The Cost of Protection

As we look out toward the end of 2023 in capital markets, I’m reminded of a floor-trading truism: “Buy protection when you can, not when you’re forced to.”

In reality, it’s easier said than done.

When there’s seemingly no reason to worry, protection becomes an afterthought. The problem is that demand for “coverage” tends to increase in a non-linear fashion.

What’s that Mean?

In short, you’re better off buying options when implied volatility levels are relatively low, and the market seems to not have a worry.

In the event you don’t have options for protection and there’s an adverse event that forces your hand, the cost of that coverage is probably far more costly.

Price is a function of supply and demand. There’s a finite number of firms able to supply the market with optionality. At present, there’s little demand for longer-dated optionality (vega), but that could change quickly.

In that scenario, the price for six-month or one-year optionality could increase with significant velocity. It calls to mind the visual of a crowded room with few exits.

Pop Culture “Lessons”

There’s been a lot of headlines around the potential existence of UFOs and non-human life forms. In fact, there was a Congressional hearing where a Pentagon employee (David Grusch) spoke about classified military programs that have existed for nearly 100 years.

I’m agnostic on the alien question, but I’m interested in the potential knock-on effects.

For example, did you know that Alien Abduction insurance policies are available? According to Geico, more than 30,000 policies have been underwritten in Europe. There are American firms that offer similar coverage. The St. Lawrence Agency (Florida) “sold over 6,000 policies.”

I’m curious about what impact the attention and hearings might have on premiums.

In Index Options

It’s much easier to track the relative cost of portfolio protection using implied volatility data that’s easily observable. Let’s focus on two specific time frames, six months and one year. In general, insurance policies are renewable on an annual basis. Like options, they are not available in perpetuity.

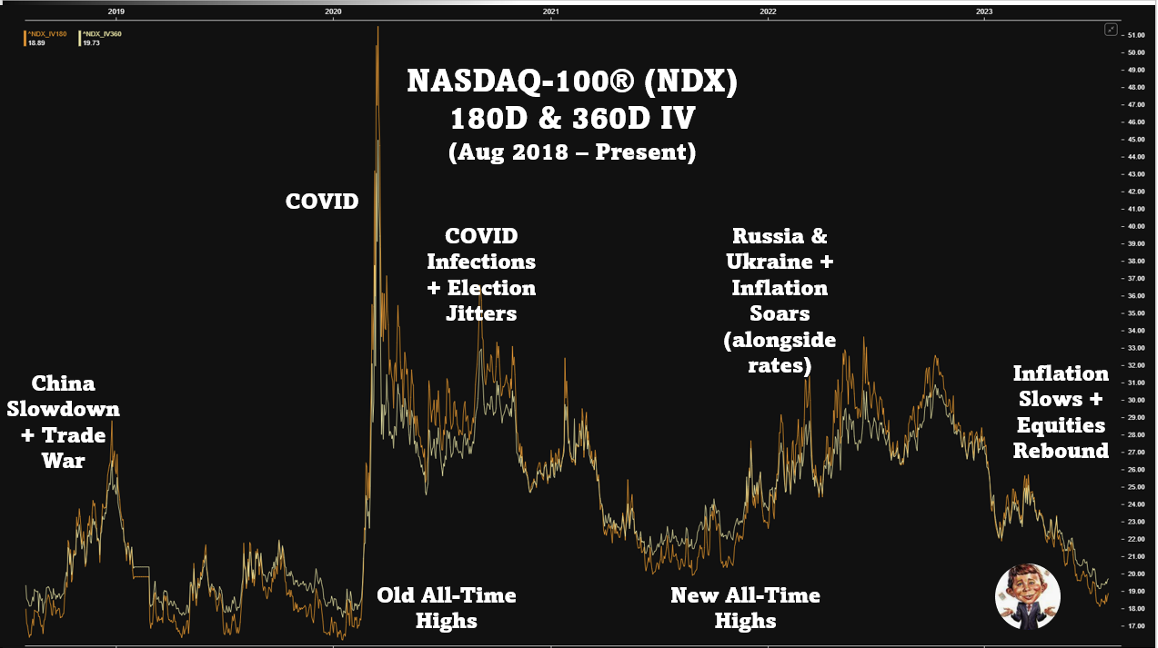

The visual below plots the implied volatility for at-the-money (ATM) (100% moneyness or 50 delta options) on the Nasdaq-100® Index (NDX). This data goes back five years and incorporates the pandemic selloff (spike in volatility) as well as two prior all-time highs for U.S. equity indexes.

Excluding March of 2020, the range for mid-term (six-month) and longer-term (one-year) NDX ATM IV vacillated between ~33% on the high end and ~17% on the low end. Adding some context, one-year realized (trailing) volatility for the NDX moved between 33% and 15% during the same period.

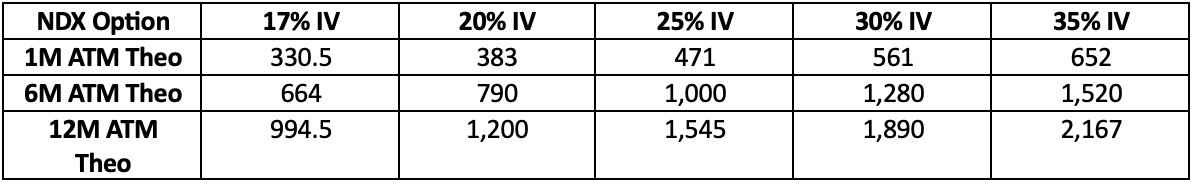

One critical component to this “puzzle” is understanding that longer-dated option values have a greater sensitivity to changes in implied volatility estimates than similar (moneyness) shorter-dated options. Let’s put some numbers around the concept.

The table above shows the theoretical values for NDX ATM options with a variety of maturities. In both raw dollar (value) terms and percentage terms, longer-dated options change in value more dramatically than shorter-dated options.

Bring it Together

U.S. equity indexes have exhibited tremendous resilience while scaling the proverbial “wall of worry” in 2023. That’s great for anyone with long equity exposure. The question becomes, what if the degree of worry is “too low” and the future incline changes?

Based on the past five years, longer-dated index volatility expectations are at/near the low end of the range. Could implied vol levels move lower? Absolutely! That’s where the old floor trading truism arguably comes in.

“Buy protection when you can, not when you have to!”

While it’s not a perfect analogy, one-year index option coverage is somewhat akin to Alien Abduction insurance. Very few market participants seem to believe there’s a significant threat to the economic outlook now. As a result, the relative cost of longer-dated index protection is relatively cheap.

Similarly, not many people believe alien insurance is necessary. However, it’s possible that the recent inquiries into non-human life forms drive the cost of “alien insurance” higher.

I do not anticipate UFOs to catalyze an increase in market volatility but it’s also a non-zero possibility. The bigger point is that “we don’t know what we don’t know.” Markets are forward-looking and dynamic.

Many investors were caught offside by the recent Fitch downgrade of U.S. debt from AAA to AA+. It’s only the second time in history that U.S. sovereign debt credit quality has been reduced.

Despite sounding obvious, we don’t purchase protective policies and expect to find out how they work. We do so to avoid worrying about unlikely outcomes. We transfer a degree of risk to groups that can aggregate and manage risk more easily than we can.

Stranger Things

Over the past five years, the world and capital markets have dealt with monumental change. A global pandemic, unparalleled interest rate volatility, an ongoing European conflict, supply chain shortages, the emergence of generative artificial intelligence and much more.

The rate of change in life, and in derivative markets ebbs and flows, but change is constant. The proactive use of index options strategies can help insulate a portfolio from potential uncertainty because “every ending has a beginning.”

For the sake of simplicity, the examples included do not take into consideration commissions and other transaction fees, tax considerations, or margin requirements, which are factors that may significantly affect the economic consequences of a given strategy. An investor should review transaction costs, margin requirements and tax considerations with a broker and tax advisor before entering into any options strategy.

Options involve risk and are not suitable for everyone. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies may be obtained from your broker, one of the exchanges or The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, IL 60606 or call 1-888-OPTIONS or visit www.888options.com.

Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and education purposes and are not to be construed as an endorsement, recommendation or solicitation to buy or sell securities.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.