The holiday season was a strong one for Lululemon Athletica (NASDAQ: LULU), even though pricing weakened into early 2023. The company's recent earnings update was packed with good news about the business, such as robust customer traffic momentum. On the other hand, a surprise drop in gross profit margins has Wall Street worried that the good times might be ending soon.

With that concern in mind, let's look at whether Lululemon stock is a compelling buy here in early 2023.

The latest update

The company's January 11 operating update showed a mixed performance through the end of 2022. Sales trends held up well, and in fact, the company raised its revenue target for the full year.

Sales should now land between $2.66 billion and $2.7 billion, translating into a roughly 26% spike year over year. The previous forecast range was $2.6 billion to $2.66 billion. "We are pleased with our continued revenue growth and momentum in our business," CEO Calvin McDonald said in a press release.

Signs of stress

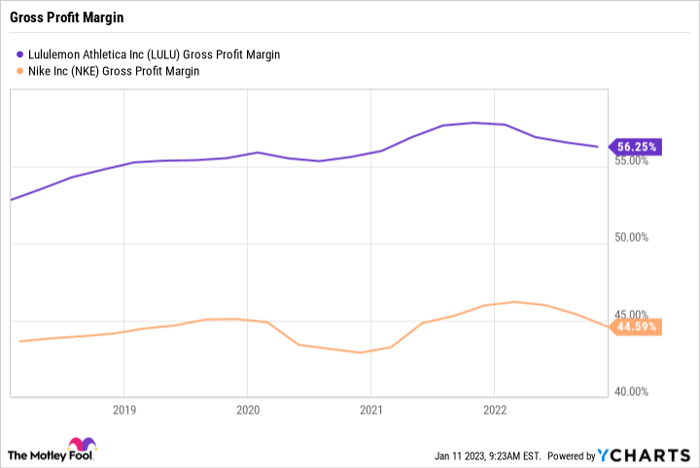

There were also signs of stress, though. Lululemon lowered expectations on gross profit margin, which implies pricing pressures into early 2023. The company had been reporting soaring inventory levels late last year, but management said this spike didn't reflect weaker demand or more price sensitivity from athleisure shoppers. But the gross profit margin decline shows that Lululemon struggled to pass along all of the rising costs currently impacting the business.

LULU Gross Profit Margin data by YCharts.

A key part of the investing thesis for Lululemon stock relies on the chain's industry-thumping profit margins. Gross profit is far above many peers, including Nike (NYSE: NKE), and has been steadily rising since before the pandemic struck. A change in that trend would threaten shareholder returns by erasing some of the premium valuation that Wall Street has assigned to the stock.

There's no cause for concern yet. The company has been seeing quick spikes in many costs, and it makes sense that these surges would temporarily pressure gross margins. Lululemon is finding room to cut costs in other areas, too, and so its operating profit margin remains far higher than most retailing peers.

Still a buy

Investors have some good reasons to temper their expectations for 2023, given the slowdown in consumer spending and the potential for a recession on the way. Lululemon's high inventory level and declining gross profit margin represent additional risks suggesting weaker sales and earnings ahead over the short term.

That doesn't change the broader bullish thesis for the stock, though. Lululemon is still finding lots of excitement for its new product releases, which are increasingly heading into new geographies, new markets, and new categories like outerwear and footwear. Its sales growth and operating profit margin metrics are far above what investors can find with most of its industry peers.

Lululemon wouldn't be immune to a recession or a sharp pullback in consumer spending, should one develop over the next few quarters. But its latest operating update doesn't describe such a slump. On the contrary, the company has a good shot at targeting another year of rising sales and improving profits over the long term. Those positive factors keep the stock firmly in the "buy" category.

10 stocks we like better than Lululemon Athletica

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Lululemon Athletica wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of January 9, 2023

Demitri Kalogeropoulos has positions in Nike. The Motley Fool has positions in and recommends Lululemon Athletica and Nike. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.