Juniper Networks, Inc. JNPR has acquired WiteSand, a leader in cloud-native zero trust Network Access Control (NAC) solutions, for an undisclosed amount.

The acquisition brings a skilled engineering team to Juniper, which will boost its efforts to deliver an innovative NAC solution as part of its AI-driven enterprise portfolio.

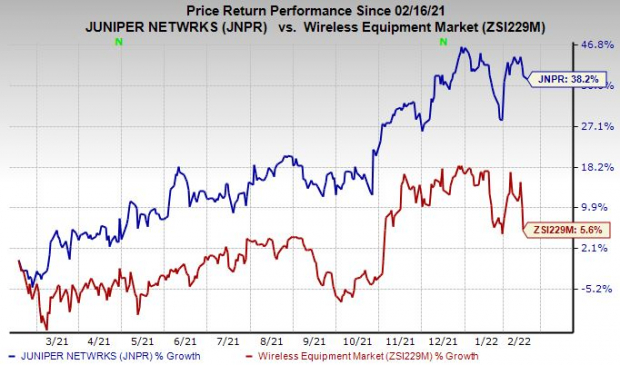

Juniper is benefiting from solid order momentum was across verticals, customer solutions and regions. The stock has gained 38.2% in the past year compared with the industry’s growth of 5.6%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

NAC plays a critical role in many IT environments by identifying which devices can securely connect to a network. However, traditional NAC solutions are often too complex to deploy and operate.

The downsides can be addressed by migrating NAC operations to the cloud and leveraging AIOps for automated provisioning, monitoring and security.

Juniper and WiteSand intend to disrupt the NAC space with cloud agility and AI-driven intelligence. WiteSand’s industry-leading NAC technology and engineering team will complement Juniper’s AI-driven enterprise portfolio.

Once NAC is integrated with wireless, wired, WAN and IoT assurance and indoor location services under a common Mist cloud and AI, Juniper customers can deliver incredible experiences to their network users.

Juniper is witnessing strong momentum across its core industry verticals and is confident of its long-term prospects. Investments in customer solutions and sales organizations have enabled it to capitalize on the increasing demand across end markets.

However, the company is experiencing supply-chain headwinds related to rising component costs and shortages, as well as elevated freight costs, which are expected to persist, at least through the first half of 2022.

JNPR currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Clearfield, Inc. CLFD is a better-ranked stock in the industry, sporting a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has been revised 20.5% upward over the past 60 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.7%, on average. It has gained 54% in the past year.

Qualcomm, Inc. QCOM, carrying a Zacks Rank #2 (Buy), is another solid pick for investors. The consensus estimate for current-year earnings has been revised upward by 12.1% over the past 60 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 12.2%, on average. It has appreciated 12.2% in the past year.

Vocera Communications, Inc. VCRA flaunts a Zacks Rank #1. The consensus mark for current-year earnings has been revised upward by 4.9% over the past 60 days.

Vocera Communications pulled off a trailing four-quarter earnings surprise of 115.4%, on average. The stock has returned 66.5% in the past year.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Juniper Networks, Inc. (JNPR): Free Stock Analysis Report

Vocera Communications, Inc. (VCRA): Free Stock Analysis Report

Clearfield, Inc. (CLFD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.