Charlie Bilello, Founder and CEO of Compound Capital Advisors, joined YCharts to discuss the most important, current market trends for advisors and their clients. Illustrated through visuals that Charlie creates using YCharts, these trends and topics provide fascinating insights and also make for excellent talking points in your own client communication.

YCharts users can access all of Charlie’s visuals as pre-built templates in the Fundamental Charts tool. Not a client? Reach out or start a 7-day free trial.

Access the full slide deck used in the webinar here, or read on for analysis of highlights from the November 18th webinar:

The Inflationary Spiral

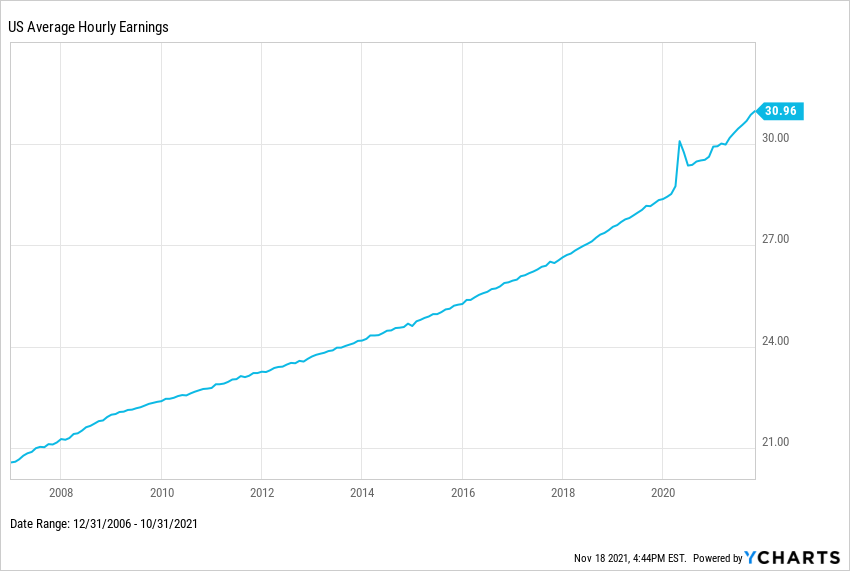

Charlie notes that wage growth was tepid under the most recent economic expansion, hovering around the low 2% range year-over-year. Now, US Average Hourly Earnings are growing at a faster pace, with the most recent YoY figure clocking in at 4.9%.

While employees ought to celebrate accelerated wage growth, inflation is quick to ruin the party. Since payroll is the largest expense for nearly every company out there, wage increases force businesses to either take profit hits, or pass the increased costs onto consumers through higher prices.

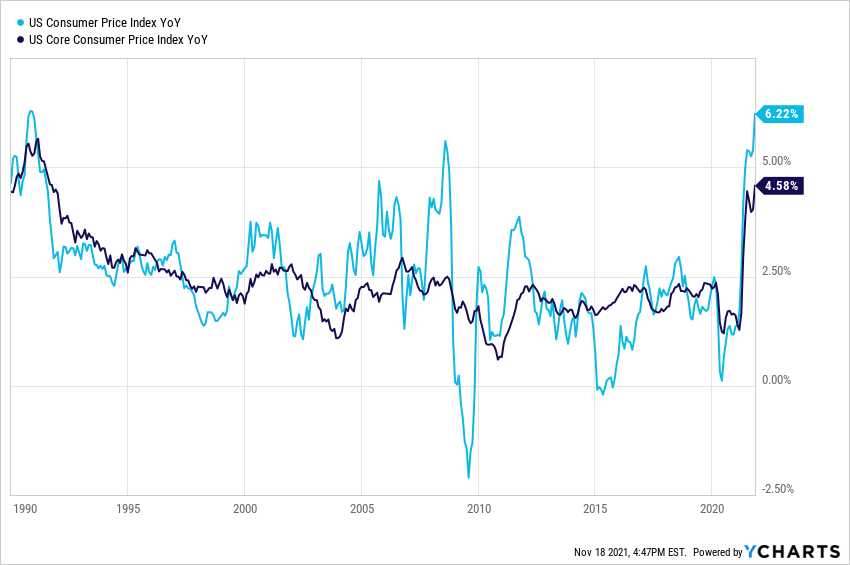

The US Core Consumer Price Index’s YoY increase of 4.6% means nearly all those wage gains are canceled out when you head to the checkout counter.

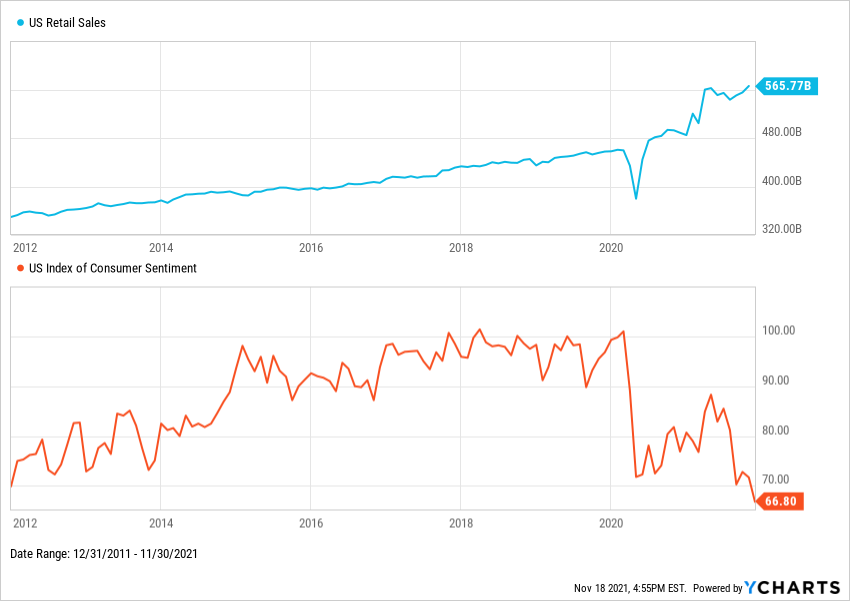

Rapid inflation has pushed US Consumer Sentiment to its lowest level since 2012, but actions speak louder than survey results. Inflation has not deterred consumers from spending, as US Retail Sales are at an all-time high. Despite glum consumer sentiment, Charlie sees prices continuing to rise so long as the consumer is willing to accept them.

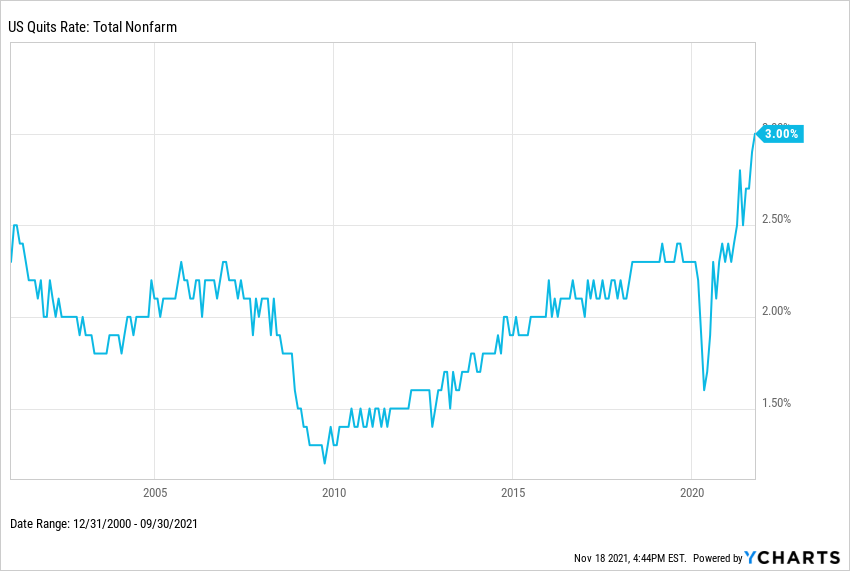

Another driver of wages and inflation has been “The Great Resignation”. In September, a record 3% of American workers left their jobs.

Given that both wages and US Job Openings are at all-time highs, Charlie concludes its workers who now have the upper hand. Many don’t feel the need to rush into a new job without better pay, benefits, and oftentimes both. But as illustrated by the first chart, when wages rise, the inflationary spiral is unleashed.

The Reopening and Repricing of Markets

Charlie notes that in the past few years, expectations of a sea change to the ways we live and work had been rising. The COVID-19 pandemic accelerated these changes and forced people to spend more time at home. In Charlie’s view, this was coming anyway.

More than 18 months on from the pandemic’s start, people are going out-and-about more than expected and driving another shift in investing themes.

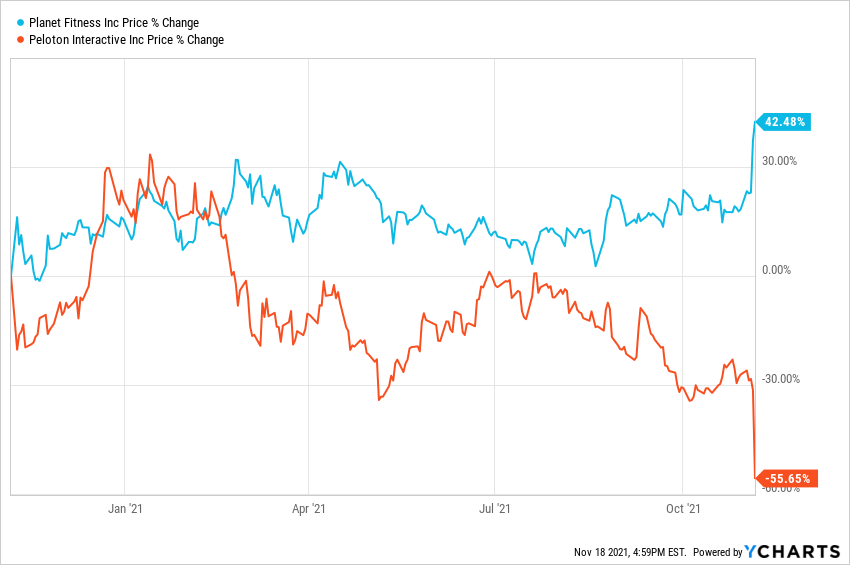

Take Peloton Interactive (PTON) and Planet Fitness (PLNT), for example. The pandemic left gym-goers no choice but to trade their memberships for home gyms and stationary Peloton bikes. As Peloton’s popularity, share price and valuation all grew, so did the perception that going to the gym would be a thing of the past.

But as businesses reopened, people parked their Pelotons and flocked back to the gym. As the new trend receded, the market repriced both Planet Fitness and Peloton, but in opposite directions.

The same goes for Live Nation Entertainment (LYV) and Zoom Communications (ZM). The “Live Entertainment” part of the former’s name and business model screeched to a halt in March 2020. For over a year, we attended virtual concerts, virtual graduations, and even virtual company happy hours.

Even as live events and in-person handshakes return, Charlie doesn’t see the hybrid work model and the need for Zoom going away anytime soon. Though he does note the market has repriced ZM’s stock and price-to-sales valuation.

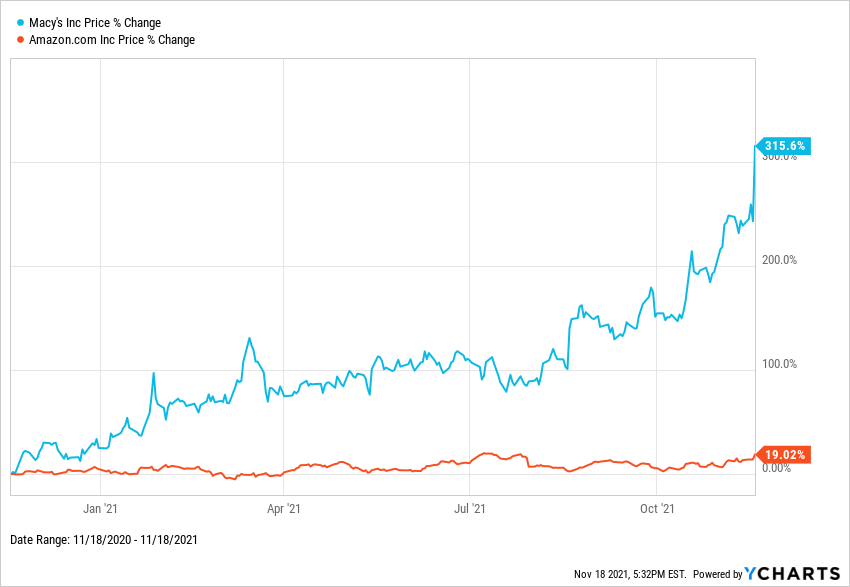

Finally, the way people shop was also drastically affected. When stores shuttered last March, people turned to e-retailers such as Amazon (AMZN) for their shopping needs. Charlie notes that after JCPenney filed for bankruptcy, many speculated other retailers with large brick-and-mortar footprints, such as Macy’s (M), would be next.

However, the reopening greatly re-ignited in-person shopping. Charlie points out that while e-commerce is still expanding, the rate of growth is slowing relative to expectations, prompting the market to reprice the likes of Amazon accordingly. Nothing like actually getting to try on a new pair of jeans in the fitting room, right?

You can download a slide deck containing all charts discussed in the webinar here. YCharts Clients can access the charts as templates in Fundamental Charts for further analysis.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.