Is This Really a Stock Picker's Market? And How to Invest In Such a Market

One of the common themes at the moment when investment professionals appear on financial TV seems to be that it is a "stock picker’s market." That should really surprise nobody. To a stock picker, it is always a stock picker’s market. I should know because in many ways, I am one.

That doesn’t mean that every investor should be rushing out to buy all the individual stock picks they hear about. Even in a "stock picker’s market," stock picks are for stock pickers and the rest of us should stick to a more passive investing style.

When I write about an individual stock, it is intended for an audience that already invests some of their capital that way, is aware of the risks, and knows how to manage such a trade or investment. If you are not in that group, don’t get tempted to join just because you hear the phrase "stock picker’s market."

You should keep in mind that actively managed funds have to tell you that frequently, or else no one would ever pay the relatively high fees for their services. If they didn’t point out the times when the indices were bouncing around in a range, while at the same time some stocks were doing well while others were falling, an even larger percentage of invested money than now would flow into passive funds that simply track indices. The fact remains, though, that for most investors, those who don’t have either the inclination or the time to manage their investments on a full-time basis, chasing every idea they may read or hear about is not a good idea.

For starters, stock picks tend to have a fairly short time horizon, while most investors don’t. If I say that I expect a stock to do well without explicitly saying something like "over the long-term," I am implicitly saying that I expect it to outperform the market over the next few months at most. That is fine for those who will sell after a run up and move on to the next trade, but most people don’t do that. They tend to buy something, watch it outperform for a while, then sit on it as it reverts to the mean, as most things tend to do eventually.

If you recognize that behavior pattern because you have lived it all too frequently, you are probably better off ignoring the "stock picker’s market" thing.

Then there are the other types of stock picks, those that don’t work out. If you have ever followed my advice or any other pundit's, then cursed us under your breath as the stock you bought drops dramatically, and stays down for a while, consistently underperforming the market while you still hang on to it hoping for a miracle, again, you should pay no attention to the "stock picker’s market."

Investing in stock picks is essentially swing trading, and it takes a trader’s mindset and discipline to do it successfully. A large part of that is setting and sticking to a stop loss level at which you will get out of a position, no matter how you may feel at the time. If you can’t or won’t do that, take the more boring, but statistically more profitable investing approach: Buy an index fund or ETF, and forget about it for a while.

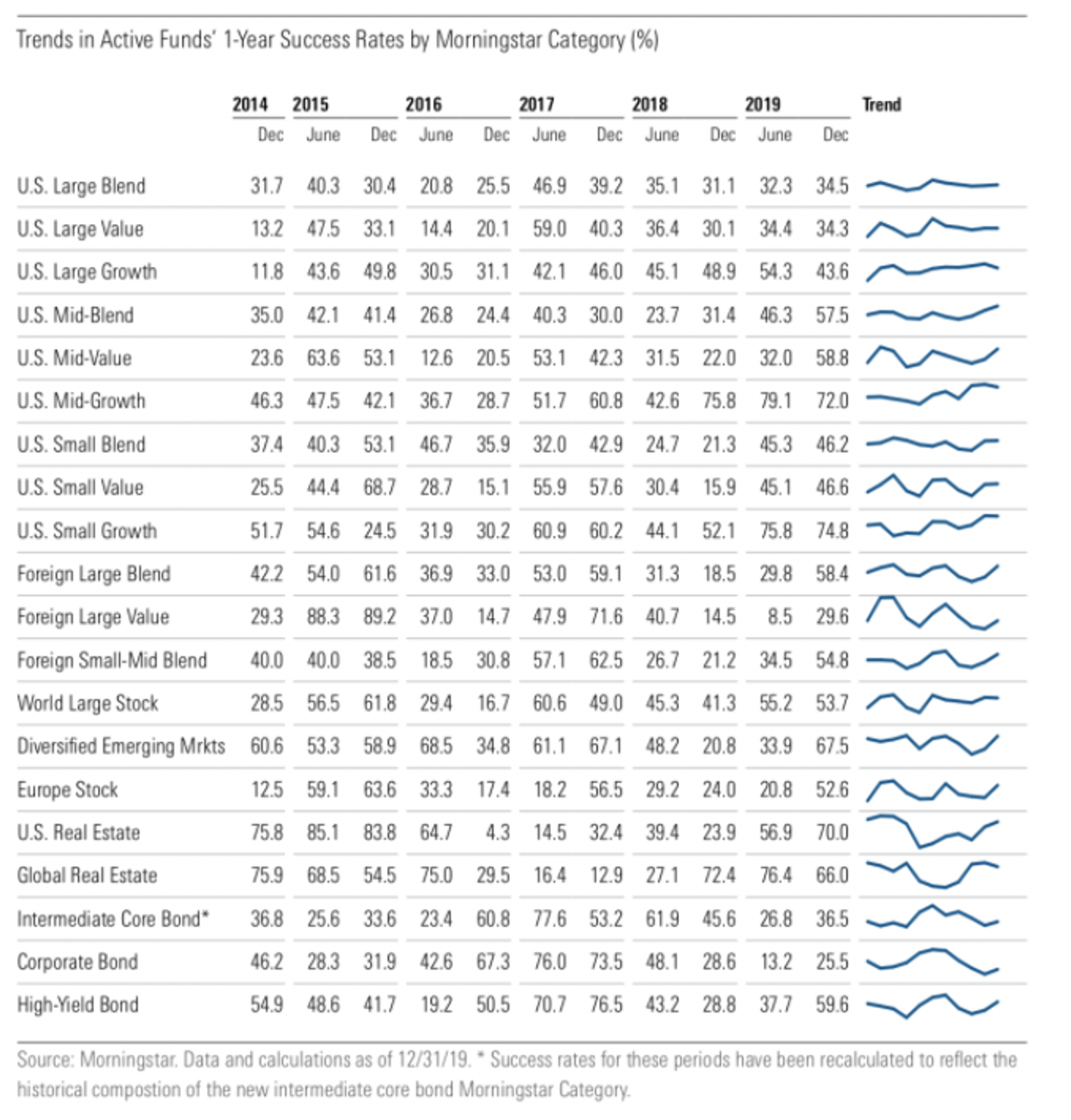

There is ample evidence that shows that to be the best approach. The table below from Morningstar shows the average relative performance versus indices of actively managed funds in different categories on a half-yearly basis from 2014 through 2019.

As you can see, there is a lot of disparity, but overall, only around 31% of the time did more than half of funds beat their indices during that period, and that is for funds actively managed by professionals. The message is clear: it is possible to beat the market, but almost impossible to do it on a consistent basis.

The problem right now is that we all hear about stories like GameStop (GME), or we look at massive returns in Tesla (TSLA) or bitcoin or whatever, and think, "Why didn’t I get a piece of that?" What we don’t hear are the countless stories of people who have gone broke over the years committing every penny to trying to do that. Remember, those success stories aren’t in the news because they happen regularly. It is their scarcity that makes them newsworthy.

Managing your own account and including some individual stock picks within that can be fun and even profitable, but you have to observe a couple of fundamental rules. Remember that you are trading in that scenario, and you should only ever commit to trading money that you can afford to lose. In addition, trading takes discipline, and if you aren’t prepared to trade that way, don’t trade at all. If you keep those two things in mind, you will be fine but, if not, you should ignore the phrase “stock picker’s market” and the stories of overnight millionaires, trust the long-term data, and invest in the market overall.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.