The Index of Bonds on The Screen

How much do you really know about buying and selling bonds? Although "bond" seems like a simple word, trading bonds is anything but simple, and vastly different from trading stocks. Wouldn't it be nice if there were a tool that could give you the most important facts about a particular bond in an easy-to-digest package? FINRA has you covered.

To educate investors about their bond investments, FINRA recently introduced a new investor tool: FINRA Bond Facts. The tool helps investors understand common bond terminology and provides bond-specific information about corporate and agency bonds, including recent trade data. Bond Facts also provides sample questions that can help investors start a conversation with their brokers so they are in a position to make informed investment decisions.

What Bond Facts Will Tell Me

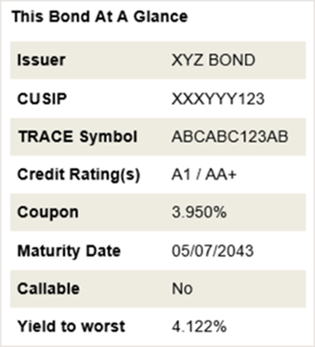

Bond Facts lays out the essential facts to know about any corporate or agency bond you are considering purchasing (or have already purchased) in a section called "This Bond at a Glance." For example, who is issuing the bond? What is the maturity date? What are the coupon rate and yield? What is the credit rating? Is the bond callable—and when?

However, these essential facts don't mean much to an investor who doesn't have a basic understanding of what these key terms mean. To some bond investors, these terms might be new or unfamiliar. So, Bond Facts provides straightforward explanations to help educate investors to make informed decisions.

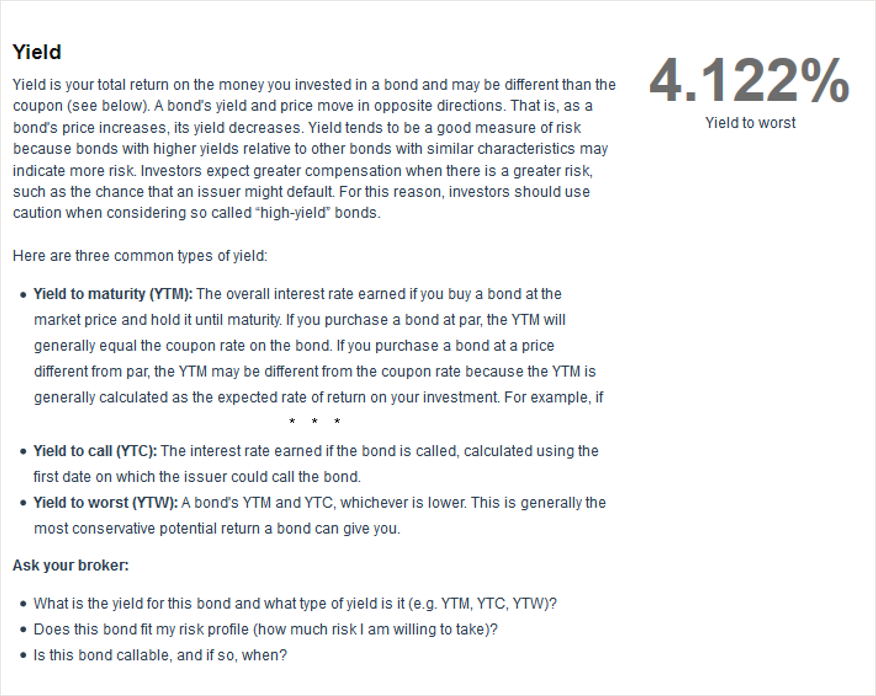

For example, investors might wonder what a 4.122% yield to worst means for their investment. Bond Facts provides a brief definition of the term yield (total return on the money you invested) and describes the differences between three common types of yield as shown below.

Talk To Your Broker

Bond Facts also creates an important action step for investors who use the tool. All of the key bond term explanations are followed by sample questions to ask your broker. In the yield example, Bond Facts provides three questions an investor can pose to their broker, such as "what is the yield for this bond and what type of yield is it?" You can use these questions to start a conversation with your broker and make sure you understand important information about your investment. You should never hesitate to ask questions about investments a broker is recommending to you.

Getting To Bond Facts

FINRA rules require that brokers include a link to Bond Facts on the trade confirmation you receive following a corporate or agency bond transaction. This means you can click on a link to the Bond Facts site on an electronic trade confirmation or type in the URL from a paper confirmation. If you are accessing Bond Facts from your trade confirmation, the link will take you directly to information about the specific bond involved in your transaction.

If you want to research bonds before making a trade, you can use the bond's 9-digit CUSIP on the Bond Facts search page to pull up information about a particular bond. If you type in a CUSIP for a municipal security, Bond Facts will redirect you to the Municipal Securities Rulemaking Board's EMMA website, which provides investors with similar information to that available in Bond Facts.

For investors who want more information, Bond Facts provides a link to FINRA's Market Data Center where you can find additional information about a bond, including an extended trade history. Bond Facts also directs investors to more detailed investor education resources on FINRA's website for each of the key concepts covered.

Subscribe to FINRA's The Alert Investor newsletter for more information about saving and investing.

FINRA is dedicated to investor protection and market integrity. It regulates one critical part of the securities industry – brokerage firms doing business with the public in the United States. FINRA, overseen by the SEC, writes rules, examines for and enforces compliance with FINRA rules and federal securities laws, registers broker-dealer personnel and offers them education and training, and informs the investing public. In addition, FINRA provides surveillance and other regulatory services for equities and options markets, as well as trade reporting and other industry utilities. FINRA also administers a dispute resolution forum for investors and brokerage firms and their registered employees. For more information, visit www.finra.org.

Photo Credit: ©iStockphoto.com/PashaIgnatov

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.