It is doubtless a positive to see that the Yellow Corporation (NASDAQ:YELL) share price has gained some 55% in the last three months. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 65% in that time. Some might say the recent bounce is to be expected after such a bad drop. But it could be that the fall was overdone.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

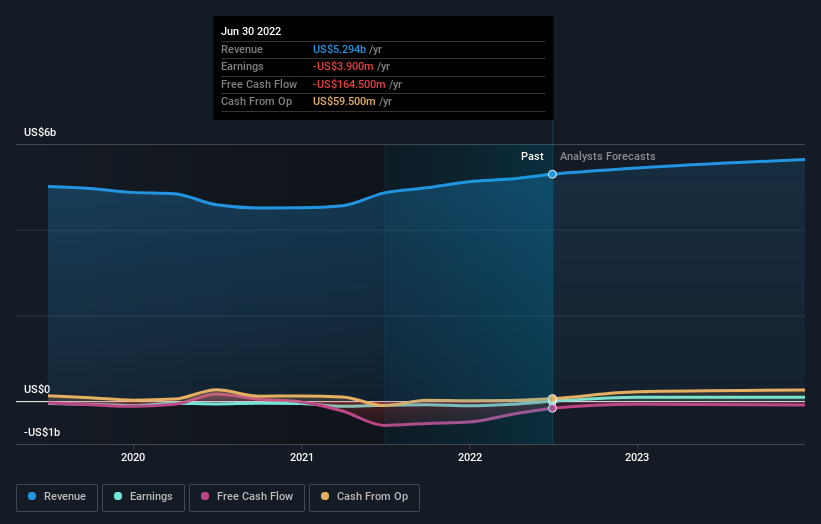

Because Yellow made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Yellow saw its revenue increase by 0.2% per year. That's far from impressive given all the money it is losing. It's likely this weak growth has contributed to an annualised return of 11% for the last five years. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Yellow in this interactive graph of future profit estimates.

A Different Perspective

While it's certainly disappointing to see that Yellow shares lost 16% throughout the year, that wasn't as bad as the market loss of 23%. What is more upsetting is the 11% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. It's always interesting to track share price performance over the longer term. But to understand Yellow better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Yellow (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

Yellow is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20have%20unfortunately%20lost%2065%25%20over%20the%20last%20five%20years%20%7C%20Nasdaq&_biz_n=10&rnd=346349&cdn_o=a&_biz_z=1742703177888)

%20have%20unfortunately%20lost%2065%25%20over%20the%20last%20five%20years%20%7C%20Nasdaq&rnd=90738&cdn_o=a&_biz_z=1742703177892)