If ever an example was needed of the old axiom “buy the rumor, sell the news,” then Gilead Sciences (GILD) could be used as its poster boy.

Following a surge which saw the healthcare giant’s share price appreciate by 30% in 2020, the stock was sold off in Friday’s session, dropping nearly 4% following the release of the company’s earnings results. The sell off was triggered by a slew of downgrades from the Street.

So, was Gilead’s Q1 earnings that bad? Nope, the company posted beats on both top and bottom line. Revenue of $5.55 billion indicated a 5.1% year-over-year increase and beat the Street’s estimate by $110 million. Q1 Non-GAAP EPS of $1.68 beat the forecasts by $0.12.

But Friday was an action-packed day for Gilead investors on account of another more pressing matter. The reason for Gilead’s impressive share price gains in these pandemic driven times has been well documented, as its experimental drug remdesivir has been mooted as a potential treatment for COVID-19.

On Friday, the company announced it had received Emergency Use Authorization (EUA) by the FDA for the drug to treat COVID-19 patients. The news was announced just as the markets were closing. So, did the share price soar following the news? No, again.

After two studies indicated the drug shortened recovery time in critically ill patients, approval was more or less a foregone conclusion, and therefore already priced in. In short, despite the approval and earnings beats, Street analysts believe Gilead’s commercial opportunities do not justify the elevated share price.

Among them is JPMorgan’s Cory Kasimov, who is “moving to the sidelines.” Kasimov further noted, “shares have now reached our target price, albeit not in the way we anticipated at the outset of 2020.”

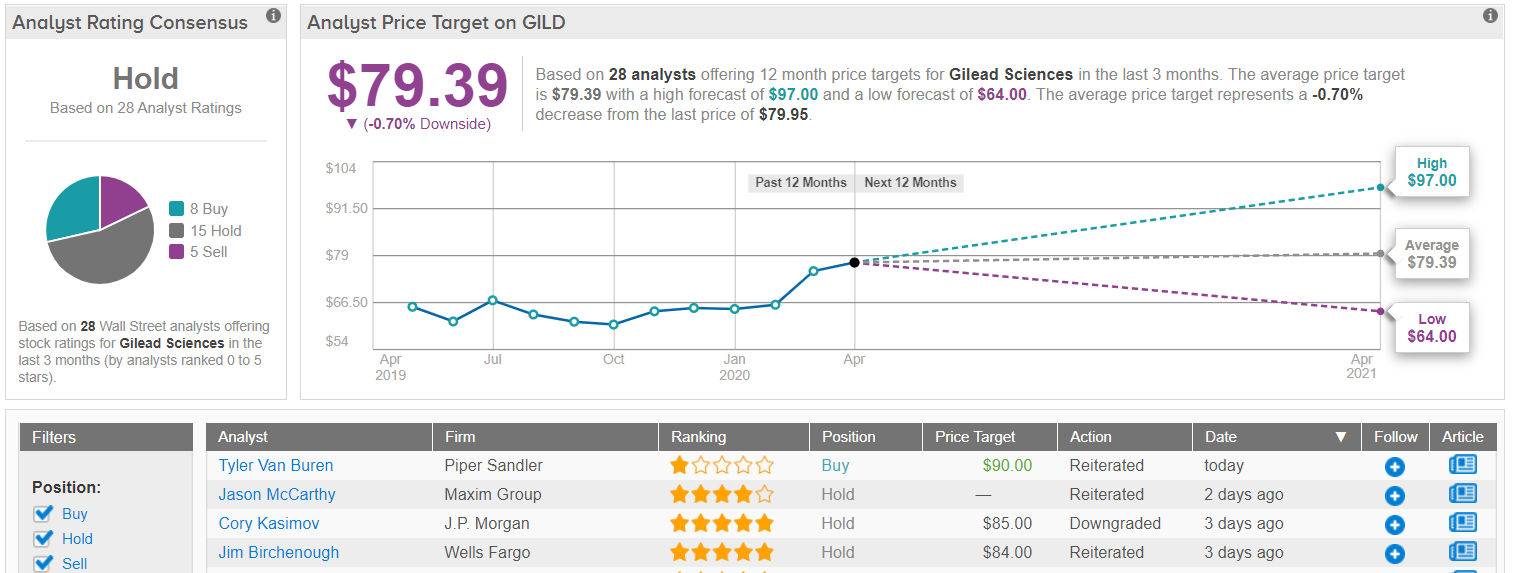

The 5-star analyst downgraded GILD stock from Overweight to Neutral and maintained an $85 price target. (To watch kasimov’s track record, click here)

Kasimov expounded further, “As repeatedly communicated, remdesivir has been a big sentiment boost for GILD (if not the entire market) and the company should be commended for its efforts in so quickly addressing this public health emergency, but we still feel it's unlikely to result in tangible long-term cash flows. Indeed, even if we were to add an incremental $5B in remdesivir sales to our model over the next 3 yrs (likely aggressive), the result is a mere $1/sh increase in our DCF.”

Kasimov’s thesis is backed by the rest of the Street, as the analyst consensus rates GILD a Hold. The average price target hits $79.39 and implies a slight downside from current levels. (See Gilead stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.