Walmart WMT stock has made a strong return (up about 78.7%) this year after falling behind Amazon AMZN. The company’s investment in technology, including artificial intelligence (AI), augmented reality, and same-day delivery, has led to record earnings and earned it the title of Yahoo Finance's "Company of the Year" for 2024.

The stock traded in a tight range of $40 to $50 from December 2019 to December 2023 and then steadily surged this year $96. Over the past five years, Walmart shares have surged more than 133%, outperforming the Food/Drug-Retail/Wholesale Market industry.

Image Source: Zacks Investment Research

CEO Doug McMillon has taken risks to drive Walmart’s success, including major acquisitions and tech investments. His focus on improving wages, education, and technology, especially during the pandemic, helped Walmart surpass competitors like Target TGT.

Growth in E-Commerce

Walmart’s online business has seen significant growth. In the second quarter of fiscal 2025, global e-commerce sales surged 21% on store-fulfilled pickup & delivery and marketplace. Walmart’s U.S. e-commerce sales rose 22%, and international e-commerce sales grew 18%.

At Sam’s Club U.S., e-commerce sales jumped 22%. The company is expanding its third-party marketplace and exploring innovative delivery methods, such as drone deliveries, to stay competitive with Amazon.

Appealing to Higher-Income Shoppers

Walmart’s improved shopping experience has helped it attract more affluent customers, shaking off its "no-frills" image. This has allowed the company to capture a larger market share and continue outperforming its competitors.

Its operating margins at Walmart US, Walmart International and Sam's Club have expanded despite consumer headwinds and investments in tech. Walmart CFO John David Rainey indicated that Walmart will likely see operating income growth of about 10% on average each year.

Shareholder-Friendly Strategies

Walmart’s healthy cash flows have been allowing it to make shareholder-friendly moves. For the nine months ending Oct. 31, Walmart shelled out $3 billion on stock buybacks — more than three times that of a year ago.

Broker Rating

Walmart currently has an average brokerage recommendation (ABR) of 1.25 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 38 brokerage firms. The current ABR compares to an ABR of 1.20 a month ago based on 38 recommendations.

Of the 38 recommendations deriving the current ABR, 31 are Strong Buy and four are Buy. Strong Buy and Buy, respectively, account for 81.58% and 10.53% of all recommendations. A month ago, Strong Buy made up 84.21%, while Buy represented 10.53%.

What Does Valuation Say?

Considering the price-to-earnings (P/E) ratio, Walmart looks slightly overvalued compared with the industry. The stock trades at a forward P/E ratio of 38.35X, which is above the forward P/E ratio (27.77X) for the industry.

Image Source: Zacks Investment Research

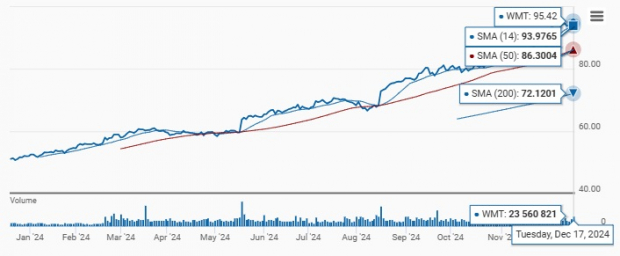

What Does the Technical Chart Say for Walmart?

Walmart stock has a good Momentum Score of “B” and a moderate Value and Growth Score of “C.”

The stock price steadily rises from January to December 2024, forming higher highs and higher lows—a classic uptrend. The upward slope of both the 50-day SMA (86.3) and 200-day SMA (72.1) confirms the strength of this uptrend.

The stock price ($95.42) is above all key SMAs, signaling a bullish trend. Investors appear confident, as indicated by high trading volumes.

The 50-day SMA (86.3) appears to act as a support level where the stock price bounces back during pullbacks.

The current price of $95.42 might act as a resistance level (short-term ceiling). At higher prices like this, investors may feel the stock is overvalued and begin to sell, causing the price to stagnate or reverse. But if WMT stock breaks above this resistance with strong volume, it could trigger a bullish breakout.

Image Source: Zacks Investment Research

Walmart ETFs in Focus

Investors who are skeptical about Walmart’s slight overvaluation and possible resistance at the current price level can try Walmart-heavy exchange-traded funds (ETFs) like Fidelity MSCI Consumer Staples Index ETF FSTA, Vanguard Consumer Staples ETF VDC, Consumer Staples Select Sector SPDR Fund XLP, VanEck Retail ETF RTH and iShares U.S. Consumer Focused ETF IEDI. These ETFs minimize the company-specific concentration risks.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week.

Get it free >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Consumer Staples Select Sector SPDR ETF (XLP): ETF Research Reports

VanEck Retail ETF (RTH): ETF Research Reports

Vanguard Consumer Staples ETF (VDC): ETF Research Reports

Fidelity MSCI Consumer Staples Index ETF (FSTA): ETF Research Reports

iShares U.S. Consumer Focused ETF (IEDI): ETF Research Reports

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.