Traders often bring up the liquidity of an option as a concern for trading. Since Oct 2018, when we published the first research piece to measure the liquidity of Nasdaq-100 Index options (NDX), the value of the index has more than doubled. A single contract is now over $1.5m in notional value and warrants an update for traders to understand the transaction costs of trading NDX. Due to the complexity of it measuring liquidity, we take this post to dig into the metrics commonly utilized by traders to gauge liquidity. We examined options execution data to illuminate average execution slippage to provide guidance and transparency while dispelling myths of perceived liquidity. Products such as the Nasdaq-100 Index Options (NDX) with large option chains are most susceptible to a perceived lack of liquidity due to lower open interest and volumes of each strike. We evaluated over 70,000 executions of NDX for the average execution price with respect to the mid-point. We found that the bulk of volume and larger notional contracts traded well under 1% away from the midpoint, showing deep liquidity on executions, even when the standard liquidity metrics suggests otherwise.

Options Slippage

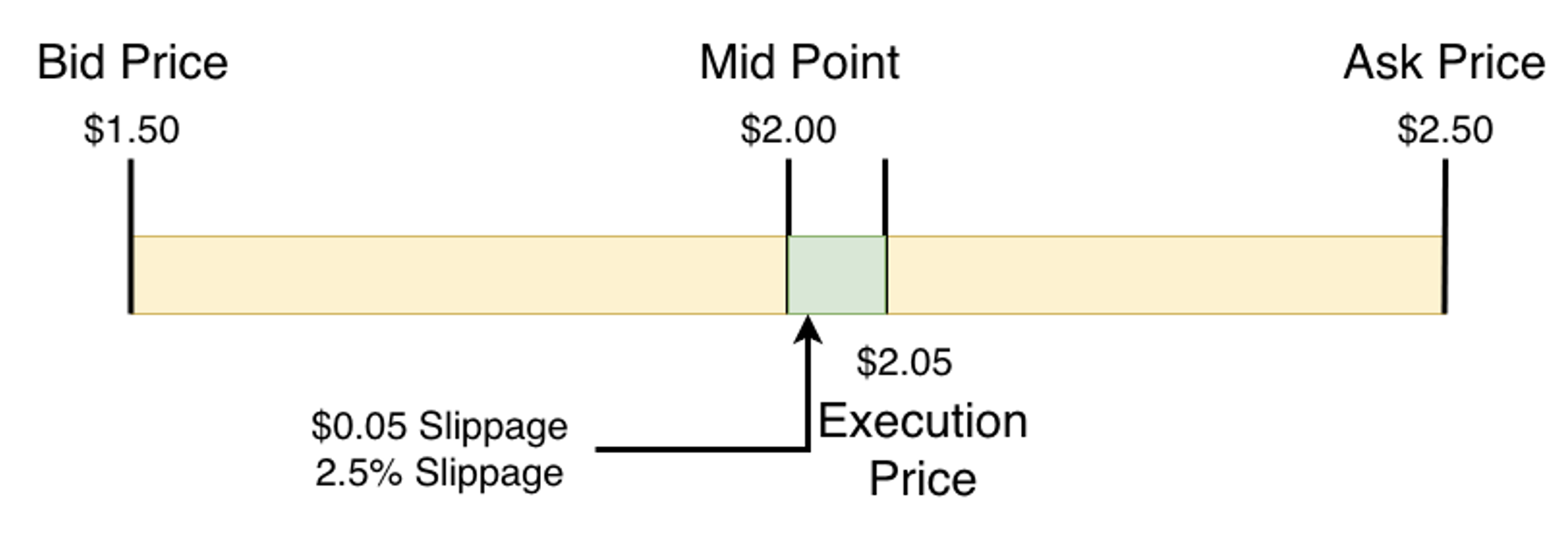

Before diving into metrics, we want first to define how we measured our findings. We define slippage as the distance between the execution price and the mid-point of an option. The larger the slippage when a trade is executed further away from the midpoint. Traders want orders filled as close to the midpoint as possible to minimize transaction costs and improve profits. We can provide guidance on the actual liquidity of NDX options by analyzing where trades are filled with respect to this midpoint. We calculate slippage in both dollar and percentage terms in the example below.

Slippage in dollars: $2.05 (Exec. Price) - $2.00 (Midpoint) = $0.05 Slippage

Slippage in percentage: $0.05 (Slippage) / $2.00 (Midpoint) = 2.5% Slippage

Perception of liquidity

Many traders will utilize open interest (OI) and volume to gauge an option's liquidity; however, we have found these metrics to be poor indicators. While it is true that options with high OI and volume typically have deep liquidity, the opposite is not always true. There are many reasons that an option with zero or low OI and volume is very liquid and will be executed within pennies of the midpoint. Furthermore, the spread between the bid/ask quote is arguably a better liquidity metric for most options, but even this has its exceptions. We have found very little correlation between slippage and the bid/ask spread size. However, by examining actual executions of trades and liquidity can be measured by the ability of large orders to be bought and sold near the mid-point.

Liquidity Metrics

These findings lead us to focus on the metric that impacts your trading bottom line, slippage. As stated in the summary, the average execution traded only 2.7% away from the midpoint. Moreover, the average slippage in dollar terms was $0.27 per contract. That translates to slippage of only $27 on a $1,500,000 contract or 0.000018%. However, this number was misleading as we dug deeper. The bulk of the volume and large trades were executed at far better prices. Moreover, 17.6% of executions are filled at the midpoint! We summarize our findings on slippage with the factors that affect liquidity, contract size, option price, and Delta to help provide research on where orders are filled. Our research shows that NDX has much deeper liquidity than what is displayed on the screens.

Contacts Size

We were pleasantly surprised to find that retail and institutional traders received quality fills with consistent slippage across trade sizes. Even trades of over $80m in notional value in a single execution were all filled with less than 1% of slippage, showing the true deep liquidity of the NDX product.

Price

The price of an option is typically a significant factor in the slippage of order executions. An index valued at over $15,000 will create option prices that are often quite large. Naturally, very far away options tend to have higher amounts of slippage, but when viewing slippage by dollar amount, it is well below the average.

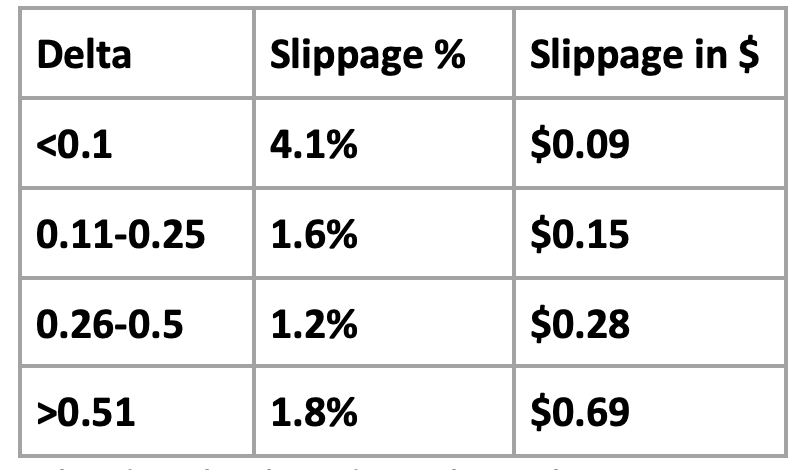

Delta

The data broken down by Delta is not surprising, as options that have very low in Delta (far away from the current price) typically will see higher bid/ask spreads. However the average slippage was only $9 per contract. While credit spreads with very low deltas are typical of index options trading, the data shows that slippage increases as a percentage of the execution price at the extremes.

In conclusion, we find that despite lower open interest, volumes, and wider bid/ask spreads, which may advertise a lack of liquidity, the reality is quite the opposite. There is a deep pool of liquidity available on Nasdaq-100 Index options. This knowledge seems to reflect institutional traders who execute large volumes within 1% of the midpoint, but less so from retail traders. Furthermore, credit spread sellers will find better liquidity by removing slightly higher up the deltas, and higher-priced options provide better liquidity. Lastly, our data shows that 81% of orders placed are filled within 2% of the mid point. This crucial data point is what traders can use the midpoint and execution data to inform decisions on placing limit orders with NDX.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.