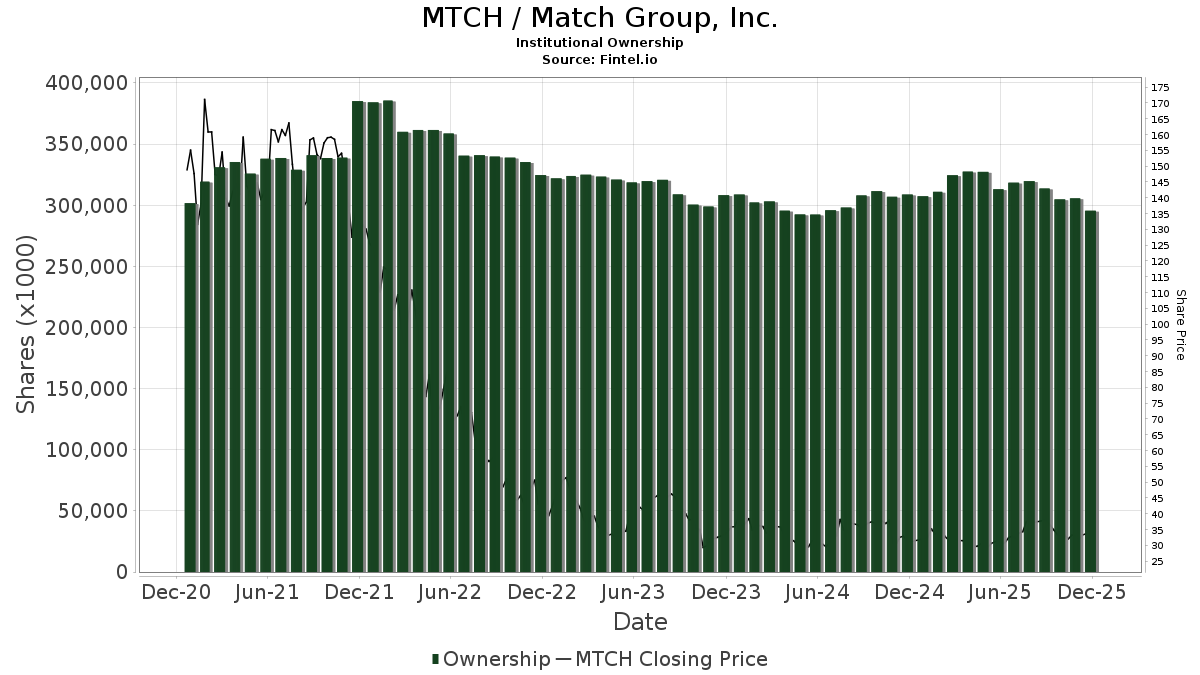

There are 1370 funds or institutions reporting positions in Match Group Inc. -. This is a decrease of 45 owner(s) or 3.18% in the last quarter. Average portfolio weight of all funds dedicated to MTCH is 0.25%, a decrease of 5.37%. Total shares owned by institutions decreased in the last three months by 1.98% to 321,001K shares.  The put/call ratio of MTCH is 0.78, indicating a bullish outlook.

The put/call ratio of MTCH is 0.78, indicating a bullish outlook.

What are Other Shareholders Doing?

Edgewood Management holds 15,879K shares representing 5.68% ownership of the company. In it's prior filing, the firm reported owning 18,394K shares, representing a decrease of 15.84%. The firm decreased its portfolio allocation in MTCH by 23.51% over the last quarter.

Price T Rowe Associates holds 12,126K shares representing 4.34% ownership of the company. In it's prior filing, the firm reported owning 12,762K shares, representing a decrease of 5.24%. The firm decreased its portfolio allocation in MTCH by 18.94% over the last quarter.

EGFIX - Edgewood Growth Fund Institutional Class Shares holds 8,648K shares representing 3.10% ownership of the company. In it's prior filing, the firm reported owning 10,156K shares, representing a decrease of 17.44%. The firm decreased its portfolio allocation in MTCH by 19.73% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 8,498K shares representing 3.04% ownership of the company. In it's prior filing, the firm reported owning 8,450K shares, representing an increase of 0.57%. The firm decreased its portfolio allocation in MTCH by 19.30% over the last quarter.

Flossbach Von Storch holds 8,094K shares representing 2.90% ownership of the company. In it's prior filing, the firm reported owning 6,547K shares, representing an increase of 19.12%. The firm increased its portfolio allocation in MTCH by 11.37% over the last quarter.

Match Group Background Information

(This description is provided by the company.)

Match Group, through its portfolio companies, is a leading provider of dating products available in over 40 languages to our users all over the world. Its portfolio of brands includes Tinder, Match, PlentyOfFish, Meetic , OkCupid, OurTime, Pairs, and Hinge, as well as a number of other brands, each designed to increase users' likelihood of finding a meaningful connection. Through its portfolio companies and their trusted brands, they provide tailored products to meet the varying preferences of our users.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.