A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

TRIPLE WITCHING + INDEX REBALANCE (S&P) today - irregular volumes expected / blocks at close

| The productive capacity of humans in an open and free market is astounding:

"Both humans and hawks eat chickens — but the more hawks, the fewer chickens; while the more humans, the more chickens."

-Henry George, Progress and Poverty, 1879

| Corporate defaults at highest rate since global financial crisis, says S&P -FT

| Zeitgeist: "The old world is dying, and the new world struggles to be born; now is the time of monsters" -BofA's The Flow Show

* source: CNBC

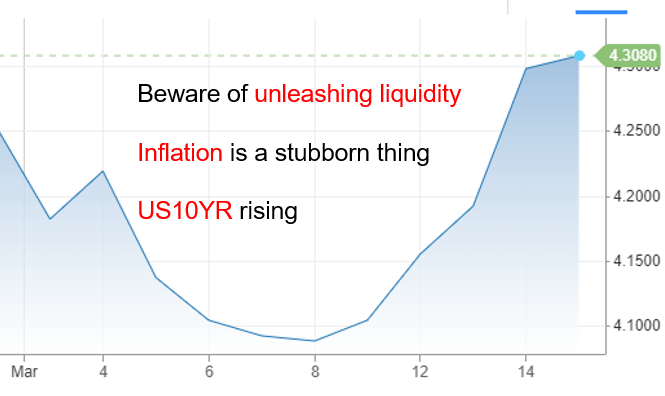

"...dramatic bond sell-off, with 10yr Treasury yields (+10.0bps) up to 4.29% as concerns mounted about stubborn inflation.

The main driver was a strong US PPI report, which showed that producer prices were rising faster than expected in February.

But alongside that, oil prices closed at their highest level since November, which added to fears that inflation was still gathering momentum.

* source: CNBC

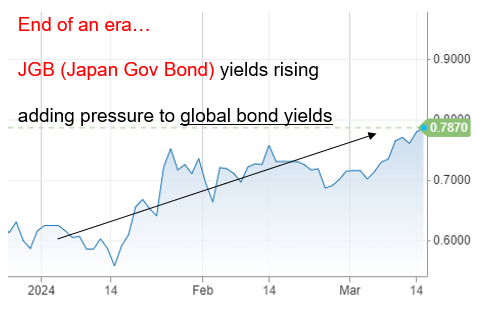

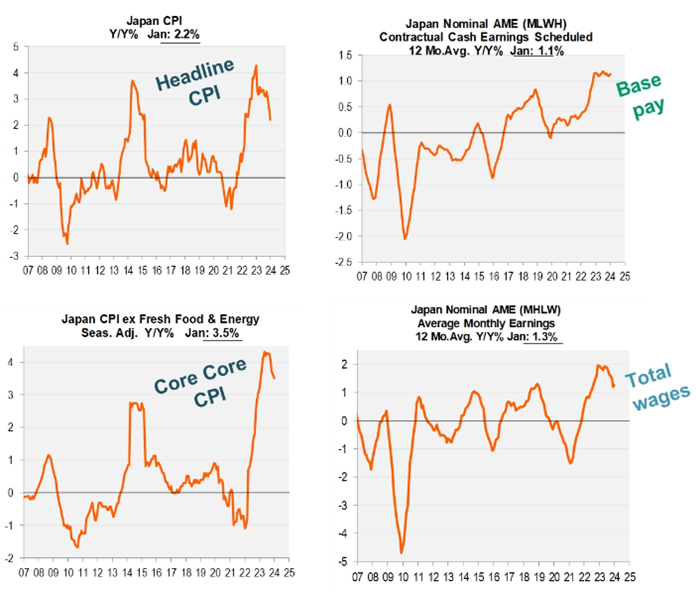

And on top of that, there was growing anticipation that the Bank of Japan would end their negative interest rate policy at next week’s meeting, which added to the upward pressure on global yields."

-Deutsche Bank, Jim Reid

* source: CNBC

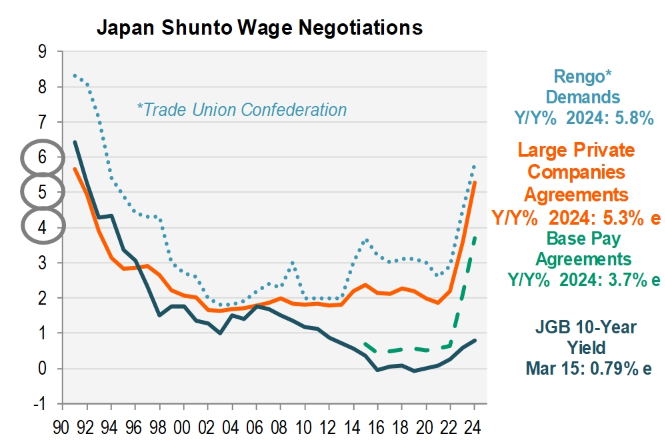

"Does Japan’s Big Wage Hike Finally Mean A Rate Hike? ...shunto wage agreements beat all expectations, coming in at 5.28% -- a 3 decade high that now has odds of a BOJ rate hike better than 50/50, at their meeting next Tuesday."

-Nancy Lazar, Piper Sandler

* source: Piper Sandler

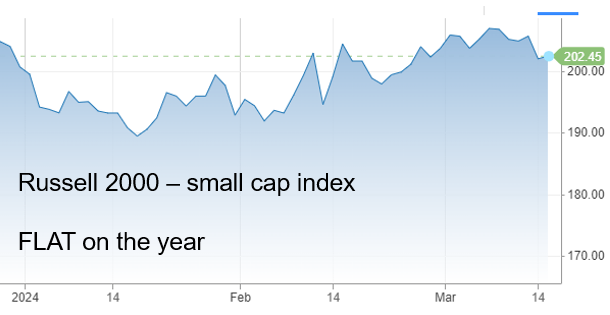

| no enthusiasm here!

* source: CNBC

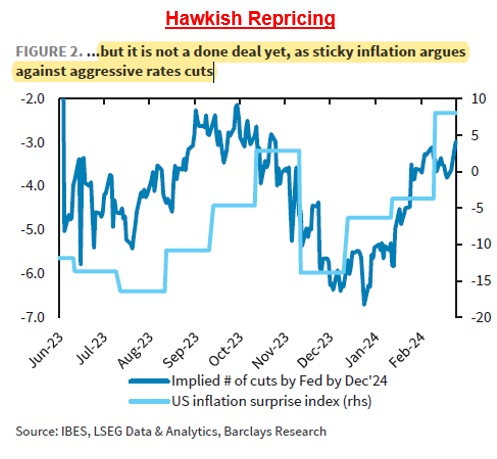

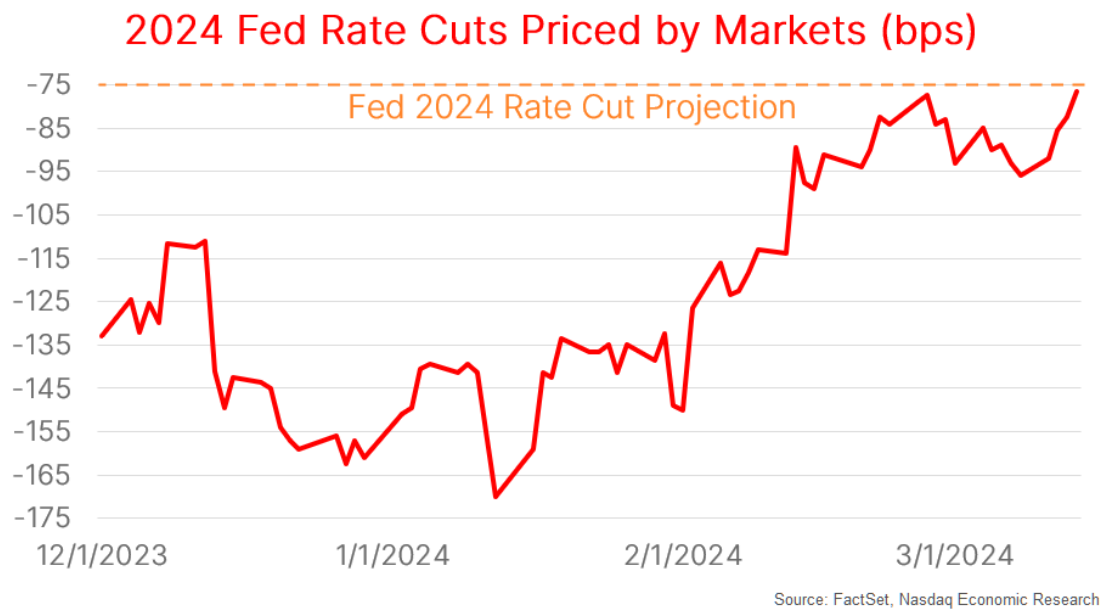

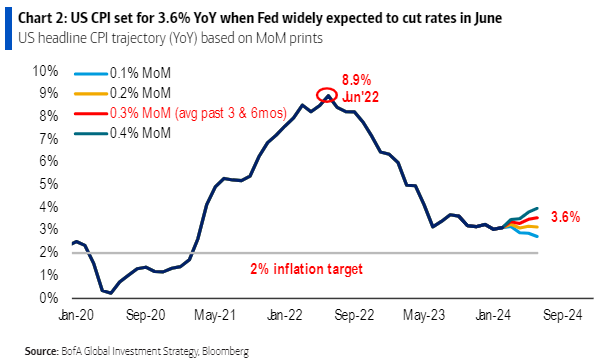

| Hawkish repricing: "futures are now pricing in roughly a one-in-three likelihood that the Fed won’t cut at all by June. And for 2024 as a whole, just 76bps of cuts are priced in by the December meeting, which is the fewest so far this year.

* source: Barclays' Emmanuel Cau

...big turnaround from the start of the year, when 158bps of cuts were expected by December, and the first cut was fully priced in by March."

-Deutsche Bank, Jim Reid

* source: Nasdaq, Michael Normyle

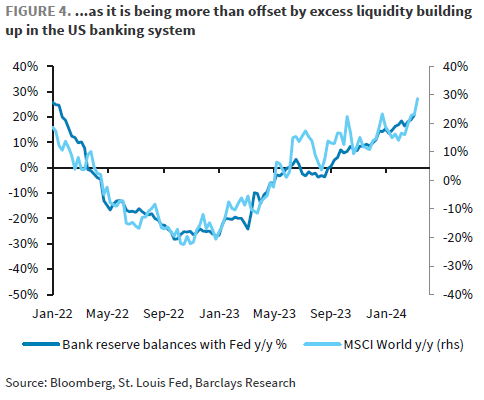

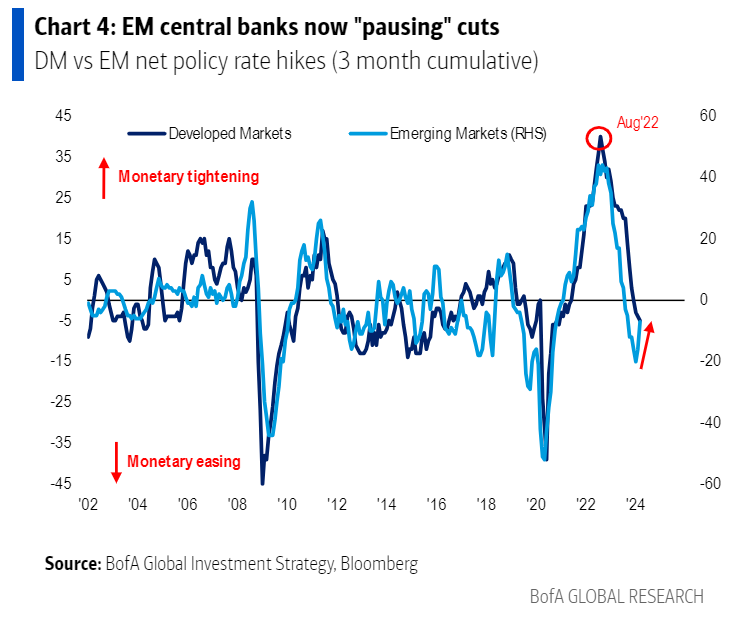

| Closely watching central banks next week | "Excess liquidity remains plentiful, however, which is supportive of asset prices. But given concerns about RRP depletion, Fed's communication about QT tapering will be important in coming months."

-Barclays Emmanuel Cau

* source: Barclays' Emmanuel Cau

| What cutting already at 3.6% inflation???

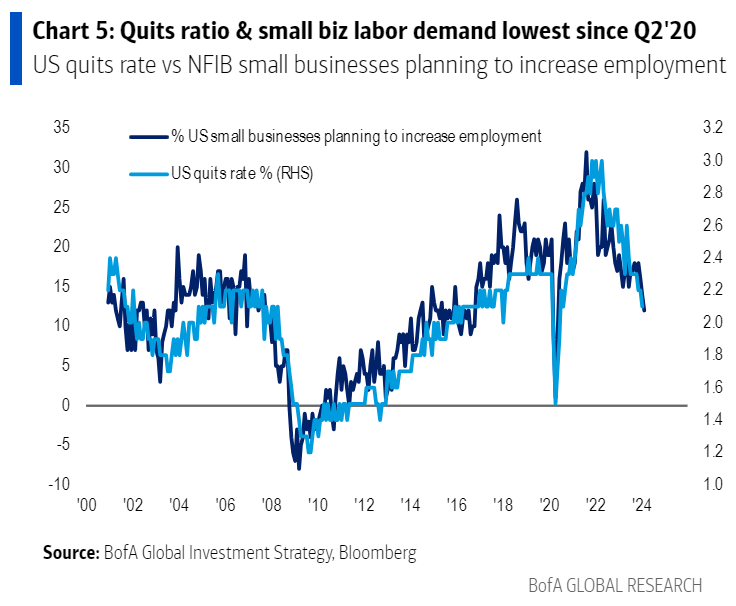

| "Inflation up, employment down, US govt spend off-the-charts...macro flipping from goldilocks to stagflation

Stagflation trades: gold, crypto, cash, much steeper yield curve, barbell of resources & defensives"

Milton's Friedman's "Fool in the Shower" analogy

"overcorrection to policy changes based on immediate conditions a persistent hazard for policymakers. "

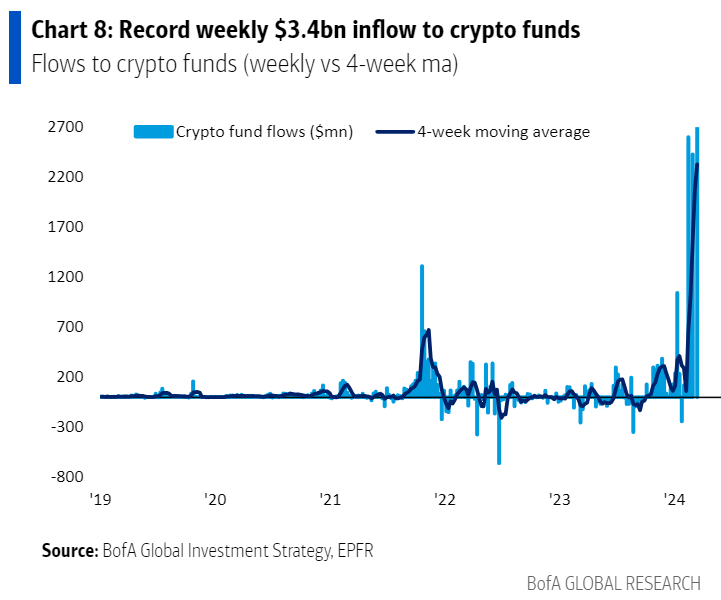

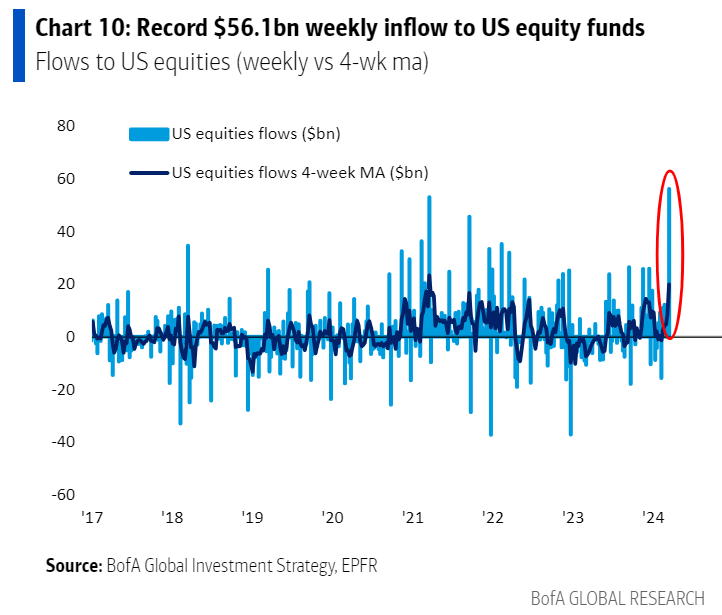

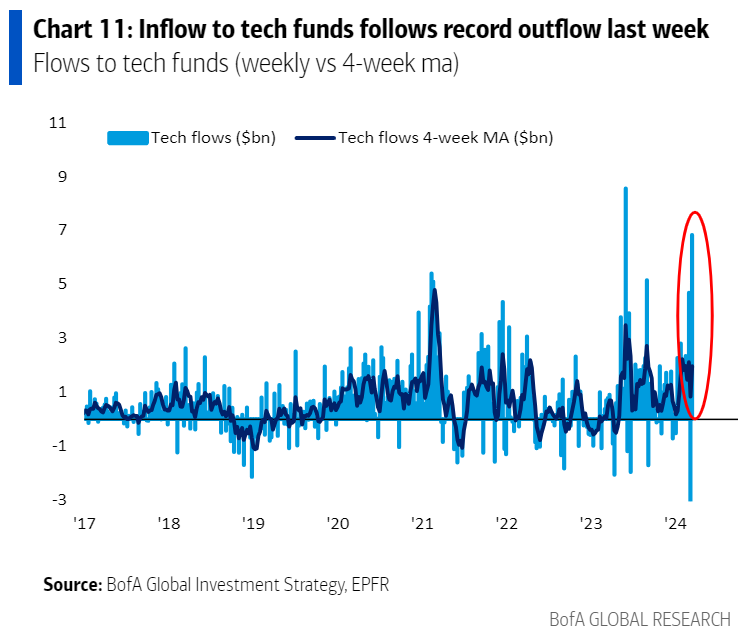

|"Boomy & bubbly...record week of inflows to crypto funds & US stocks"

* source: BofA, The Flow Show, Michael Hartnett

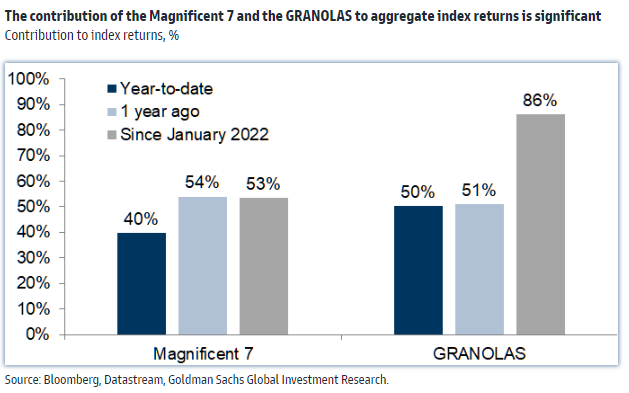

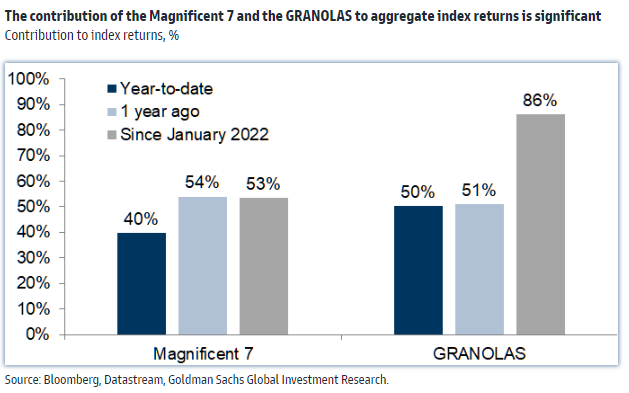

| Concentration Risk in US + Europe ...

GRANOLAS = GlaxoSmithKline, Roche, ASML, Nestle, Novartis, Novo Nordisk, L'Oreal, LVMH, AstraZeneca, SAP, Sanofi

* source: Goldman Sachs

| Feeling bubbly? Risk on baby, corporate bond spreads tight...

* source: BofA, The Flow Show, Michael Hartnett

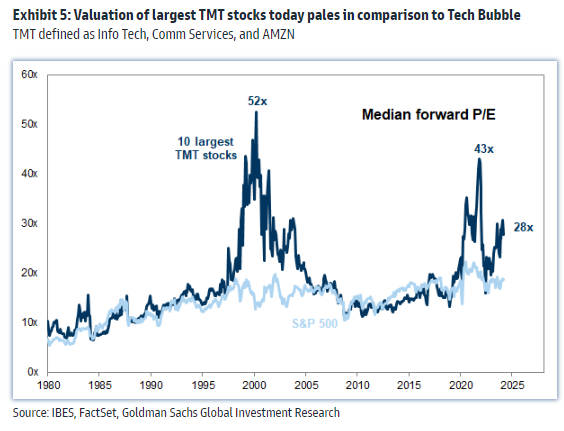

but not too bubbly...

S&P would need to rise 20% to look like 90s bubble, SocGen says -BBG

* source: Goldman Sachs Global Investment Research

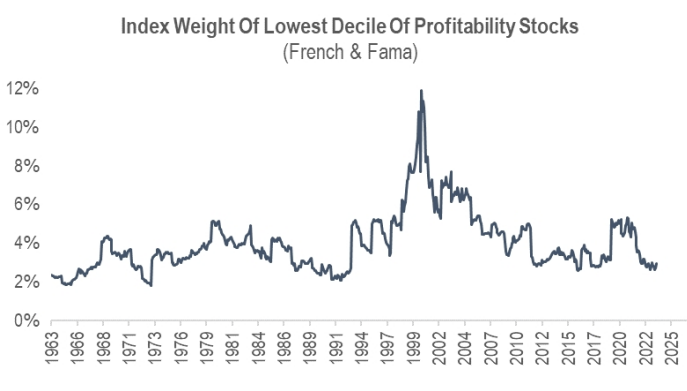

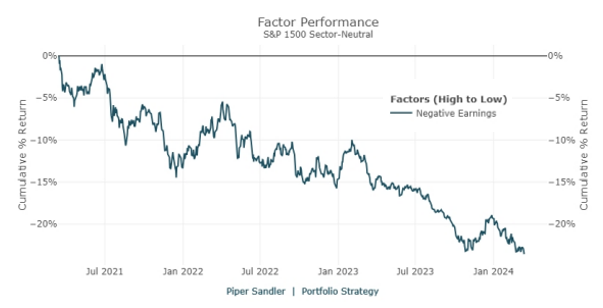

| #QualityMatters

"There is plenty of speculation today across asset markets, but the foundation of current momentum stocks is at least rooted in current (realized) fundamentals.

...stark contrast between 2000 and today – in how the basket of LOW/NEGATIVE profitability stocks went from 3% to 12% of the U.S. equity market during the run-up in stocks in 1999-2000.

Currently, the weight of the same portfolio is near decade lows at around 3%"

negative EPS stocks continue to underperform

* source: Piper Sandler, Michael Kantrowitz

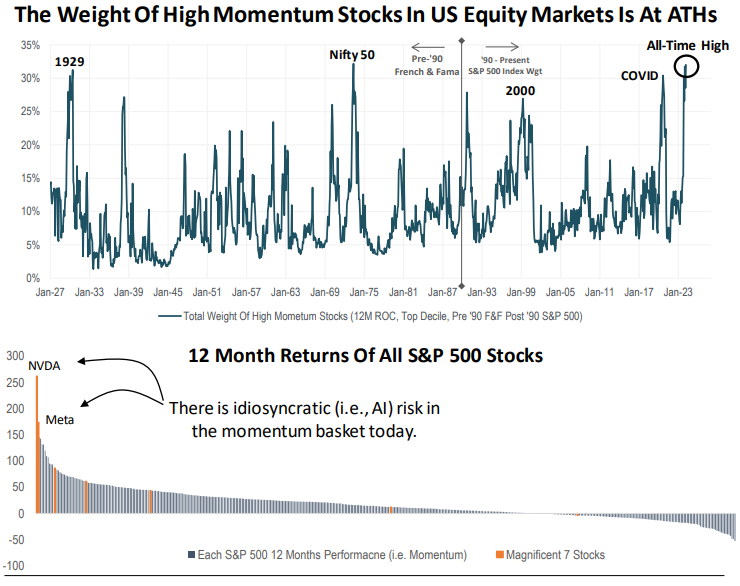

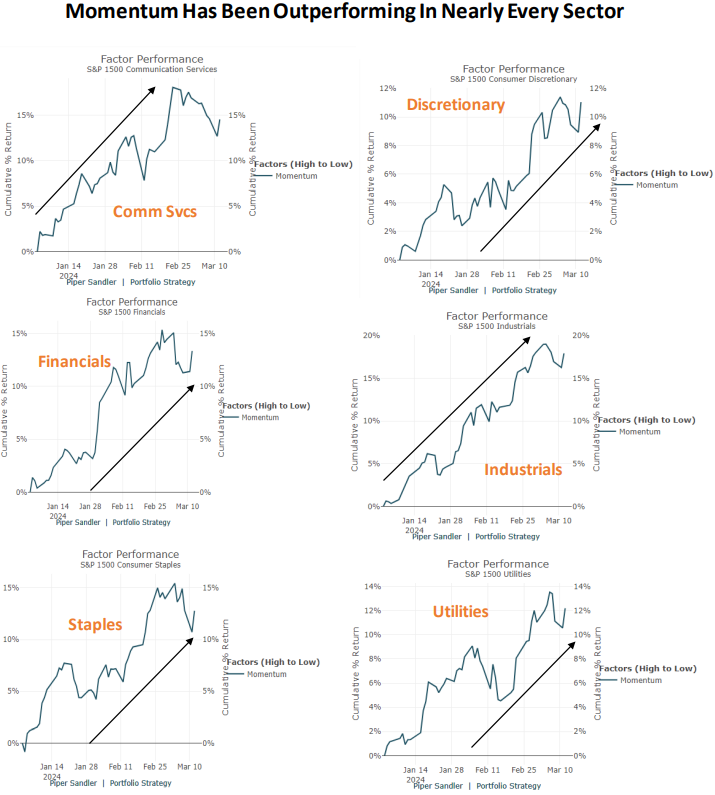

| "With NVDA up 85% and SMCI up 309% so far in the 1st quarter, there has been a lot of talk this year about the momentum trade.

Currently, The Momentum Trade Is Mostly High Quality And Profitable Stocks!"

* source: Piper Sandler, Michael Kantrowitz

1) KEY TAKEAWAYS

1) Equities + Oil LOWER | Dollar + Gold HIGHER | TYields MIXED

DJ -0.4% S&P500 -0.7% Nasdaq -1.0% R2K +0.0%

Stoxx Europe 600 +0.1% APAC stocks LOWER, 10YR TYield = 4.306%

Dollar HIGHER, Gold $2,162, WTI -0%, $81; Brent -0%, $85, Bitcoin $68,104

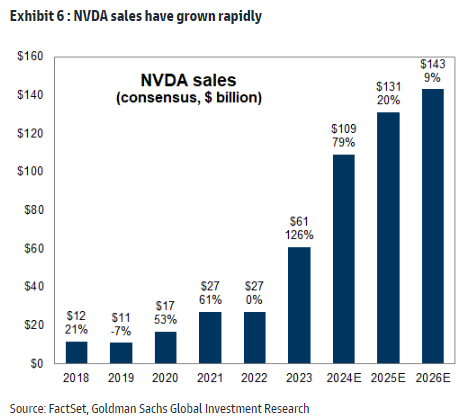

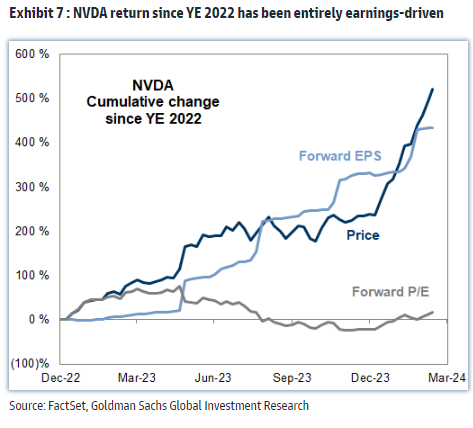

2) "NVDA has been the largest near-term AI beneficiary, with earnings driving the entirety of its 522% return since the start of 2023.

NVDA sales appear on track to increase by 300% in just 2 years. Despite AI optimism, the stock's forward P/E is virtually unchanged since the start of 2023."

* source: Goldman Sachs Global Investment Research

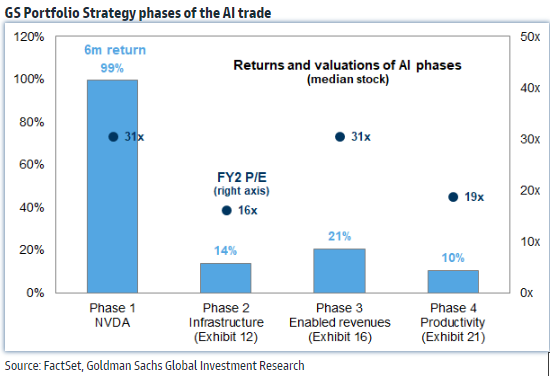

3) "We highlight three subsequent phases of the AI trade.

Phase 2: AI "infrastructure" companies involved in the development, manufacturing, and infrastructure of AI (semiconductors, cloud providers, equipment, data center REITs, utilities, and security).

Phase 3: AI "enabled" companies with business models that can easily incorporate AI in product offerings to boost revenues (software and IT services).

Phase 4: AI "productivity" companies in labor-intensive industries that can harness AI technology to improve productivity and realize efficiency gains (software and services, commercial and professional services)."

* source: Goldman Sachs Global Investment Research

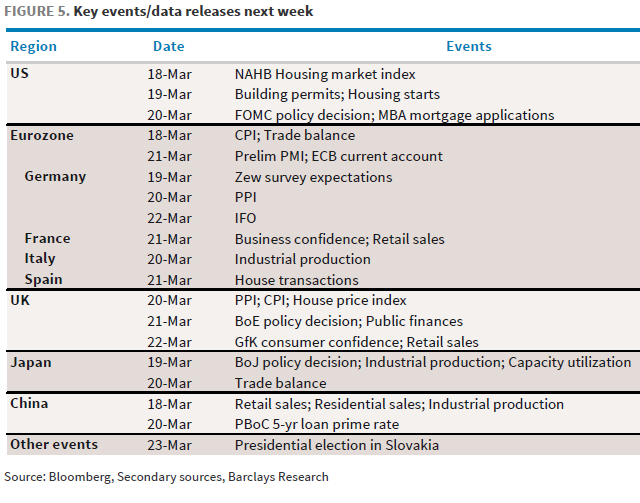

4) NEXT WEEK:

"Policy decisions from the Fed, the BoJ and the BoE will be the key highlights next

week.

Key economic updates will come from global flash PMIs on Thursday as well as inflation reports in Japan and the UK.

Economic activity indicators for China are due Monday."

-Deutsche Bank

* source: Barclays' Emmanuel Cau

2) Weekly ESG by Nathan Greene

Oil Companies Challenge SEC’s Climate Rules in Fifth Circuit - BBG

The petition seeking a review of the regulations—filed by the Texas Alliance of Energy Producers and the Domestic Energy Producers Alliance—is one of at least three against the Securities and Exchange Commission pending in the US Court of Appeals for the Fifth Circuit over the climate rules.

US Chamber of Commerce sues SEC over climate risk disclosure rules - Reuters

"The final rule makes substantively harmful changes to 50 years of corporate governance precedent that will have implications well beyond this single rule," said Tom Quaadman, executive vice president, U.S. Chamber of Commerce Center for Capital Markets Competitiveness.

Bank climate group to report capital markets related emissions - Reuters

The Net-Zero Banking Alliance (NZBA), whose 143 members oversee $74 trillion in capital, said their guidelines will also require data disclosure on transition planning and climate-related advocacy by the banks.

Canadian banks face ESG-related proposals at AGMs, but little new on climate - BNN

The eight proposals this year contrast with the 13 filed last year that were pushing RBC, TD, BMO, Scotiabank, CIBC and National Bank to increase action on climate change.

EU Set to Water Down Climate Rules to Placate Angry Farmers - BNN

Officials are discussing relaxing requirements on land management to limit soil erosion, as well as rules about soil cover and crop rotation. Exemptions would also ease the requirement for farmers to leave 4% of their land fallow to improve biodiversity, one of the key points pushed by farmers’ unions, according to EU diplomats.

Shell weakens 2030 climate targets - DW

Shell said it will target a 15-20% reduction in net carbon intensity of its energy products by 2030 compared with 2016 levels. It had previously aimed for a 20% cut. Shell also added that it would drop a plan to slash net carbon intensity by 45% by 2035 due to "uncertainty in the pace of change in the energy transition." It still targets a 100% reduction by 2050.

3) MARKETS, MACRO, CORPORATE NEWS

- BofA says record rush to US stocks ignores stagflation risk-BBG

- Money-market assets rise to fresh record for third straight week-BBG

- Fed gets more reasons to delay interest-rate cuts-BBG

- A new surge in power use is threatening U.S. climate gobals-NYT

- Cities face cutbacks as commercial real estate prices tumble-NYT

- China c.bank leaves key policy rate unchanged, as expected-RTRS

- BOJ to end negative rates in April, high chance of March, analysts say-RTRS

- China's home prices extend declines despite support measures-RTRS

- China economy likely had muted start as 5% GDP goal in focus-BBG

- China loans grow at slowest pace on record amid weak demand-BBG

- China eases tourist visa restrictions to boost economy-FT

- China’s fiscal stimulus plan may be bigger than it appeared-BBG

- US Senate not moving to fast-track House bill for TikTok divestiture-RTRS

- Johnson says he expects to take up Ukraine aid with Democratic votes-POL

- Judge denies one of Trump’s efforts to derail documents case-NYT

- Hamas presents ceasefire proposal detailing exchange of hostages-RTRS

- Japan on cusp of ending negative interest rates, chance of March BOJ exit heightens-RTRS

- United Airlines close to gaining Airbus jets after Boeing Max 10 delays-BBG

- KKR said to weigh $1 billion sale of school chain EuroKids-BBG

- Samsung poised to win over $6 billion for expanded US investment-BBG

- Adobe drops on weak forecast fueled by AI competition fears-BBG

- McDonald's suffers global tech outage, rules out cybersecurity incident-RTRS

- US Steel rival is ready to pick up the pieces if Nippon deal collapses-BBG

- Corporate defaults at highest rate since global financial crisis, says S&P-FT

- Mnuchin now wants to buy TikTok, days after leading NYCB rescue-BBG

- Apple buys startup DarwinAI, adds staff to its AI division-RTRS

Oil/Energy Headlines: 1) Oil’s emerging strength doesn’t guarantee a rally-BBG 2) Non-OPEC+ to lead 2024 oil production growth, offsetting output cuts – EIA-RTRS 3) Russia’s diesel exports fall as drones hit oil refineries-BBG 4) Singapore's middle distillates stocks hit highest in 2-1/2 yrs as exports dip.

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.