The Roundhill Sports Betting & iGaming ETF (BETZ) debuted Thursday as the first exchange traded fund focusing on the sports wagering and internet casino segments – two of the fastest-growing areas in the gaming business.

For new ETFs, particularly those that qualify as thematic, success is never guaranteed and there's always plenty of moving parts, including timing and validity of the underlying theme. In the case of BETZ, it has both of those important factors on its side.

Start with the credibility of the sports betting investment thesis, which is more important than timing because rookie ETFs can overcome bad timing. Put simply, the sports gambling and iGaming markets are experiencing exponential growth.

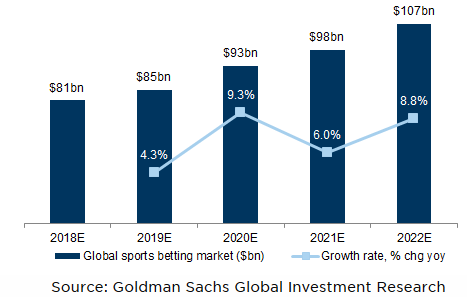

“Sports betting is the activity of placing wagers on predicting the results of sporting events. As of 2018, sports betting represented approximately 18% of the $449 billion global gaming market, as measured by gross gaming revenues, or 'GGR',” according to Roundhill Research. “In terms of the sports upon which wagers are placed, popularity varies significantly from region to region. Goldman Sachs expects the online sports betting market to grow 7.1% per annum from 2018 to 2022.”

Courtesy: Roundhill Investments

If that's not convincing enough, perhaps the following: earlier this week, Bank of America analyst Shaun Kelly said the online casino and sports wagering verticals could each ascend to $20 billion over the next several years.

That's relevant to BETZ investors because the new fund allocates 57.6 percent of its weight to sportsbook and iGaming companies not to mention the 25.3 percent weight to technology companies.

Timing, too and BETZ Has It

There are timing elements potentially benefiting BETZ, including one of a cosmetic nature and one with more substantial, longer-ranging implications.

Starting with the superficial part of this equation, the Roundhill fund is the first ETF featuring exposure to DraftKings (DKNG) with the daily fantasy sports (DFS) and sportsbook company being the fund's the largest holding at seven percent. Likewise, BETZ is the first fund to hold shares of cloud software company GAN Ltd. (GAN), which derives essentially all of its revenue from the gaming industry.

It's also the ETF with the largest weight to Penn National Gaming (PENN), a traditional casino operator with major online betting and sports wagering exposure. GAN and Penn combine for about 10 percent of the BETZ roster.

The other side of the timing equation here is potentially more compelling. Today, 18 states and Washington, DC have live and legal sports betting with four being legal but not operational. When it comes iGaming, that number is even smaller as that market is basically just New Jersey and Pennsylvania.

In the wake of the coronavirus, expect those numbers to increase. Regardless of blue or red status, states' coffers were adversely affected by the COVID-19 shutdown. Tax collection faltered and budgets are crimped, prompting analysts to speculate that more states will turn to internet casinos and sports betting as means of boosting revenue.

Demographics Matter, Too

Another perk with BETZ is that it taps into important demographic changes that many traditional casino operators are grappling with – primarily how to woo millennials and Gen Z. Those groups are displaying reluctance to head to land-based casinos on par with baby boomers or Gen X.

However, those younger groups are tech savvy and do like to gamble. The BETZ lineup addresses this demographic conundrum as even its standard casino components, such as Penn, are heavily involved in iGaming, sports betting or both.

Given its focus on app-driven, asset-light companies with technology leanings, BETZ could very be appealing to younger investors, too.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.