Aurora Cannabis (NYSE: ACB) had a disastrous 2019. Much of the decline in its share price was due to the company's reckless spending, along with external headwinds. It lost 56% of its stock value in 2019, worse than last year's 36% slump of the industry benchmark -- Horizons Marijuana Life Sciences Index ETF.

However, the company is making every possible attempt this year to rebound and recapture the cannabis market. Its efforts included shutting down unproductive facilities, reducing the workforce to conserve cash, and diluting its stock through a reverse stock split -- which isn't appealing to investors, who do not see diluting stock as a positive sign. Aurora opted for a 1-for-12 reverse stock split in May to save its stock from getting delisted from the New York Stock Exchange when its stock price dropped below $1. Diluting stock isn't necessarily a bad thing, if it helps the company grow its earnings and boost the stock price. However, that's not what happened with Aurora. The company is still struggling to stay afloat.

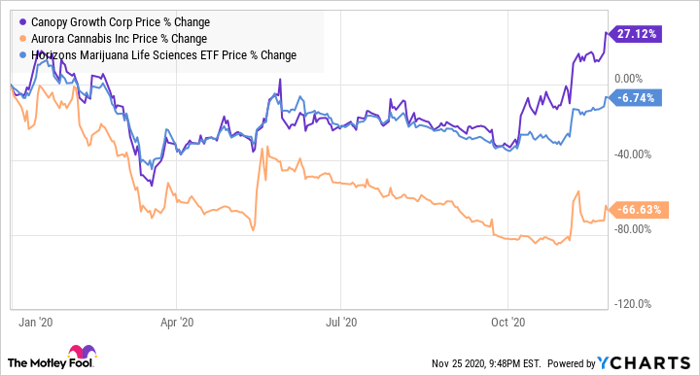

Given an up-and-down year, investors were hoping to hear some sort of positive news from the company's recent first-quarter fiscal 2021 report, released Nov. 9. But the report was a disappointment, dragging the stock deeper into the abyss. So far this year, Aurora's shares are down 72%, while its peer, Canopy Growth (NYSE: CGC), has seen its stock surge by 12%. Meanwhile, the industry benchmark has slumped 13% over the same period. Let's take a detailed look at the results and determine whether there are signs of recovery for Aurora in the near future.

Image source: Getty Images.

Cannabis derivatives could be a key market for Aurora to rebound

For the quarter ended Sept. 30, Aurora's total cannabis net revenue sank 8% year over year to 67.8 million Canadian dollars.

The fall was mostly due to a sales decline for Aurora's Daily Special value brand, which management says lost market share due to new entrants and increased competition in the cannabis flower category. However, the good news was a CA$3.6 million increase in consumer cannabis extract net revenue driven by higher-margin products, including cannabis-derivative products. Cannabis derivatives include vapes, edibles, concentrates, and beverages. Canada legalized these nationwide in October 2019 as a part of "Cannabis 2.0" legislation.

The company hasn't launched any new derivatives in months, and management didn't discuss any new rollouts in this quarter's call. I am not surprised by this, given that Aurora's main focus now is to conserve cash by reducing expenses and not spending more on new products. However, it's important for Aurora not to lose out on the opportunity of this new, expanding derivatives market, while its Canadian peers and U.S. counterparts are striking when the iron is hot. Aurora has also not shown any interest in launching cannabis beverages.

Meanwhile, its peer, Canopy Growth, has been rapidly expanding its derivatives position with the launch of a variety of these offerings. Its cannabis beverages, in particular, have been available since March and are drawing consumers' attention. In a research report, Deloitte estimates that cannabis-infused beverages alone could generate CA$529 million annually. And the U.S cannabis beverages market could be worth $2.8 billion by 2025, according to Grand View Research.

Image source: Getty Images.

Aurora still has a long way to go

Aurora assured investors in its most recent results that it will hit positive earnings before income, taxation, depreciation, and amortization (EBITDA) by the second quarter of fiscal year 2021, which ends Dec. 31. But it looks doubtful to me. Its Q1 EBITDA rang in at a loss of CA$57.8 million, compared with a loss of CA$33 million in the year-ago quarter. Sequentially, EBITDA losses were also up from CA$32.2 million in the fourth quarter of 2020, largely because of legal-settlement and contract-termination fees associated with workforce reduction as part of the business transformation plan announced in June.

While management is working to reduce its selling, general, and administrative (SG&A) expenses, it will need to work harder to achieve profitability. SG&A expenses fell from CA$58.8 million in Q4 to CA$46.9 million in Q1.Management will also have to prove that they can make the best of some high-price tag-acquisitions, especially hemp products company Reliva, which Aurora acquired for $40 million of its common stock in March to expand its reach in the U.S. cannabidiol (CBD) market. Some investors have questioned the leadership team, believing that Aurora made too many aggressive spending mistakes last year. But new CEO Miguel Martin -- previously the CEO of Reliva -- has promise, especially if the company can use his experience in the cannabis and consumer space to its advantage.

For now, Aurora remains a very risky investment with a reputation for not delivering on its promises. The company has to live up to its target of achieving positive EBITDA by the second quarter -- and even if it does, investors need to be aware that any cannabis stock still carries some amount of risk. Aurora also has to prove that it can capitalize on its Reliva acquisition, reduce costs further, and continue to expand into the derivatives market with more products.

This is a good buy for aggressive investors who believe high rewards come with high risk. But for risk-averse investors, my advice would be to wait until the company reports higher revenues or profit numbers before investing in this cannabis stock.

Here's The Marijuana Stock You've Been Waiting For

A little-known Canadian company just unlocked what some experts think could be the key to profiting off the coming marijuana boom.

And make no mistake – it is coming.

Cannabis legalization is sweeping over North America – 11 states plus Washington, D.C., have all legalized recreational marijuana over the last few years, and full legalization came to Canada in October 2018.

And one under-the-radar Canadian company is poised to explode from this coming marijuana revolution.

Because a game-changing deal just went down between the Ontario government and this powerhouse company...and you need to hear this story today if you have even considered investing in pot stocks.

Simply click here to get the full story now.

Sushree Mohanty has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.