International Business Machines Corporation IBM recently unveiled plans to develop its first quantum data center in Europe. The strategic investment is likely to help the company better serve its clients in an expanding quantum computing ecosystem in the continent. The facility is the second of its kind from the company after Poughkeepsie, NY.

Located at IBM's facility in Ehningen, Germany, the data center is expected to be operational in 2024. Leveraging multiple IBM quantum computing systems, each equipped with quantum processors of more than 100 qubits, the facility is likely to cater to cloud-based quantum computing research and exploratory activity of users in diverse domains such as material science, high energy physics, energy transition, sustainability and financial applications. It is likely to help clients manage their European data regulation requirements, while tapping its huge potential to solve some of the world's most challenging problems.

In March this year, IBM launched Quantum Computational Center in collaboration with Fundación Ikerbasque in the Basque Country of Spain. The center works with the Basque country government, businesses and academic partners to develop innovative quantum technology solutions to facilitate regional scientific advancement. The collaboration aims to enhance international research and industrial cooperation and construct a world-class quantum-trained community pool with comprehensive learning programs.

IBM expects its growth to be driven primarily by analytics, cloud computing and security services. A better business mix, improving operating leverage through productivity gains and increased investments in growth opportunities will likely drive its profitability.

However, IBM’s ongoing, heavily time-consuming business model transition to the cloud is likely to be a headwind in the near term. Although the public cloud market is expected to be one of the fastest-growing IT categories, with about 25% to 30% CAGR over the next five years, IBM is unlikely to keep up with its competitors. High integration risks from a continuous acquisition spree are potent challenges.

In addition, weakness in its traditional business and foreign exchange volatility remain significant concerns. Also, higher profit on lower revenues indicates that the company has been lowering costs to maintain profits. We believe that the scope for further cost-cutting is limited. Consequently, if costs are further reduced, there could be a negative impact on product quality. It could also lead to an additional delay in launching products, denting its long-term growth potential to some extent.

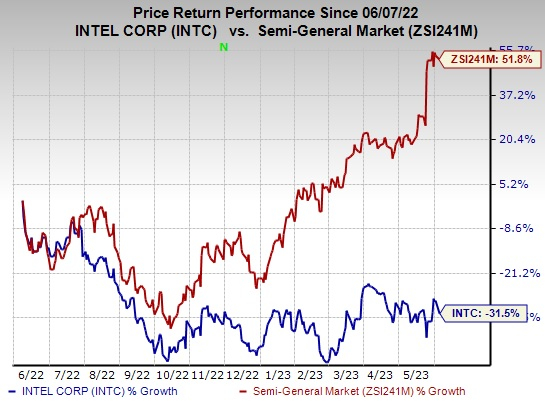

The stock has lost 7.2% over the past year compared with the industry’s decline of 8.5%. We are impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock.

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

InterDigital, Inc. IDCC, sporting a Zacks Rank #1, delivered an earnings surprise of 170.89%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 579.03%. It has a long-term earnings growth expectation of 13.9%.

It is a pioneer in advanced mobile technologies that enables wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular and wireless 3G, 4G and IEEE 802-related products and networks.

Akamai Technologies, Inc. AKAM, sporting a Zacks Rank #1, delivered an earnings surprise of 4.9%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 10%.

Akamai is a global provider of a content delivery network and cloud infrastructure services. The company’s solutions accelerate and improve the delivery of content over the Internet, enabling faster response to requests for web pages, streaming of video & audio, business applications, etc. Akamai’s offerings are intended to reduce the impact of traffic congestion, bandwidth constraints and capacity limitations on customers.

Turtle Beach Corporation HEAR, carrying a Zacks Rank #2 (Buy), is another key pick. It develops, commercializes and markets gaming headset solutions for various platforms, including video game and entertainment consoles, handheld consoles, personal computers, tablets, and mobile devices under the Turtle Beach brand.

Turtle Beach is well positioned to benefit from quality products and enjoys a solid foothold in its served markets. Its headsets are suited for learning and working remotely via video or audio conferencing. It has a long-term earnings growth expectation of 16%.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to "insane levels," and they're likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Download free today.International Business Machines Corporation (IBM) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Turtle Beach Corporation (HEAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.