With a major focus on developing the country’s roads, bridges and more, the construction companies are benefiting from President Biden’s new 'Bipartisan Infrastructure Framework'. Solid construction activities in the public sector, low interest/mortgage rates, an improving job market and solid GDP numbers have aided the Zacks Construction sector.

Given this backdrop, construction stocks could offer a safe haven to investors because of their stability and the fact that these are fundamentally strong enough to withstand industry woes.

Here, we focus on two companies from the Zacks Engineering - R&D Services industry falling under the broader Construction space — Quanta Services, Inc. PWR and Jacobs Engineering Group Inc. J.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Before drawing a head-to-head comparison between PWR and J, let’s check out a few key statistics of the companies.

What Defines the Stocks

Quanta is a leading national provider of specialty contracting services and one of the largest contractors serving the transmission and distribution sectors of the North American electric utility industry. The company is benefiting from its three-pronged growth strategy, focusing on timely delivery of projects to exceed customer expectation, leverage on core business to expand in complementary adjacent service lines and continuation of exploring new service lines. Also, the acquisitions strategy to boost market share and strong liquidity and demand for its services are adding to the bliss. Impressively, solid prospects of the Electric Power Infrastructure Solutions segment and increased demand for infrastructure solutions will continue to provide multi-year growth opportunities to Quanta.

Based in Texas, Jacobs is one of the leading providers of professional, technical and construction services to industrial, commercial and governmental clients. J primarily banks on efficient project execution, ongoing contract wins, solid buyouts and enough liquidity. Also, strong global trends in infrastructure modernization, energy transition, national security and a potential super-cycle in global supply chain investments are likely to aid the company. In late 2020, Jacobs launched the Focus 2023 initiative. Through this initiative, it has been accelerating the adoption of digital technology across all facets of operations. Jacobs expects this transformative initiative to drive growth through technology-enabled solutions by 2023. Focus 2023 integration/transformation is expected to drive double-digit adjusted EBITDA growth in fiscal 2022.

Customer Base & Market Cap

PWR serves customers engaged primarily in utilities, renewable energy development, communications, industrial and energy delivery as well as governmental entities. At 2021-end, its largest customer accounted for 7% of total revenues and 10 largest customers accounted for 38% of the same. In fact, utility customers accounted for 74% of total 2021 revenues.

In fiscal 2021, J earned 33% of total revenues directly or indirectly from the agencies of the U.S. federal government. Also, its Critical Mission Solutions largely serve U.S. government services, cyber, nuclear, commercial and international sectors. Jacobs' People & Places Solutions’ clients include national, state and local government in the United States, Europe, United Kingdom, Middle East, Australia, New Zealand and Asia as well as multinational private sector clients across the world.

At present, market capitalization of Quanta is $17.49 billion, while that of Jacobs stands at $16.39 billion. Both Quanta and Jacobs currently carry a Zacks Rank #3 (Hold).

Based on both the statistics, Quanta has an edge over Jacobs. PWR serves a broad range of both government and private sector entities than J and has a slightly higher market cap.

Stock Performance

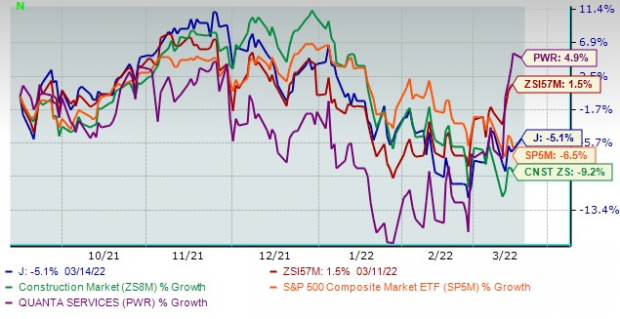

Quanta has gained 4.9%, while Jacobs fell 5.1% over the past six months. The Engineering – R&D Services industry collectively gained 1.5%, while the Zacks Construction sector and S&P 500 declined 9.2% and 6.5%, respectively, during the same period. Quanta here is a clear winner between the two.

Image Source: Zacks Investment Research

Earnings Growth Rate & Surprises

The ability to consistently boost profit levels defying industry woes is a defining characteristic of the best companies. Analysts expect Jacobs’ earnings to grow 12.1% for the current year. Comparatively, Quanta’s earnings are expected to grow 27.9% in the same time frame. Hence, Quanta’s higher growth rate implies a greater potential for capital appreciation.

Meanwhile, considering a more comprehensive earnings history, Quanta surpassed estimates in all the last four quarters, with an average of 7%. That said, Jacobs topped analysts’ expectations in three of the last four quarters, with an average surprise of 8.9%.

Valuation

Two stocks under consideration Quanta and Jacobs have a trailing 12-month price-to-earnings (P/E) ratio of 27.68 and 19.7, respectively. The industry has a trailing 12-month P/E ratio — which is the best multiple for valuing Engineering - R&D Services stocks — of 23.8, above the S&P 500 average of 20.23. Quanta is clearly overvalued than Jacobs, industry and S&P 500.

Profitability and Returns

Return on Capital (ROC) of both Quanta and Jacobs is 9.2%. The industry’s ROC stands at 7.2%. This signifies that both the businesses generate higher return on investment than the industry.

Return on Equity (ROE) in the trailing 12 months for Quanta is 15.4%. Jacobs’ trailing 12-month ROE is 13.9%. Quanta not only outpaced Jacobs but also the industry, which generated an ROE of 13.1%, in the said period.

Bottom Line

Quanta appears to be a comparatively better investment option than Jacobs in terms of all the statistics discussed above other than the P/E ratio.

Some Better-Ranked Stocks

Fluor Corporation FLR — a Zacks Rank #1 company — is gaining from the "Building a Better Future" initiative focused on enhancing markets outside the traditional oil and gas sector, fair and balanced commercial deals, financial discipline, and high-performing business culture. It has made significant progress toward strategic goals that comprise the reduction of outstanding debt by 30% and identified ways for more than $150 million in annual cost savings.

The Zacks Consensus Estimate for Fluor’s earnings for 2022 indicates 42.6% year-over-year growth. FLR’s earnings estimates have increased in the past 30 days.

AECOM ACM — a Zacks Rank #2 (Buy) company — is a leading solutions provider for supporting professional, technical and management solutions for diverse industries across end-markets served. The company has been continuously focusing on delivering industry-leading margins and unlocking capital to promote growth as well as innovation. Also, focus on higher-margin and lower-risk Professional Services businesses bodes well.

The consensus mark for AECOM’s fiscal 2022 earnings suggests growth of 20.6% year over year. That said, ACM’s earnings estimates have increased 1.5% in the past 30 days.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR): Free Stock Analysis Report

Fluor Corporation (FLR): Free Stock Analysis Report

AECOM (ACM): Free Stock Analysis Report

Jacobs Engineering Group Inc. (J): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20Reports%20Q2%20Loss%2C%20Lags%20Revenue%20Estimates%20%7C%20Nasdaq&_biz_n=1&rnd=314665&cdn_o=a&_biz_z=1743442446157)