Marshall Gittler is the Head of Investment Research at online brokerage firm BDSwiss Group

USD/JPY recently broke through ¥105 and started trading toward ¥104. That set off familiar alarm bells in Tokyo and the usual warnings from officials that I’ve been hearing for decades now. When are the Japanese authorities going to learn how the foreign exchange market works and take a more sophisticated view of their currency?

On Friday as USD/JPY was hitting the lows of 104.19, Bloomberg ran a story, “Japan Officials Meet to Show Vigilance as Yen Hits 4-Month High”

(Bloomberg) -- Senior officials from Japan’s finance ministry, central bank and financial regulator met Friday in a show of vigilance after the yen gained to the highest level since March.

“The government and the Bank of Japan confirmed we will act together if necessary while we continue to closely watch developments in financial markets and the economy,” the finance ministry’s top currency official, Kenji Okamura, told reporters after the meeting…

Separately, Finance Minister Aso said the strength of the yen doesn’t correlate with trade balance shifts and that he would continue to watch the FX market “with a sense of urgency.”

These comments were entirely predictable. In fact, if I may pat myself on the back, I did predict them in my daily comment last Wednesday. But that’s nothing extraordinary for anyone who knows how Japanese officials view the FX market. They focus on USD/JPY and the well-known tendency of markets to treat round numbers as both obstacles and targets. In particular, they worry about USD/JPY breaking through ¥100, which experience has shown opens up a huge gap. So they try to head it off – normally starting to express their concern around ¥105.

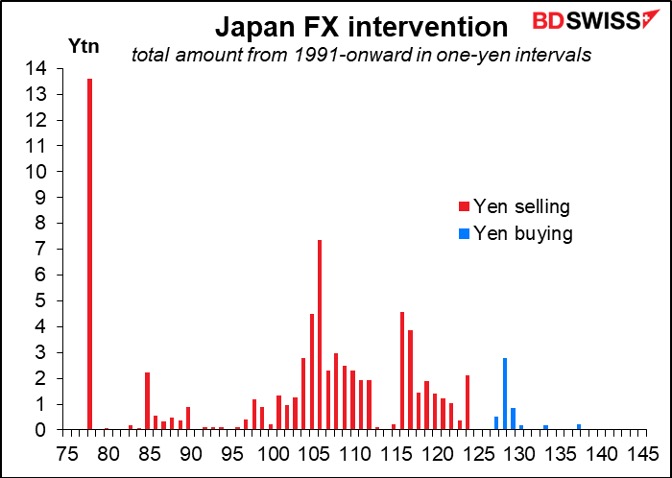

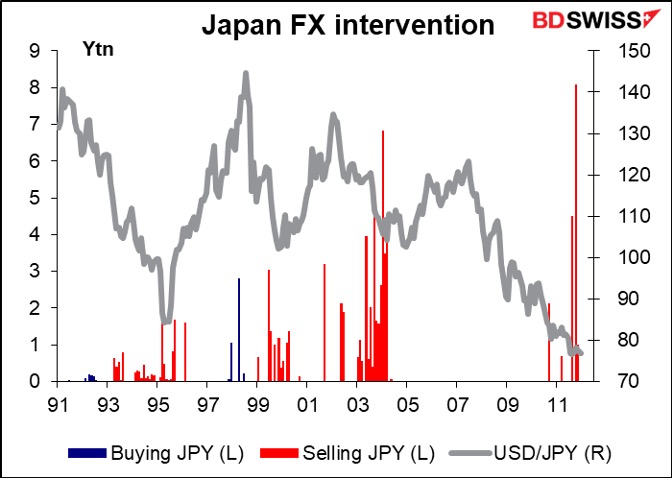

The history of Japanese FX intervention shows that, aside from massive intervention below ¥80, their biggest intervention was at ¥106, followed by ¥105.

The significance of this is: most of this intervention took place back in 2003/04. The authorities are still worried about a USD/JPY rate that was important 17 years ago!

A lot has changed in the world since then. In particular, Japan has had much lower inflation than most other countries. That means the nominal exchange rate should naturally drift lower to keep the real value, the purchasing power of the two currencies, stable. If it doesn’t, then the real value of the currency will depreciate.

That’s exactly what’s happened in Japan. The yen’s nominal value – the number of yen per dollar or euro or whatever – has stayed relatively stable over the last 20 years. The nominal effective exchange rate (NEER), which measures this nominal value of the currency against those of Japan’s major trading partners, is pretty close to its average level since 1994.

But what that means is the real value of the yen – as measured by the real effective exchange rate (REER) – would depreciate. And indeed, that’s exactly what’s been happening.

The problem is that Japanese officials still focus on the nominal value of the currency rather than the real value, which is what’s important for the economy.

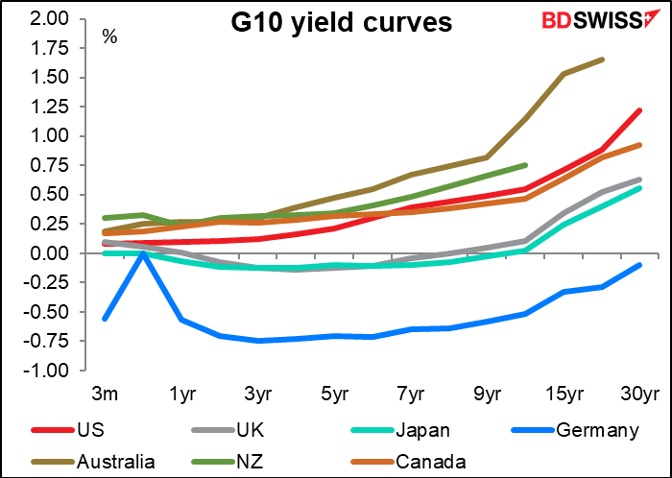

Aso’s comment about “trade balance shifts” is also telling – he apparently hasn’t realized that it’s capital flows, not trade flows, that move currencies nowadays (as has been the case for decades!). Japan’s ultra-low interest rates are now no longer the global outlier that they used to be but rather the norm, or even high relative to Germany. With little or no yield pickup, there’s little incentive for Japanese investors to move money abroad.

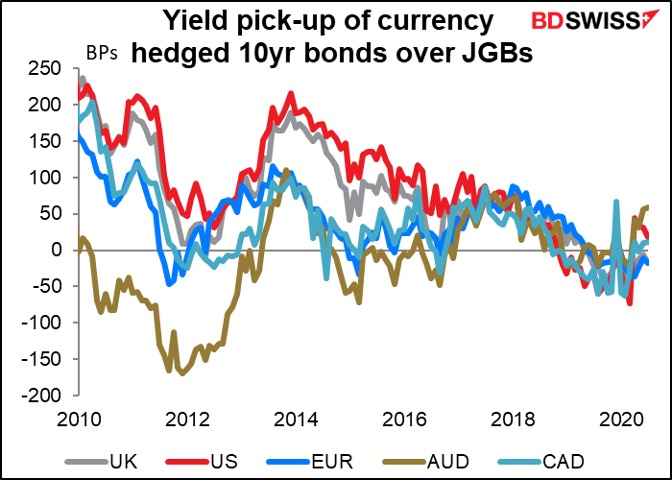

After hedging the currency, there’s barely any reason for Japanese investors to buy overseas bonds. US Treasuries, the favorites of Japanese investors, yield only 18 bps more than the equivalent Japanese Government Bonds (JGBs) after hedging.

In any case, this is less of a “strong yen” move than it is a “weak dollar” move. The yen’s 2.9% rise vs USD this year isn’t that much more than its 1.8% depreciation vs EUR.

One would’ve hoped that over time, the politicians would have gotten more sophisticated and stopped complaining about the currency at the same points. Alas, that doesn’t seem to be the case. But the predictability of their response does offer some good trading opportunities.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.