InflaRx IFRX, a clinical-stage biopharmaceutical company, was up almost 84% on Apr 4, as the FDA granted an emergency use authorization to Gohibic (vilobelimab) to treat hospitalized COVID-19 adults who received invasive mechanical ventilation within 48 hours of treatment initiation.

Per the company, Gohibic is the first authorized drug to control complement factor C5a, a protein that plays an essential yet harmful role in the body's immune response.

The authorization was granted based on results from a phase III PANAMO clinical study evaluating vilobelimab in invasively ventilated COVID-19 patients in intensive care units. The data showed that vilobelimab treatment improved survival with a relative reduction in 28-day all-cause mortality of 23.9% compared to placebo in the global data set.

InflaRx is continuing discussions with the FDA to submit a biologics license application for full approval of Gohibic in this COVID-19 indication. The company is also developing vilobelimab in other indications, including pyoderma gangrenosum, for which it is currently initiating a phase III study.

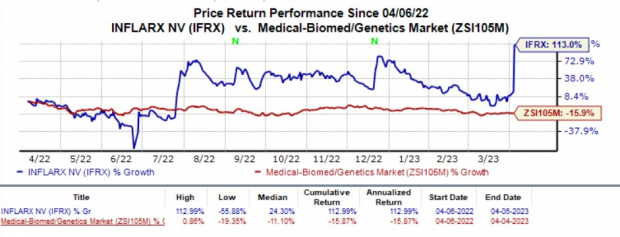

InflaRx’s shares have gained 113% in the past year against the industry's 15.9% decline.

Image Source: Zacks Investment Research

Vilobelimab was granted Fast Track designation by the FDA for treating critically ill, intubated and mechanically ventilated COVID-19 patients.

InflaRx N.V. Price and Consensus

InflaRx N.V. price-consensus-chart | InflaRx N.V. Quote

Zacks Rank & Stocks to Consider

Currently, InflaRx has a Zacks Rank #3 (Hold).

Some better-ranked stocks for investors interested in the same sector are CRISPR Therapeutics CRSP, Kala Pharmaceuticals KALA and Kodiak Sciences KOD, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Loss per share estimates for CRISPR have narrowed from $8.21 to $7.35 for 2023 in the past 60 days.

The company’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, the average surprise being 3.19%. CRSP’s shares have plunged 33.4% in the past year.

Loss per share estimates for Kala have narrowed from $19.67 to $15.35 for 2023 and from $14.41 to $13.12 for 2024 in the past 60 days. The company’s shares have plunged 75.8% in the past year.

KALA’s earnings beat estimates in two of the last four quarters and missed the mark in the other two, the average surprise being 11.56%.

Loss per share estimates for Kodiak Sciences have narrowed from $5.66 to $5.30 for 2023 and from $5.18 to $4.71 for 2024 in the past 60 days.

The company’s earnings beat estimates in three of the last four quarters and missed the mark in one, the average surprise being 0.96%. KOD’s shares have plunged 33.9% in the past year.

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don't miss your chance to download Zacks' top 5 stocks for the electric vehicle revolution at no cost and with no obligation.

>>Send me my free report on the top 5 EV stocksCRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

InflaRx N.V. (IFRX) : Free Stock Analysis Report

Kala Pharmaceuticals, Inc. (KALA) : Free Stock Analysis Report

Kodiak Sciences Inc. (KOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.