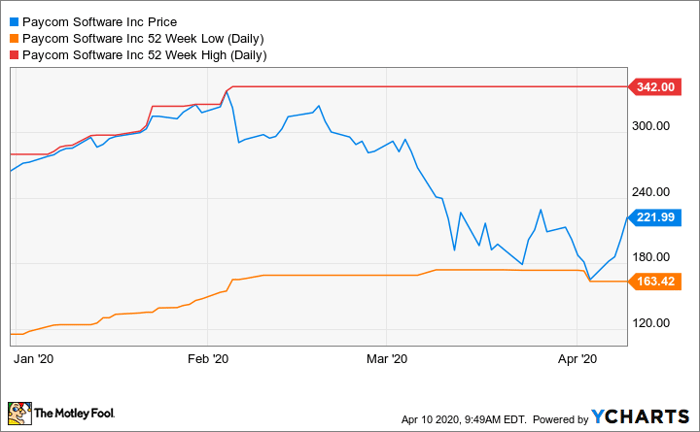

Paycom Software (NYSE: PAYC) shareholders have been on a wild ride lately. The stock doubled in 2019 on the back of strong growth and a profitable business model. It continued its momentum into 2020 and hit a 52-week high, but then it dropped to a 52-week low as the market got spooked with its exposure to U.S. small businesses and as part of the broader market downturn related to the coronavirus epidemic.

Paycom stock has bounced back in April as the market was reassured by the government's aid programs for employers.

Year to date stock chart through Thursday, April 9, 2020, market close. PAYC data by YCharts.

This online payroll processor turned human capital management software specialist has been a great investment since its IPO in 2014. But with non-essential business closures, unemployment growing daily, and a possible recession on the horizon, is this stock a buy today?

Let's dive into the business, its growth levers, and leadership to help investors decide.

The business of human resource management

Paycom's human capital management software helps organizations track the entire lifecycle of an employee in the cloud. It makes money from monthly subscriptions for its modules, receives additional payments based on the number of employees a customer has, and collects transactional fees for administering government forms or processing unscheduled payroll runs.

Revenue growth has been impressive, averaging 35% annually from 2016 and hitting $738 million for the 2019 full year. Gross margins are a strong 85%, enabling it to invest in its platform and still sport a healthy net income of 24.5% for full-year 2019. As of Dec. 31, 2019, it had $133 million in cash and cash equivalents on the balance sheet with the ability to borrow an additional $125 million if needed.

In its most recentearnings callon Feb. 5, the company projected revenue gains for 2020 at 24%, but that was before the impact of the coronavirus pandemic was fully realized across the U.S.

Let's look at Paycom's growth levers with an eye toward how these can be adapted to a tighter economic market.

Growth levers provide flexibility

Paycom's primary engine for growth is adding new customers. It has sales centers in 38 of the 50 largest metropolitan areas of the U.S. and believes it still has more opportunity in those markets. Resources could be added selectively in the cities that are more economically resilient.

Another opportunity is to expand its offering with existing customers. The value proposition for many of the modules is to help streamline HR processes and make the entire organization more effective. With a single, centralized database and a pay-as-you-go subscription model, adding new functionality doesn't have to be a huge implementation effort or a large lump-sum financial commitment, and it could even save the customer money.

Paycom's easy-to-access platform saves time for managers, employees, and HR professionals. Image source: Paycom.

Lastly, since 2018, Paycom has been having success selling to larger customers with between 3,000 and 5,000 employees. These bigger clients should have more resources and be more stable.

Still, even with a smart and adaptable growth plan, no one really knows how 2020 will play out. That's why leadership is so important.

Experience matters in uncertain times

Founder and current CEO Chad Richison started the company in 1998. Since then, he's led its employees through two recessions. During those times, this online payroll processor had a smaller suite of offerings, fewer customers, and fewer resources to tap into. Richison should be able to rely on his experience leading a small business to empathize with what customers are going through today. In his community, he's personally donated $1 million to help Oklahoma City Schools through the coronavirus crisis. We'll see if this generosity will extend to customers in need.

Chief Sales Officer Jeffrey York joined the company in 2002 and was named to his current position in 2007. Craig Boelte joined in 2006 as the chief financial officer. York and Boelte teamed up with the CEO to guide Paycom through the 2008-09 Great Recession. This trio should have a hard-won list of lessons to apply to whatever this inevitable recession brings and be a stabilizing force during the rocky year ahead.

But is it a buy today?

Even with the pullback in the stock price, Paycom still sports premium valuations with a price-to-earnings ratio of 60 and a price-to-sales ratio of 15. At this level, any bad news or results below market expectations could make the stock drop.

With no official guidance on how its customers are dealing with the pandemic and no public record on how it fared through the last two recessions, cautious investors may want to wait before buying. The upcoming shareholders meeting on April 27 or the fiscal 2020 first-quarter earnings report on or around May 5 should shed some light on the current situation. But for me, the 35% discount from its all-time high is an attractive entry point for a small position in this proven growth stock, with the idea of building a bigger position over time.

Paycom will be a much stronger company five years from now, and patient investors could be handsomely rewarded if they buy today.

10 stocks we like better than Paycom Software

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Paycom Software wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of March 18, 2020

Brian Withers owns shares of Paycom Software. The Motley Fool owns shares of and recommends Paycom Software. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.