At Hillcrest, we have examined the long-term predictiveness of short interest, a prominent factor in the year-to-date environment following the recent astronomical returns of AMC, GameStop, and other highly shorted companies.

While some investors have been wooed into believing that heavily shorted companies are attractive investments, the data we analyzed rebutted this notion and demonstrated that companies with elevated short interest typically underperform over time. Another important aspect of the current market environment has been discussions surrounding prudent risk levels in stock selection following several recent bursts of risk-on market sentiment. We thought it would be appropriate to examine a factor commonly held by investors to be an effective barometer of risk in stock selection: beta.

Beta is a statistical measure of a company's share price volatility relative to the overall market calculated using regression analysis. The factor is notably rooted in its use as an input in the Capital Asset Pricing Model (CAPM), a centerpiece of academic finance and a pricing model that is widely taught to investment students. Importantly, the theory behind this prominent pricing model equates the share price volatility captured by beta as an accurate measure of a company's risk. Accordingly, companies with higher beta coefficients have exhibited greater share price volatility than the overall market and are thus purported to have more risk.

Companies with lower beta coefficients have conversely exhibited lower share price volatility relative to the overall market and are therefore thought to have a lower level of risk. To be sure, issues with the practicality of the CAPM in real-world settings have been widely noted, and thus the overall pricing model is largely relegated to academic theory. However, while the CAPM is generally not utilized by practitioners, it is still common for beta to carry weight among market participants as a relevant measure of a company's broad risk level.

While beta is routinely regarded as an informational measure of risk, as a behavioral manager, we recognize that this premise should be objectively tested. A key parameter in conducting such a test is determining an appropriate definition of "risk" that the beta factor should be tested against. While differing descriptions of risk abound, we believe a reasonable definition of risk for a real-world practitioner engaging in stock selection centers around the probability of a long-term loss of the capital allocated to an investment. Accordingly, our analysis focuses on the long-term total returns of the beta factor. Our backtest results can be seen in the table and chart below.

The table on the left displays the average twelve-month returns of the factor by decile over the test period. The first decile represents companies with the lowest beta and is thus thought to offer the lowest risk levels. Conversely, the tenth decile represents the returns of companies with the highest betas that supposedly bring the most elevated risk levels. It is important to note that these deciles are sector neutral, meaning that each decile comprises the same sector weights as the overall universe. The chart on the right breaks out how the factor performed throughout the test period. The data specifically represents the rolling twelve-month return spread of the factor's top three (lowest beta) deciles versus the bottom three (highest beta) deciles. The results reflect a Q1 2000 - Q2 2021 test period run with a quarterly frequency and with the Russell 3000 used as the universe.

The test results oppose the notion that beta is an informational measure of risk in stock selection. We would expect that the factor would demonstrate some meaningful degree of predictiveness for stock returns over time if beta was indeed an effective measure of risk. However, this data shows there is very little difference in the return level of companies with high, average, or low betas. In fact, there is critically no material difference in the return of the tenth decile of data, which represents the companies with the highest betas (and thus allegedly the greatest risk levels), and the average company in the universe. Furthermore, the time-series data shows that these generally muted results are not concentrated to a specific period as the top three deciles of the factor outperformed the bottom three deciles in a relatively benign 58% of periods.

The underlying reason that beta is ineffective as an indicator of risk, or the potential for long-term loss of capital, is that beta is simply a measure of share price volatility. The true risk associated with a company is a result of its business fundamentals. In other words, the variables that determine the riskiness of a company are deeper fundamental business factors that go beyond what can be captured by a calculation of share price volatility, which can be driven by several ancillary circumstances unrelated to a company’s fundamentals.

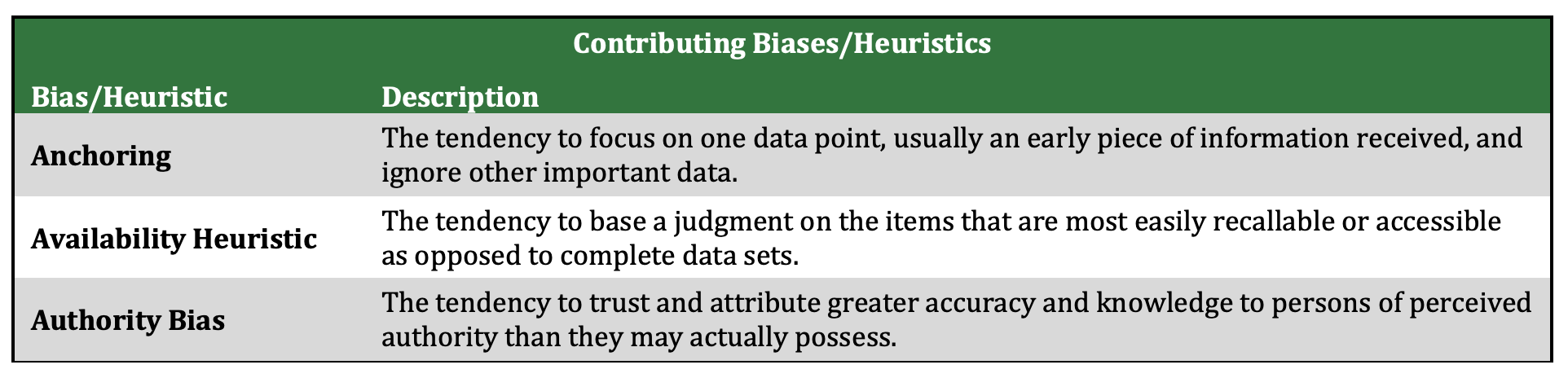

This begs the question of why some investors would be prone to misconstrue a simplistic measure of share price volatility as an effective barometer of risk in stock selection. We believe this phenomenon results from market participants falling victim to a confluence of behavioral errors, a representative list of which can be found in the table below. For example, the availability heuristic plays a large role in the undue influence of beta in stock selection, given that beta can be readily found for any company and is also easily digested. The ample availability of the factor also influences the tendency of investors to anchor to the beta datapoint, while its prominence in academic finance also likely prompts the effect of the authority bias. These behavioral errors, among others, together serve to result in an ineffective measure of risk carrying undue weight in the stock selection processes of many investors.

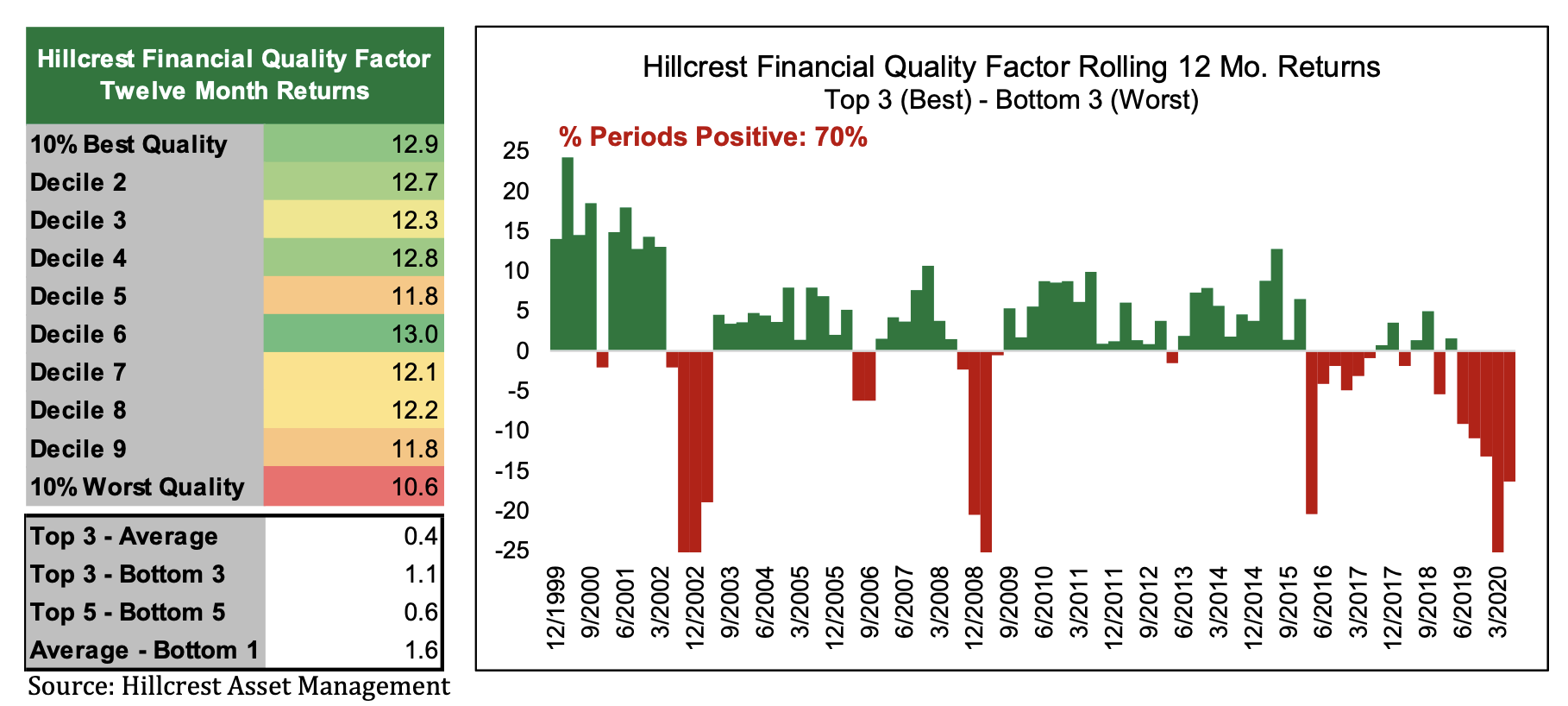

While relying on beta as a measure of risk when making investment decisions is problematic, an understanding of investor behavior and company fundamentals can be utilized to construct a factor that is a more effective measure of a company’s actual risk level. An example of such a factor can be seen in Hillcrest’s Financial Quality factor. This factor specifically uses a proprietary combination of over fifteen underlying indicators that include measures of profitability, liquidity, accounting, and earnings quality, among others, to quantify the health of a company’s financial position and thus the risk facing an investor considering an investment. The backtest results of the Financial Quality factor are below.

The first decile of the data reflects the companies with the best financial position (lowest risk), and the tenth decile represents the companies with the worst financial position (highest risk). Like the previous data, the results are sector neutralized and reflect a Q1 2000 - Q2 2021 test period that was run with a quarterly frequency with the Russell 3000 used as the universe.

The backtest results of the Hillcrest Financial Quality factor are distinctly differentiated from the test results of the beta factor. Most notably, the tenth decile of the factor, which represents companies calculated to have the worst financial positions, is the single worst performing decile in the universe by a decent margin. We would also note that the decile returns are positively correlated with the factor as the results evidence a linear relationship between a company’s financial quality and future returns. This is consistent with expectations for a factor designed to be a practical measure of risk in stock selection. At the same time, the time series data exhibits that this relationship is persistent over an impressive 70% of historical periods.

These results objectively show that investors should not rely on beta as a measure of risk in stock selection despite the prevalence of the factor. This data also exhibits the broader importance of avoiding behavioral biases by utilizing objective research to guide decision-making and inform an investor’s process. Not only can objective research protect an investor from utilizing pieces of information that are either ineffective or detrimental to returns, but research capabilities also enable an investor to create datapoints that can contribute to outperformance over time.

Any forecasts, figures, opinions, or investment techniques and strategies explained are Hillcrest Asset Management, LLC's as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given, and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment. The material should not be relied upon as containing sufficient information to support any investment decision.

Data is provided by various sources and prepared by Hillcrest Asset Management, LLC and has not been verified or audited by an independent accountant. Test results are not indicative of future results and should not be relied upon. While the information provided above is not based on the performance of any individual security or group of securities, the methodology used to provide the information can be obtained by contacting Hillcrest Asset Management, LLC.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.