TLDR: The strong rally in stocks has been underpinned by the hope Fed tightening is behind us (ok, hedge fund short covering helped too). The key to this hope lies in inflation dynamics, assuming that a) inflation has peaked and b) it’s fast converging to the 2% target the Fed wants. January CPI print will offer clues to both.

Markets are currently expecting both a) and b) to get further confirmation in the data print. Core CPI inflation, which strips out the volatile food and energy components, is expected to slow to an annual rate of 5.4%, down from 5.7% in December. High rents will have prevented a bigger drop in core inflation, which is why the Fed has often highlighted the inflation measure that excludes rents.

The problem with these prognostications is that they…could all be horribly wrong in the longer run. Here is why.

Any inflation forecast further out than a month - or two - has to account for the insanely strong U.S. labor market. After several months of apparent cooling, markets expected that trend to continue with 187k number of net jobs added in January. The economy blew through those expectations, adding 517k jobs and the unemployment rate fell to its lowest level since 1969.

How do you like them apples?

A tightening labor market isn’t conducive to an inflation fight. You don’t have to be an economist to understand that a tight labor market isn’t helpful if you’re hoping for wage growth to cool.

A lot of focus will be on whether core is declining in line - or faster, which would be better - with expectations. Another important bit is housing inflation. That’s been making the overall numbers stickier but is expected to drop by mid-year. Any positive surprises (faster deceleration) here would make the Fed’s job a lot easier (and markets happier).

It would definitely make a nice Valentine’s Day surprise.

What stocks are doing well today

This section is powered by OpenAI using TOGGLE AI

The market pre-open performance of S&P 500 stocks is a closely watched indicator of the days market trends. At pixel time, the median performance of the S&P 500 stocks was 0.03%, with 48% of the SPX stocks down pre-open.

A closer analysis of the stocks that pre-opened up today reveals that they had a high number of analyst SELL recommendations (27.0% of all rising stocks), had high capitalization (21.0%), and high expectations of earnings growth (20.0%). The top 5 gainers were HRL:NYSE with 1.8%, NSC:NYSE with 1.95%, MDLZ:NASD with 1.96%, AES:NYSE with 2.39%, and MRO:NYSE with 3.43%.

On the other hand, stocks that pre-opened down were characterised by low trading volume (89.0% of all falling stocks), sales that surprised on the downside (58.0%), and weak earnings growth (47.0%). The top 5 losers were FIS:NYSE with -9.53%, LH:NYSE with -4.76%, AWK:NYSE with -2.94%, CTVA:NYSE with -2.32%, and MPC:NYSE with -2.23%.

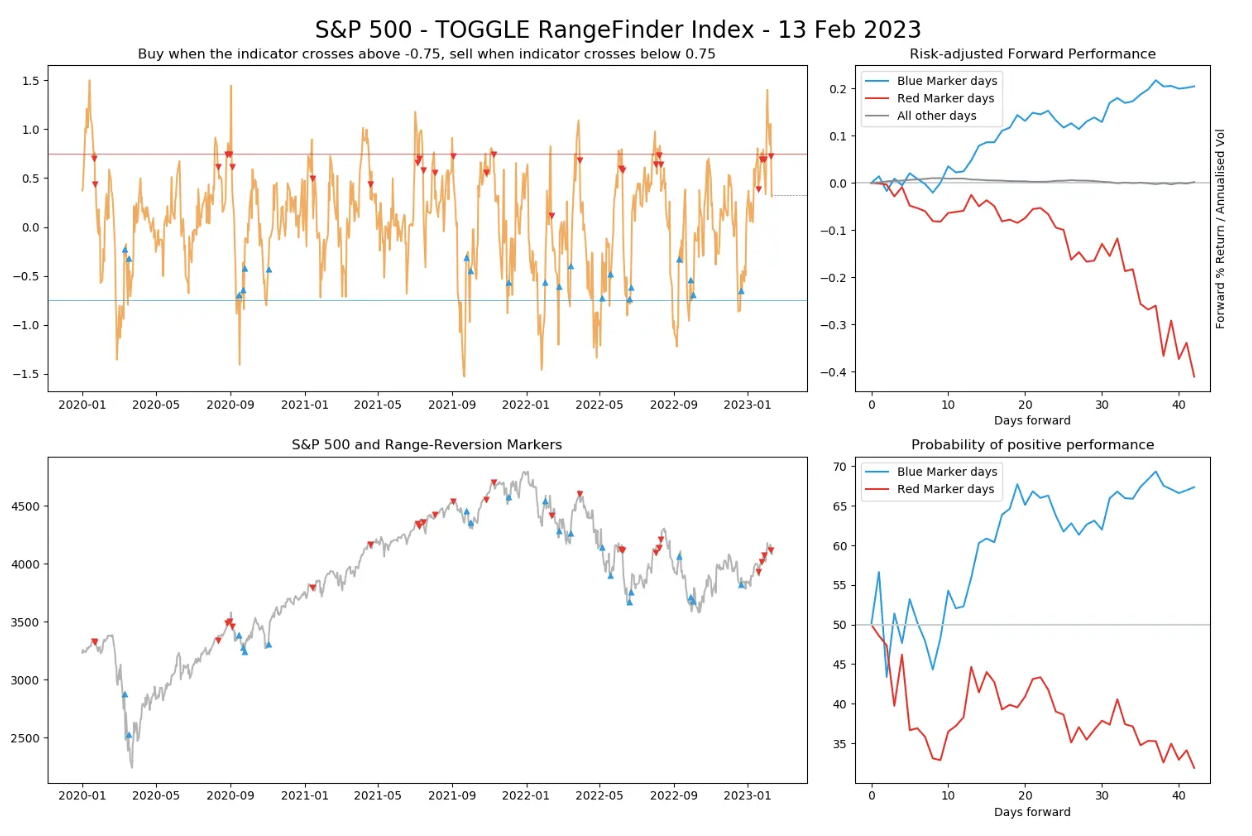

TOGGLE Leading Indicators: Leading indicators tilt bearish

After the last rally, all our indicators are pointing bearish

- TLI: began flashing red two weeks ago now, now it retraced into neutral

- Rangefinder Index: posted another bearish transition last Friday

- Peak Probability Indicator: still not active, nearing the 95% threshold

- Candle Breadth: reached the bearish threshold last week

- Market Phase Shift Indicator: still not active, this is a longer-term indicator

Learn more about the Leading Indicators in the Learn Center!

Upcoming Earnings: Coca-Cola (KO) releases tomorrow

Click here to test what to expect when KO releases earnings tomorrow.

Discover how other companies could react post earnings with the help of TOGGLE's WhatIF Earnings tool.

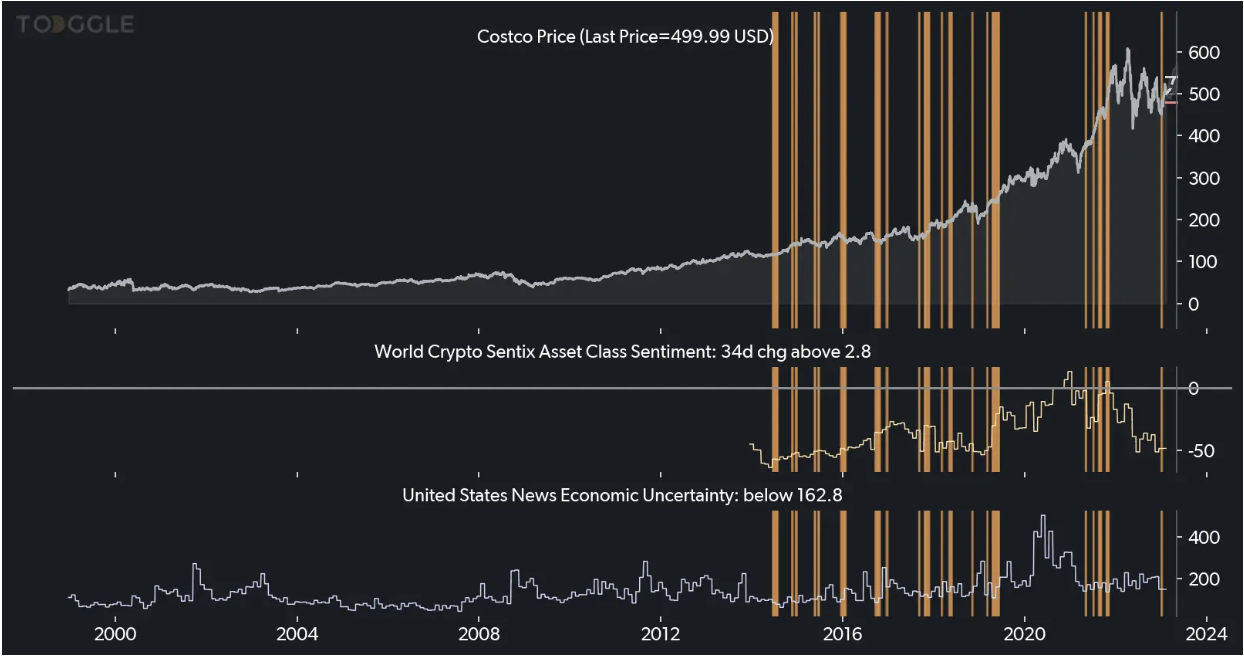

Asset Spotlight: Improving sentiment for Costco (COST)

TOGGLE analyzed 20 similar occasions in the past where sentiment indicators for Costco are improving and and historically this led to a median increase in the asset price over the following 3M. Check it out!

General Interest: The Pentagon shoots down 4 UFOs

Sunday night, Pentagon officials fielded questions from journalists after the U.S. shot down the fourth unidentified object in its airspace in a matter of days.

It appears that once the Department of Defense took a closer look at the skies, they found out the balloon floating over Montana was not an isolated occurrence.

“We have been more closely scrutinizing our airspace at these altitudes, including enhancing our radar, which may at least partly explain the increase in objects that we’ve detected over the past week”, Assistant Secretary of Defense Melissa Dalton.

A journalist asked if it was aliens. With more likelihood, it appears the Chinese have been flying/floating balloons over the U.S. (and presumably the rest of the world) for a while now.

You can read more here on Bloomberg.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.