BJ's Wholesale Club (NYSE: BJ) does not attract as much attention as larger warehouse clubs such as Costco or Walmart-owned Sam's Club. However, the stock has still managed to surge more than 80% since the beginning of the year, taking it to record highs.

Despite the share price gains, company expansion has only moved westward at a slow pace. Given the growth in store numbers, investors will have to decide whether BJ's has finally become a growth name or if it will likely return to range-bound trading once COVID-19 runs its course.

Image source: Getty Images.

BJ's and its stock

Americans who live west of the Mississippi might not know BJ's well. It's a warehouse club with a footprint primarily on the East Coast. It currently operates 218 warehouses and has attracted more than 5.5 million members. Like Costco and Sam's, it sells bulk amounts of groceries, general merchandise, and at most of its locations, gasoline.

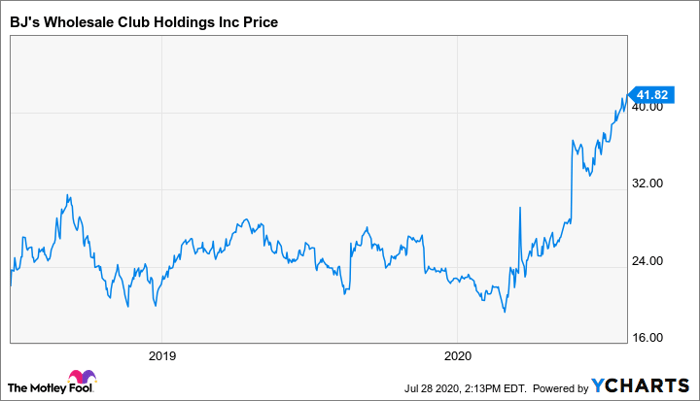

Investors should also consider the brief history of the stock itself. BJ's shares did not begin trading until June 2018. It remained in a tight range for two years, only gaining traction as stocks started to recover from the bear market in the spring.

However, BJ's stock now looks like one of the few beneficiaries of the COVID-19 pandemic. Between January and March, BJ's stock fell by over 15%, dropping to an intraday low of $18.84 per share in mid-March. From that point, it began a steady and sustained move higher, now trading at a high of almost $42 per share.

Data by YCharts.

This could point to tremendous potential as both Walmart and Costco were once regional names like BJ's. They made stockholders wealthy as they expanded across the country and beyond.

A gradual expansion

However, BJ's holds just over $1.33 billion in long-term debt. With this obligation and other liabilities, the company has struggled to keep positive amounts of equity on the balance sheet.

Nonetheless, in the latestearnings call CFO Robert W. Eddy made it clear that the company has "earnings to invest" and is eyeing real estate opportunities with some of its cash. In 2018, the company stated a goal of opening 15 to 20 additional locations over the next five years. They announced these will constitute infill in existing markets and expansion to adjacent locations. This included an expansion into Michigan in 2019.

BJ's has announced opening dates for only two warehouses so far in 2020. Still, this includes the Chesterfield, Michigan location, which will open July 31. The same month, the company revealed plans to open two more warehouses in New York in 2021. Hence, while COVID-19 may have slowed BJ's expansion, it continues to plan for new locations.

Should investors buy?

At first glance, the company looks like a bargain. At a forward P/E ratio of about 20.5 as of this writing, it trades at a significantly lower valuation than its peers.

And like other warehouse retailers, BJ's has seen increased traffic because of the COVID-19 pandemic. During the company's first quarter, comparable sales (excluding gasoline) increased 27% year over year. Also, earnings of $0.69 per share came in 176% ahead of profits in the same quarter last year. By comparison, earnings per share were up 29% in fiscal 2019.

Furthermore, free cash flow for the quarter came in at around $434.7 million. That quarterly number alone exceeded the yearly free cash flow levels for each of the last three fiscal years.

At some point, the COVID-19 threat will end. When that happens, sales will probably return to pre-pandemic levels. The company admitted as much in the previous conference call. However, Eddy made clear BJ's intent to turn "one quarter's fantastic performance" into "many years of growth."

For now, analysts forecast that a 56% earnings increase in fiscal 2020 will give way to a 7.5% drop in profits next year. Nonetheless, the sales bump helped relieve much of the strain on the balance sheet. It also likely played a role in BJ's stock reaching record levels. If the retailer can continue expanding and build on this newfound momentum, the recent rally could be just the beginning for BJ's stock.

10 stocks we like better than BJ's Wholesale Club Holdings, Inc.

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and BJ's Wholesale Club Holdings, Inc. wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of June 2, 2020

Will Healy has no position in any of the stocks mentioned. The Motley Fool recommends Costco Wholesale. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.