Juniper Networks, Inc. JNPR recently inked an agreement with Nipa Cloud to augment its network capabilities in order to cater to the exponential growth in customers and related cloud demands in Thailand. The improvement in cloud infrastructure facilities is expected to reduce the complexity of the network while increasing the operational flexibility and efficiency as the South East Asian country aims to accelerate its transition to a digital economy.

Nipa is a leading cloud service provider in Thailand, offering Infrastructure-as-a-service (IaaS) with OpenStack and NCP for improved cloud capabilities. These enable small and medium-sized business enterprises to expand their operations by utilizing its cloud facilities without investing in expensive infrastructure upgrades and hiring technology experts to run the system. Nipa offers technologically advanced cloud solutions and aims to create unique value by adapting them to local market conditions through greater flexibility, modularity and local understanding as a homegrown provider.

Thailand is likely to spearhead innovation by increasingly prioritizing investments toward cloud infrastructure as part of its fourth industrial revolution. In 2022, spending on cloud infrastructure is expected to grow 28.2% in the country on post-pandemic market revival, with IaaS likely witnessing the highest growth as business enterprises tend to scale up infrastructure and migrate complex workloads to the cloud to better enable a remote work culture.

In order to capitalize on this huge revenue-generating opportunity, Nipa has deployed routing solutions from Juniper to upgrade its data center networks and better differentiate its offerings. These will likely enable it to deploy a common set of policies across campuses and deliver enhanced throughput, scalability, capacity, performance and security to fast-track the transition to a digital ecosystem.

The simplified network traffic management from Juniper eradicates the complexity associated with multiple networks and delivers optimal bandwidth utilization. With the latest routing platforms, the company aims to significantly improve the network for more agile service delivery and better security features for enhanced visibility and customer data protection. This is expected to provide shorter time-to-market for new services while ensuring regulatory compliance and data security.

Segment routing simplifies operations and reduces resource requirements in the network by removing network state information from intermediate routers and placing path information into packet headers at the ingress node. This improves operational flexibility and agility for cost-effective user experiences as fewer network elements are involved, avoiding slow response to sudden network changes.

Juniper is set to capitalize on the growing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence. The company is offering new suites of products, such as the T4000 core router, QFX data center platform, ACX and PTX packet/optical solution, among others. With the growing use of smartphones and tablets, mobile data traffic has gone up. This has resulted in higher demand for advanced networking architecture, which is leading service providers to spend more on routers and switches. Juniper is expected to benefit from the higher spending pattern among carriers to upgrade their networks for supporting the incremental growth in data traffic.

Despite short-term challenges, particularly within the cloud and service provider verticals, Juniper expects healthy progress in most areas of its business, which augurs well for its long-term growth. The company has made significant changes to its go-to-market structure to better align its sales strategies with each of its core customer verticals. Moreover, several new products are in the pipeline, which are expected to further strengthen its competitive position across service provider, cloud and enterprise markets.

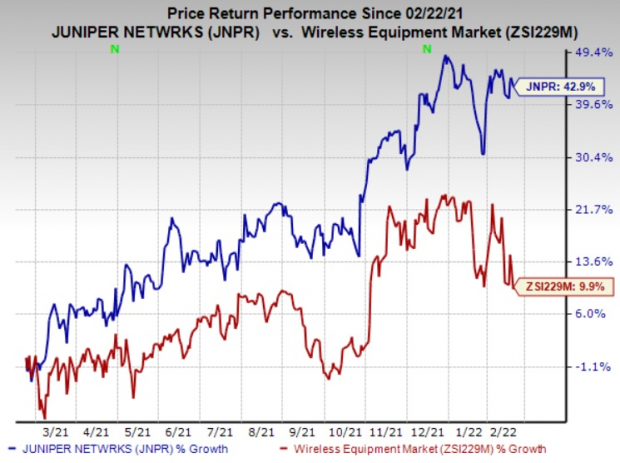

The stock has gained 42.9% over the past year compared with the industry’s rally of 9.9%.

Image Source: Zacks Investment Research

Juniper currently has a Zacks Rank #3 (Hold).

Clearfield, Inc. CLFD, sporting a Zacks Rank #1 (Strong Buy) is a solid pick for investors. You can see the complete list of today’s Zacks #1 Rank stocks here.

Clearfield delivered an earnings surprise of 50.7%, on average, in the trailing four quarters. Earnings estimates for the current year for the stock have moved up 102.7% since February 2021. Over the past year, Clearfield has gained a solid 77.5%.

Qualcomm Incorporated QCOM, carrying a Zacks Rank #2 (Buy) is another key pick. It has a long-term earnings growth expectation of 16.1% and delivered an earnings surprise of 12.2%, on average, in the trailing four quarters.

Earnings estimates for the current year for the stock have moved up 43.1% over the past year, while that for the next fiscal is up 48.6%. Qualcomm is likely to benefit in the long run from solid 5G traction and a surge in demand for essential products that are the building blocks of digital transformation in the cloud economy.

Knowles Corporation KN sports a Zacks Rank #1. It has a long-term earnings growth expectation of 10% and delivered a modest earnings surprise of 14.9%, on average, in the trailing four quarters. Earnings estimates for the current year have moved up 21% since February 2021.

The transformation from an acoustic component supplier to an audio solutions provider has enabled Knowles to migrate to higher-value solutions and increase content per device. This, in turn, has empowered the company to capitalize on the positive macro trends in audio and edge processing solutions.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Juniper Networks, Inc. (JNPR): Free Stock Analysis Report

Knowles Corporation (KN): Free Stock Analysis Report

Clearfield, Inc. (CLFD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.