By Leland B. Hevner

President, National Association of Online Investors (NAOI)

This is the second in a series of articles that show how the National Association of Online Investors (NAOI) is changing how investing works to better cope with modern market volatility. The first article entitled “A 'Vaccine' for Protecting Portfolio Value in Sick Markets” is found at this link.

Overview: In this article I show how the NAOI developed an alternative to Modern Portfolio Theory (MPT) for designing and managing investment portfolios. Called Dynamic Investment Theory (DIT), it creates market-sensitive investments and portfolios designed to thrive in today’s volatile markets.

Why Investors Are Leaving the Market Today

In Article 1 of this series I explained why the way we invest today needs to change at a fundamental level. There I discussed the NAOI observation that many individuals are leaving the market because the only option offered to them for portfolio design and management is based on an approach called Modern Portfolio Theory (MPT). Introduced to the market in the 1950’s, MPT dictates that portfolios be designed to match the risk tolerance of each investor using asset allocation techniques. Then they are to be held for the long-term. Because these portfolios have no sensitivity to market they are dangerously vulnerable to market crashes.

We saw evidence of this risk when the stock market crashed in 2008-2009 and many MPT portfolios lost from 30% to 50% of their value. And we are seeing evidence of this risk again, today, as the coronavirus pandemic ravages both markets and the value of MPT-based portfolios.

To meet the needs of the investing public and to stem the flow of individuals leaving the market, the NAOI is introducing an alternative to the MPT approach called Dynamic Investment Theory (DIT). You will learn why and how it was developed below.

The Development of a Better Approach to Investing

Founded in 1997, the NAOI is the premier supplier of investor education to the public. Thousands of individuals have taken our online courses, read our books and/or attended our college classes. We taught the use of MPT portfolio design methods for over a decade.

But following the 2008-2009 market crash and the significant losses suffered by many of our students holding MPT portfolios that we had taught them to create, I stopped all NAOI investor education classes until we could find either a supplement to, or a replacement for, MPT methods. For this purpose, I opened the NAOI Research Division. I could no longer, in good conscience, teach MPT as the only approach to portfolio design and management.

Starting with Investor Goals

As we formulated a plan for finding an MPT alternative, I set two rules for the development effort as follows:

- The new approach must be designed based on meeting the wants and needs of the investing public; not based on decades old academic theories like MPT.

- The new approach must be developed using strict scientific methods.

Thus, our first task was to determine what individuals wanted in a new investing approach that would empower them to enter, or reenter, the market with confidence. Fortunately the NAOI is uniquely positioned to collect this data as we have direct contact with hundreds of individuals who are current or former students. Following are the top three features that they told us they wanted to see in a new approach to investing:

- Simplicity and Control – The world of investing today is so complex that individuals see little option but to entrust their financial futures to advisors, who are also salespeople, and simply accept the portfolios they are given. And this is stressful, especially when they can do little more than watch when their savings melt away during market crashes. Our focus groups told us that they wanted to hold portfolios that are simple to understand and that they could easily change on their own, if they wish, using methods that require minimal education to master.

- Higher Performance – They told us that they wanted higher returns with lower risk than the MPT portfolios they are given by the financial services industry today.

- Absolute Protection from Market Crashes – They told us that they wanted absolute and automatic protection of their portfolio value from significant market price drops and crashes.

It was immediately obvious to us that MPT met none of these requirements. So we started our research effort with a blank slate, unconstrained by how investing works today.

Approaching Investing from a Different Angle

To develop an approach that met the above goals we saw that the following changes to the MPT approach were needed:

- A More Effective Portfolio Goal – The portfolio goal needed to change from matching each investor’s risk profile to maximizing returns while minimizing risk in all economic conditions. This is a universal goal that works for all investors regardless of their risk profile.

- A More Effective Portfolio Management Strategy – To meet the above goal, the new approach needed to use a buy-and-sell management strategy instead of the buy-and-hold methods dictated by MPT. Such a strategy would make portfolios market-sensitive and capable of taking advantage of market uptrends while avoiding market downtrends.

- A Trading Plan –MPT provides no guidance for making changes to a portfolio other than to suggest a periodic rebalancing to revert to original allocations. A new and more effective approach would provide a standardized trading plan; one capable of automatically signaling profitable trades based on objective observations of empirical market data, not based on subjective human judgments.

This last point needs further explanation as provided below.

Reduction or Elimination of the “Human Risk” Element

Human judgments and decisions are required in virtually every step of the MPT portfolio design and management process starting with a “guesstimate” of a client’s risk tolerance and continuing with the selection of equities to place in a portfolio and then determining when and how changes to the portfolio should be made.

Actions based on human judgments inject a massive risk element into the MPT-based investing process. These risks include the use of bad data, incorrect analysis, sales bias and even scams and fraud. We found it to be unacceptable for the performance of an individual’s portfolio to be dependent on the competency and honesty of the financial advisor a person chooses to work with.

Therefore, we saw the need to replace today’s subjective approach to portfolio design and management with a scientifically-based, objective approach. Fortunately the tools exist that enable us to do so.

Turning to Quantitative Analysis

The NAOI research team included individuals with experience in data analysis and its use in the investing process. We were aware that hedge funds had been producing astounding returns for decades using momentum/price-trend following techniques that take advantage of the empirical observation that equities moving up in price for a significant amount of time in the past have a high probability of continuing this trend for at least a short time in the future.

While this was exactly the type of objective trade-trigger that we needed in our new approach, trend-following methods, as used by hedge funds, are too complex and risky for use by individual investors. Our goal then became to make these methods simple and safe. To do so, we began an extensive examination of what makes trend-following methods work.

Market Price Observations

To begin this effort we posed the following question: “What do we know about market price behavior with a high degree of confidence?” The answer to this question lies in the following three simple empirical observations found in historical equity price data:

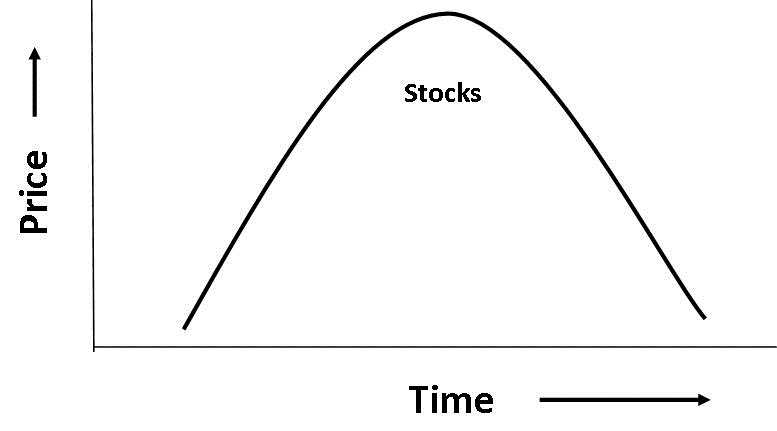

1. The prices of asset classes and market segments are cyclical in nature. Their price moves up and down over time as illustrated for the Stock asset class below.

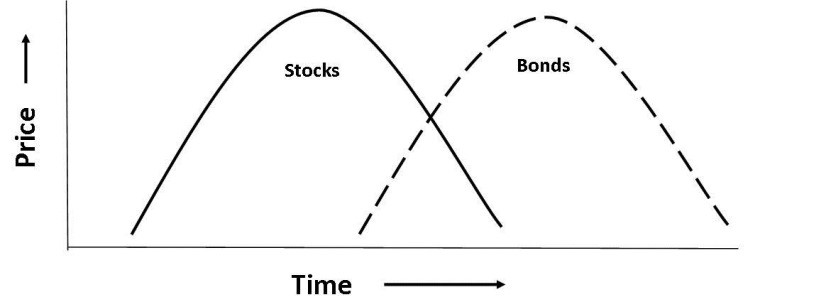

2. The prices of different asset classes and market segments move up and down at different times as illustrated below for Stocks and Bonds. The diagram shows that when the price of Stocks goes down the price of Bonds tend to go up and vice versa.

3. Price trends have a relatively long time-duration. History tells us that stock market price downtrends (i.e. Bear Markets) have a length of about 14 months while price uptrends (i.e. Bull Markets) tend to last an average of about 33 months. This leads to the inference that if the price of an equity has been moving up for a significant amount of time in the past, it has a relatively high probability of continuing to move up for at least a short period of time in the future. If testing showed this inference to be true, we would have the tool needed to take advantage of the high returns potential of trend-following methods in the simple and safe manner required.

An in-depth study of historical market price trends showed the above observations and inference to be true with a high level of confidence. Therefore, in keeping with the rules of scientific method, we created a working hypothesis for a new approach to investing as presented below.

A Working Hypothesis for a New Approach to Investing

“At all times, in any economic environment, there exist in equity markets areas of uptrending prices. It is projected that a simple, dynamic investment type, hereafter referred to as a ‘Dynamic Investment’ (DI), can be designed that is capable of detecting equities trending up in price and capturing their positive returns as well as detecting equities moving down in price and avoiding their losses. Such a DI would be capable of signaling profitable trades based solely on empirical observations of market price data, with no subjective, human decisions required. It is further projected that a DI so designed would be able to produce returns that are consistently higher than those of virtually any MPT portfolio, over the same time period, and with lower risk.”

Of course this description looks nothing like how the MPT approach works. I was satisfied that our hypothesis was the result of thinking differently about investing. But a hypothesis was not yet the “theory” that we needed. For it to become one, the hypothesis needed to be thoroughly tested.

The Birth of Dynamic Investment Theory

Following an extended period of testing and the discovery of a Dynamic Investment design that met all of the required simplicity, value protection and higher performance criteria, we determined that our hypothesis was true with a high level of confidence. As a result, we relabeled the hypothesis as Dynamic Investment Theory (DIT) and a new approach to investing was born.

Success

DIT is the alternative to MPT for designing and managing portfolios that we had set out to find following the crash of 2008-2009. It meets every goal set for us by the investing public. NAOI student focus groups that we have used to field-test the use of Dynamic Investments told us that this is the approach to investing they needed to enter, or reenter, the market with confidence and without fear. We are now incorporating DIT methods and the use of Dynamic Investments into all of our investor education content.

Coming Next – An Introduction to Dynamic Investments

In the next article of this series I show how Dynamic Investments are designed and managed using the logic and rules set forth by Dynamic Investment Theory. I will also show examples of the superior performance that DIs are capable of producing in virtually all economic conditions – including market crashes such as the coronavirus crash we are experiencing as these words are written.

You will see this next article in approximately two weeks from the date of this posting.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.