EVI Industries, Inc. (NYSEMKT:EVI) shareholders have seen the share price descend 24% over the month. But that doesn't change the fact that the returns over the last half decade have been spectacular. In that time, the share price has soared some 589% higher! So it might be that some shareholders are taking profits after good performance. But the real question is whether the business fundamentals can improve over the long term.

We love happy stories like this one. The company should be really proud of that performance!

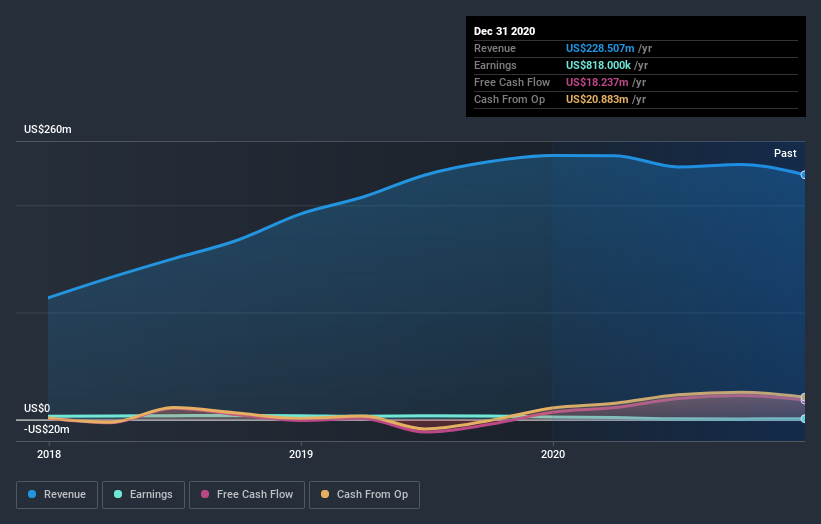

While EVI Industries made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, EVI Industries can boast revenue growth at a rate of 34% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 47% per year in that time. Despite the strong run, top performers like EVI Industries have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on EVI Industries' balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered EVI Industries' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that EVI Industries' TSR of 598% over the last 5 years is better than the share price return.

A Different Perspective

EVI Industries' TSR for the year was broadly in line with the market average, at 65%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 47% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. It's always interesting to track share price performance over the longer term. But to understand EVI Industries better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with EVI Industries (including 1 which is a bit unpleasant) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20Stock%20Five%20Years%20Ago%2C%20You%20Could%20Pocket%20A%20589%25%20Gain%20Today%20%7C%20Nasdaq&_biz_n=8&rnd=583638&cdn_o=a&_biz_z=1743342291169)

%20Stock%20Five%20Years%20Ago%2C%20You%20Could%20Pocket%20A%20589%25%20Gain%20Today%20%7C%20Nasdaq&rnd=950721&cdn_o=a&_biz_z=1743342291178)

%20Stock%20Five%20Years%20Ago%2C%20You%20Could%20Pocket%20A%20589%25%20Gain%20Today%20%7C%20Nasdaq&_biz_n=8&rnd=583638&cdn_o=a&_biz_z=1743342294169)

%20Stock%20Five%20Years%20Ago%2C%20You%20Could%20Pocket%20A%20589%25%20Gain%20Today%20%7C%20Nasdaq&_biz_n=8&rnd=583638&cdn_o=a&_biz_z=1743342294171)

%20Stock%20Five%20Years%20Ago%2C%20You%20Could%20Pocket%20A%20589%25%20Gain%20Today%20%7C%20Nasdaq&_biz_n=8&rnd=583638&cdn_o=a&_biz_z=1743342294172)