Johnson & Johnson JNJ announced that the FDA has approved another long-acting formulation of its antipsychotic drug, paliperidone palmitate, Invega Hafyera, for treating schizophrenia in adults.

Invega Hafyera is a long-acting injectable treatment, which will be administered every six months. The new long-acting formulation results in continuous treatment and symptom control over six months. The drug is the first and only FDA-approved twice-a-year treatment for schizophrenia. It offers schizophrenia patients the fewest doses per year for their treatment.

Please note that two other formulations of paliperidone palmitate — Invega Sustenna and Invega Trinza — are already approved to treat schizophrenia. While Invega Sustenna needs to be administered every month, Invega Trinza is administered once every three months. We note that a tablet formulation of paliperidone, Invega, was the first to receive FDA approval as acute and maintenance treatment of schizophrenia in 2006. It needs to be administered every day.

J&J has come a long way over the last 15 years in developing improved treatment options which significantly improves convenience for schizophrenia patients. The reduced administrations will help patients control their disorder with a better treatment plan.

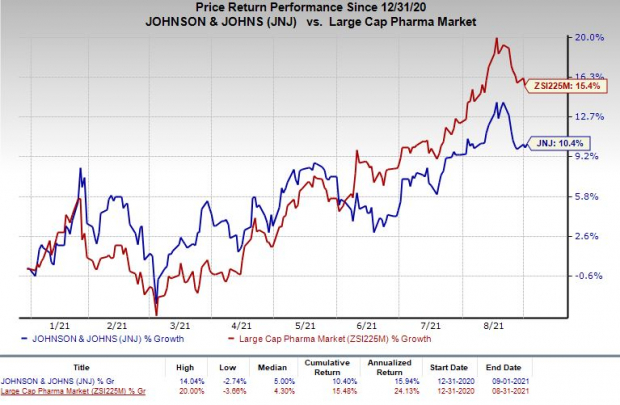

Image Source: Zacks Investment Research

This year so far, J&J’s shares have risen 10.4% compared with an increase of 15.4% for the industry.

The approval of Invega Hafyera was based on data from a global phase III study that evaluated Invega Hafyera for non-inferiority compared to Invega Trinza. Data from the study demonstrated that 92.5% of patients who were administered Invega Hafyera were relapse-free at 12 months compared to 95% for Invega Trinza. The safety profile of Invega Hafyera was consistent with the safety profile of Invega Sustenna and Invega Trinza observed in previous studies.

Meanwhile, we note that J&J’s Invega franchise has maintained strong growth over the past few years. Worldwide sales from this franchise were almost $2 billion in the first half of 2021, gaining more than 10% year over year.

However, as Invega Sustenna and Invega Trinza get older, the risk of generics rises. Several generic-makers including Teva TEVA, Viatris VTRS, and Mallinckrodt Pharmaceuticals are trying to get approval for the generic version of either of these two drugs. J&J has initiated litigations against these companies to retain patent exclusivity. Moreover, the approval of Invega Hafyera provides long-term protection to J&J’s sales from the Invega franchise as it will have a longer patent exclusivity.

Johnson & Johnson Price

Johnson & Johnson price | Johnson & Johnson Quote

Zacks Rank & Stock to Consider

J&J currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A better-ranked stock from the biotech sector is Regeneron REGN, which sports a Zacks Rank #1.

Regeneron’s earnings per share estimates have moved north from $49.96 to $54.15 for 2021 and from $40.91 to $44.11 for 2022 in the past 30 days. The stock has risen 41% so far this year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA): Free Stock Analysis Report

Viatris Inc. (VTRS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.