Incentivizing a Competitive NBBO for All

Incentives in the stock market are a hot topic right now. Many different types of incentives exist, but the way each works is different.

Different regulations mean everyone has different incentives

Because each type of trading center has to comply with different regulations, a number of unique incentives have evolved across the equity market to help participants compete for trades.

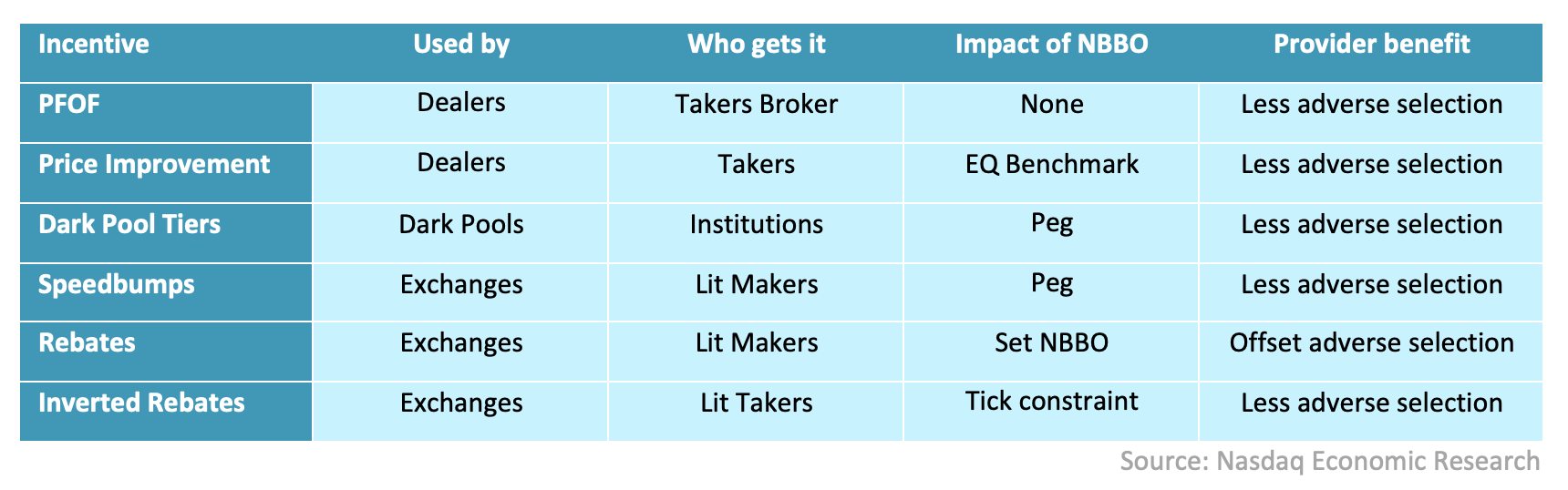

Table 1: Different equity market trading incentives

Most incentives are designed to lower adverse selection. That’s mostly done by excluding traders with high trading alpha.

Off-exchange incentives include:

- Direct payments (PFOF) or price improvement to lower alpha customers looking to cross the spread (takers).

- Tiering that excludes high-alpha takers entering venues or trading with all orders.

Even speed bumps mean high-alpha takers miss trades, effectively segmenting the market.

In contrast, exchanges have fair access. Exchange rebates are paid to providers who provide NBBO quotes. In fact, by design, they are only paid to a provider whose lit quote also leads to a trade. They are the only incentive that rewards anyone for setting a competitive and firm National Best Bid and Offer (NBBO). Which, as we’ve noted before, benefits all investors (even those trading off-exchange).

Do rebates really improve NBBO?

Only exchanges set prices. But there are still a variety of different exchange incentive models, allowing us to compare which models provide investors with the most competitive spreads on more stocks.

The data is hard to argue with.

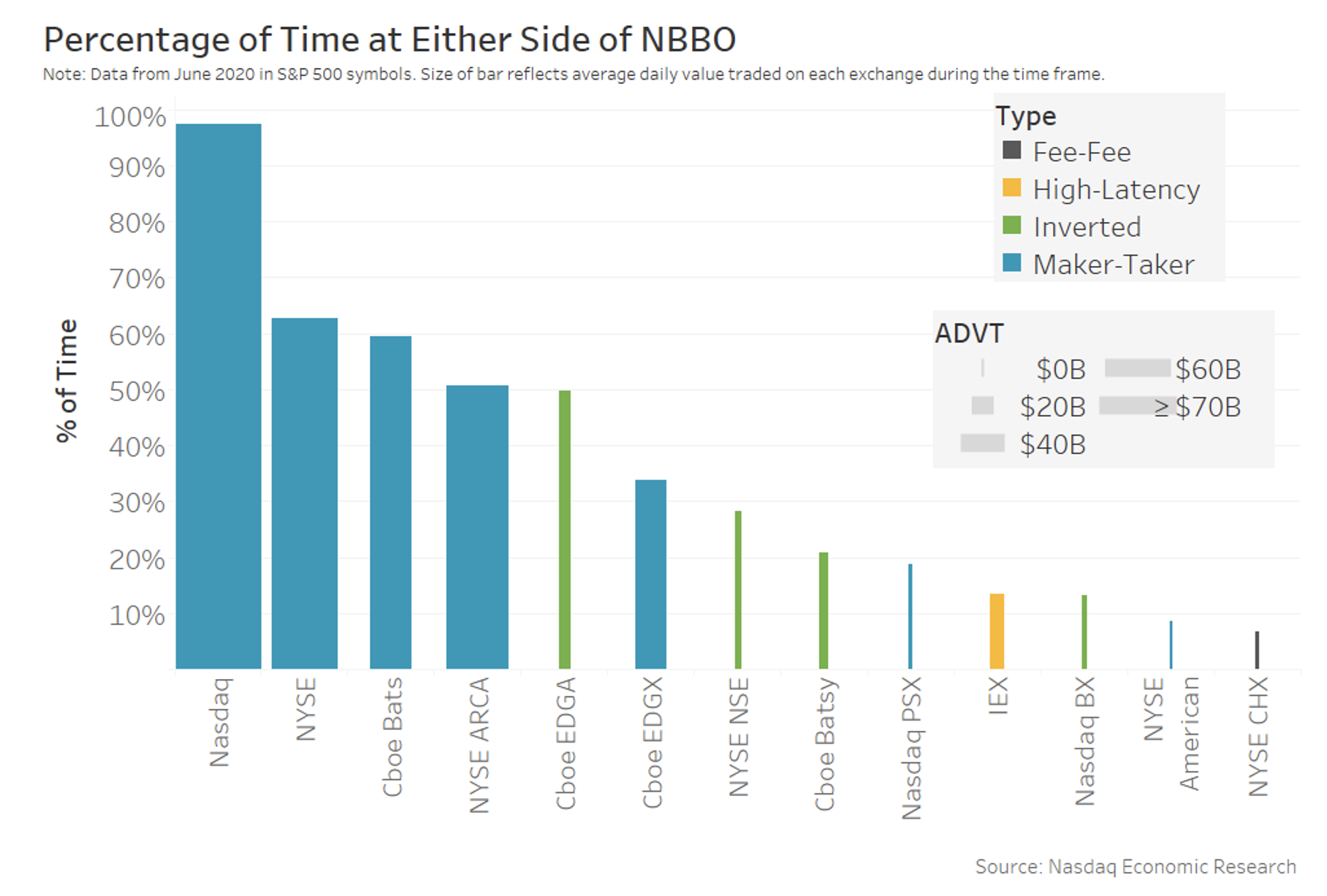

First, we look at how often each exchange is setting the “best” price (either the on the bid or the offer). With 16 exchanges competing for NBBO, exchanges adding to the NBB or NBO will help improve the NBBO spreads and liquidity over time.

The results in Chart 1 highlight how often each exchange is on at least one side of the NBBO for S&P500 stocks. It shows clearly that maker-taker (blue) exchanges overwhelmingly provide the most competitive quotes to the market.

The bars in Chart 1 are also sized based on liquidity (value traded), showing that in addition to more competitive spreads, rebate markets (blue) also provide the bulk of liquidity to investors trading on exchange (wider bars).

Chart 1: Contribution to NBB or NBO by exchange for S&P 500 stocks

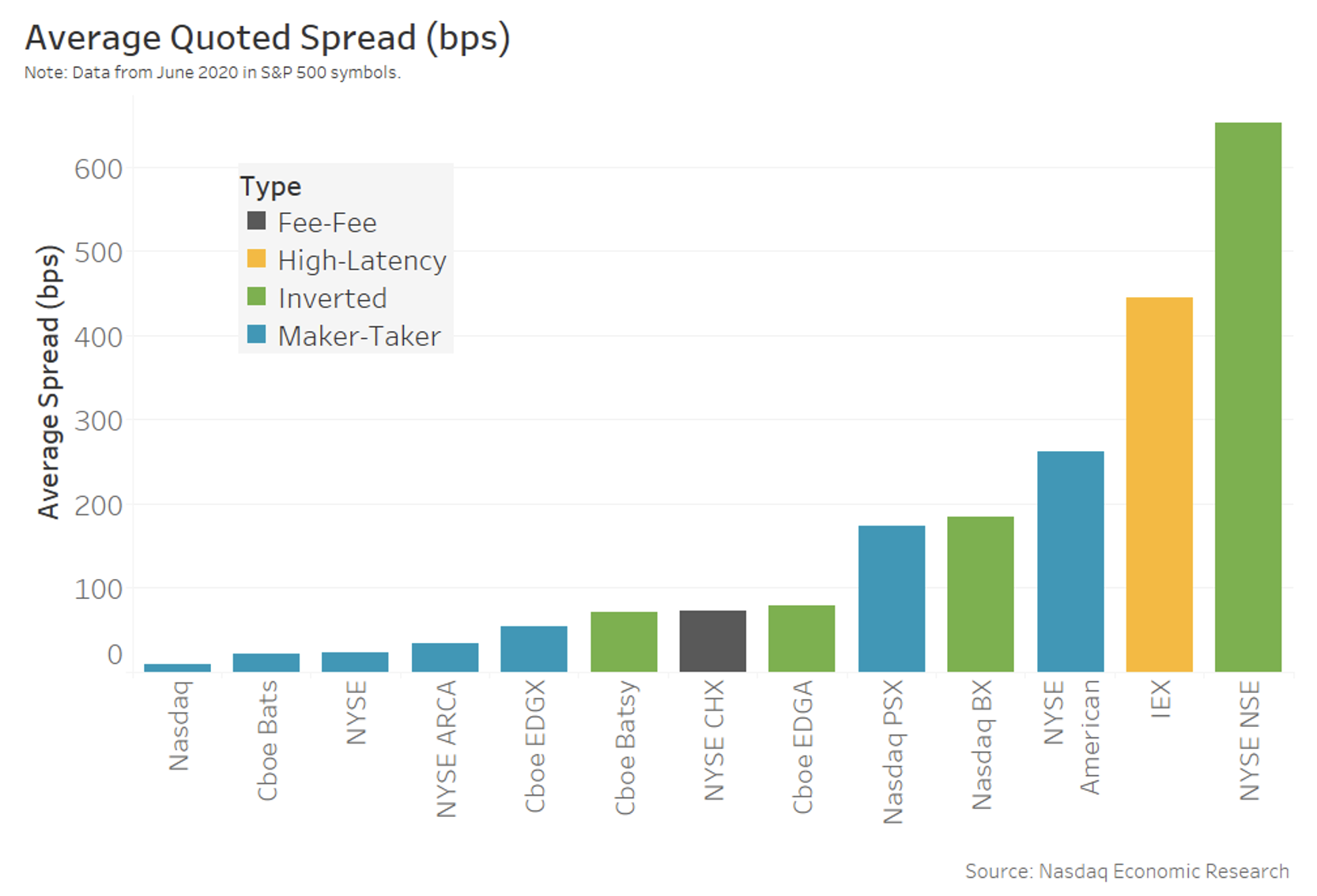

Ultimately, tighter spreads are what benefits investors by lowering their costs.

If we look at the average spreads across each exchange, again for S&P 500 stocks, the data also shows that the average spreads on the top five maker-taker exchanges (blue) are also far superior.

Chart 2: Average spreads in large-cap stocks by exchange

However, setting tight spreads on S&P 500 stocks should be easy. They are all highly liquid stocks, trading around 2 billion shares each day, with more liquidity coming from ETFs and futures arbitrage.

It is important for investors and issuers to have competitive spreads in all the other NMS stocks, too.

Setting NBBO in thinly traded markets is hard

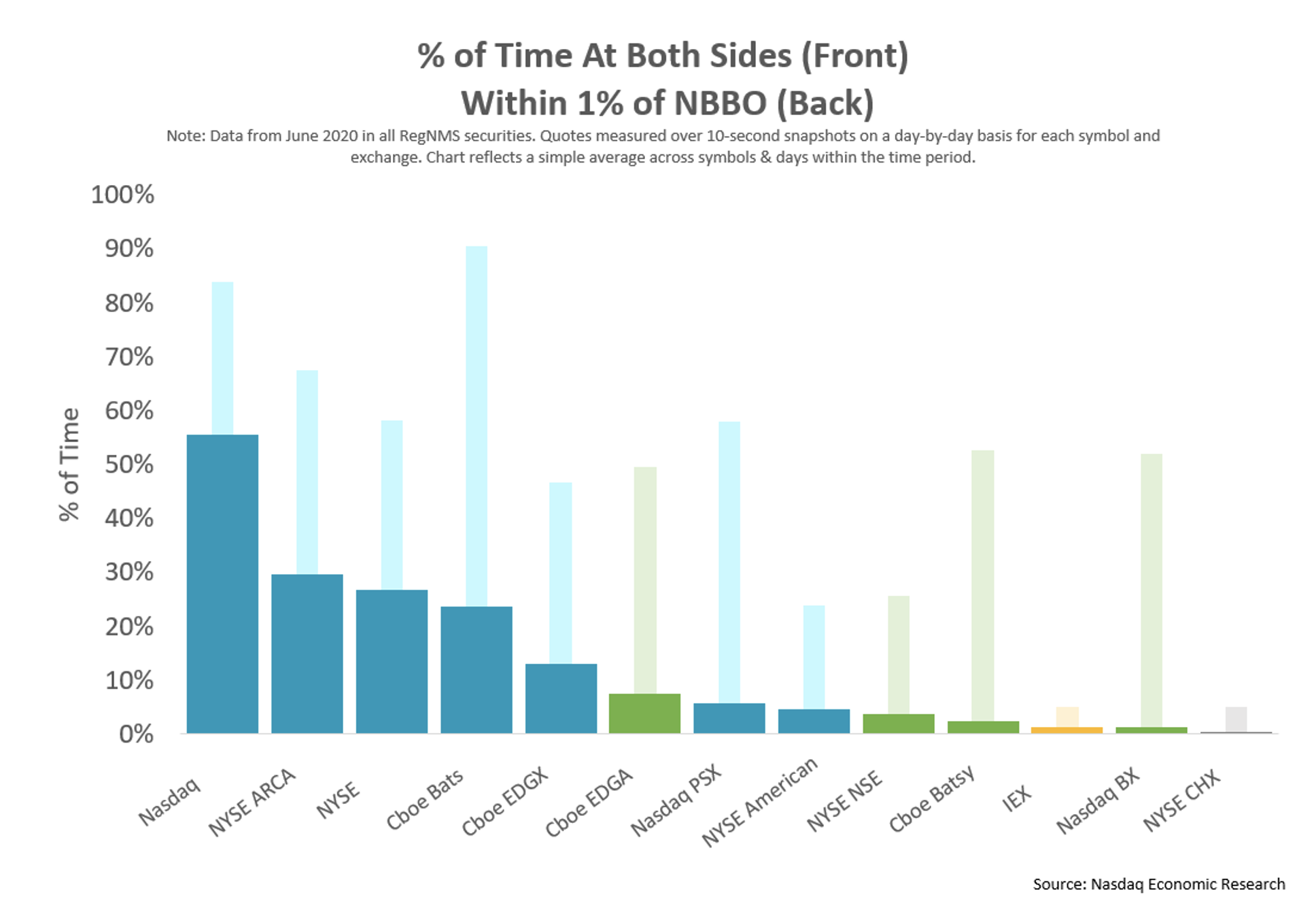

Looking at data for all NMS stocks shows that attracting competitive quotes for all stocks is hard.

If we look at the time each exchange sets both the NBB and NBO across all stocks, we see a notable drop in market quality (fat bars in Chart 3). Although this shows even more clearly that rebates are important to reward price setters on more thinly traded stocks.

Markets with other incentives rarely attract competitive quotes in smaller stocks; in fact, data shows they often fail to have two-sided quotes at ANY price.

Even if we widen our tolerance and look for exchanges with quotes within 100 basis points of the NBB and NBO across all NMS stocks (thin bars in Chart 3), we see rebates work much better than other incentives.

In short, maker-taker markets (blue) provide much broader and more consistent quote competition, as well as more depth, to thinly traded stocks.

Chart 3: Time with a two-sided quote at & within 1% of NBBO across all NMS stocks

Those with an eye for detail might see that this data is from 2020. Not much has changed. However, more current data shows that MEMX, which pays some of the highest rebates, is jumping ahead of many of the smaller markets. Unfortunately, new charts also show the incentives of speed bumps too. Many argue the SEC approval of D-limit has inflated truly available liquidity, segmenting flow, rather than making NBBO better. Data here seems to confirm that.

Inverted (so-called Taker Maker) markets also have rebates (for takers), but the data here indicates they don’t contribute as much to NBBO. However, other research shows they address a different market inefficiency. By paying rebates to liquidity takers, inverted venues allow exchanges to offer tighter effective spreads and shorter queues, leading to less adverse selection and opportunity cost. That helps them compete indirectly with off-exchange venues in tick-constrained stocks.

Why is this important?

All investors, even those trading off-exchange, benefit from competitive exchange quotes.

Research suggests that issuers also benefit from a competitive and liquid NBBO, which, by making trading more efficient, helps to reduce their costs of capital.

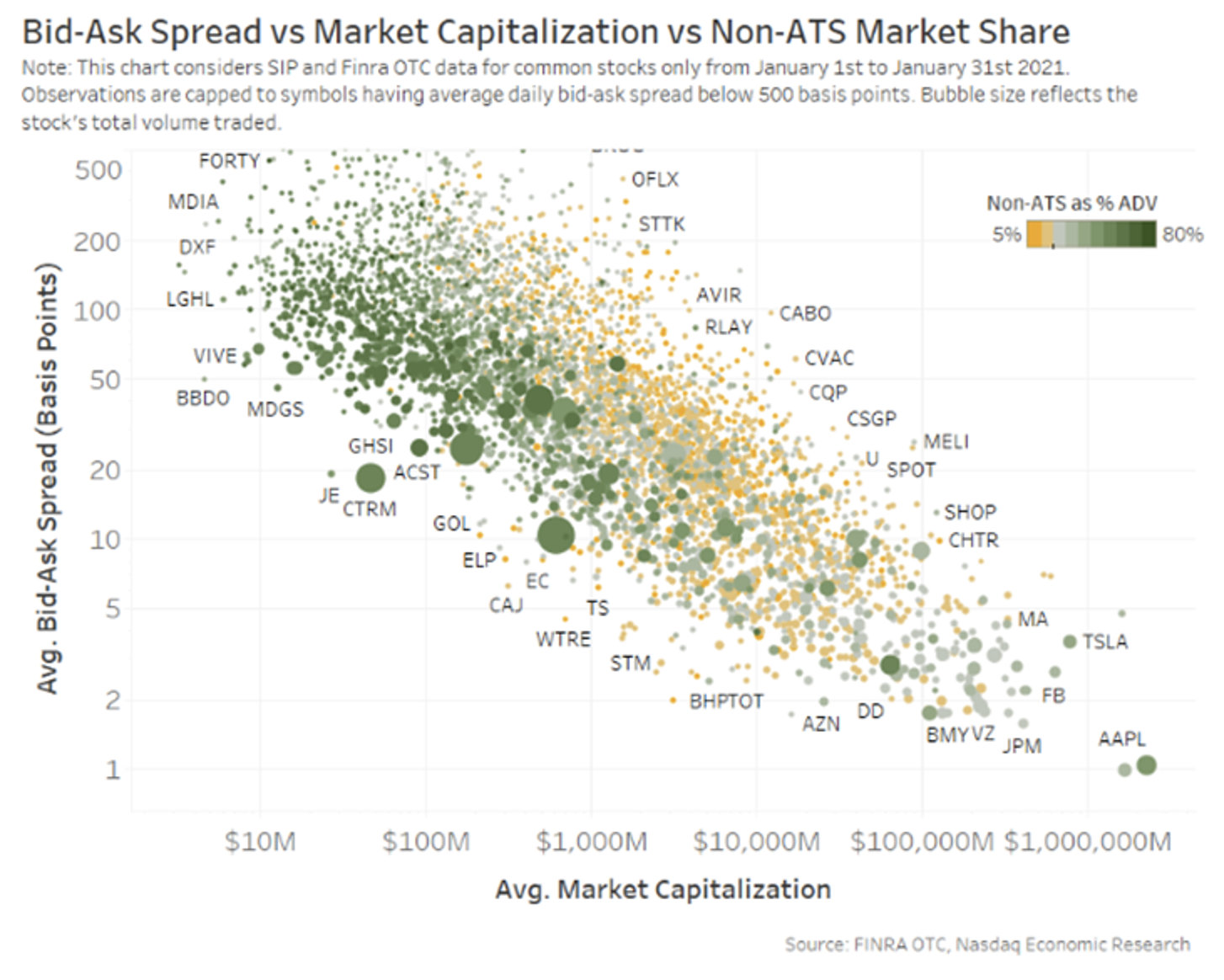

And we see above, encouraging quotes is especially important for smaller-cap stocks, particularly given the data in Chart 4 showing they have the widest spreads. Data from FINRA indicates that, despite rebates, those stocks also have some of the highest off-exchange trading (green color).

Chart 4: Many of the smallest stocks also have the widest spreads and the highest off-exchange trading

Importantly, changes to one incentive will alter the competitive benefits of remaining incentives, as each is part of a competitive ecosystem.

A more competitive NBBO is good for all investors and issuers. Rebates are the only incentives paid to any liquidity provider whose quotes also lead to trades. This data shows that they help improve the NBBOs and tighten spreads. They’re also important to compete with all the other incentives in the market.