By Goran Damchevski

This article was originally published on Simply Wall St News

International Business Machines Corporation (NYSE:IBM) has been on a long, slow and painful decline over the last few years. It is no longer a high-growth company, and the market has stopped seeing the possibilities and started focusing on the profit. We want to look at the bigger picture, and see what the future entails for this large US$129b market cap giant.

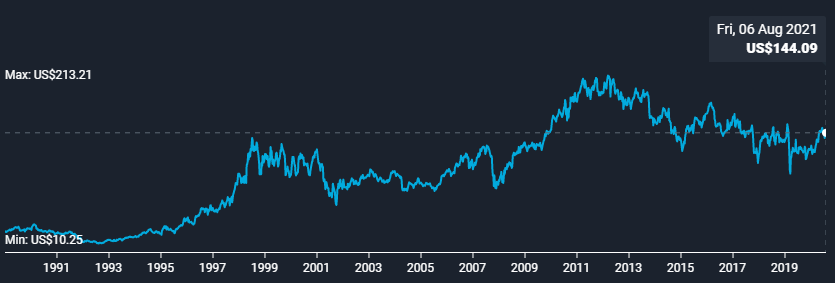

By looking at the price history of IBM stock, we get a general sense of the performance of this company, the periods of tech enthusiasm and the subsequent disappointments of shareholders.

It seems that after 2011, investors started experiencing negative price action and the company started being more appropriate for short-term traders. The chart does not show the returns of dividends, but buying a declining stock for its dividends is postponing the problem, and riskier than buying stable or growing dividend stocks.

IBM's Performance

In order to see the current quality of the company, we need to take a look at IBM's past performance and also see what are analysts estimating on average. This is really helpful for cleaning up the noise from news and high-tech jargon that all investors are not used to, and focusing on the bottom line - or better yet, on cash.

Let's start with the highlights from the latest quarterly report:

- Sales of US$19b surpassed estimates by 2.4%

- Statutory earnings per share missed, coming in 21% below expectations at US$1.47 per share

- US$8.2b cash, reduced byUS$6.1b from 2020 year-end, primarily resulting from debt payments

- Debt at US$55b, down US$6b since 2020 year-end. The company increased their debt balance in Q2 2019 and is now slowly delivering

- Free Cash Flow for the last 12 months of US$9.7b (unadjusted) vs US$5.2b in Net Income

- Red Hat revenue up 20%, more than 3,200 clients using the hybrid cloud platform, about 4x clients since they announced the Red Hat acquisition.

As you can see, there is some growth and attempts to stabilize the business. There are some challenges still, as IBM is engaged in divesting and reconciling the latest large US$34b cash acquisition of Red Hat. Shareholders have the right to be cautious, as IBM has a large product portfolio, but the profits of these products have fallen short, so it is normal for investors to want to see results, rather than listen to possibilities.

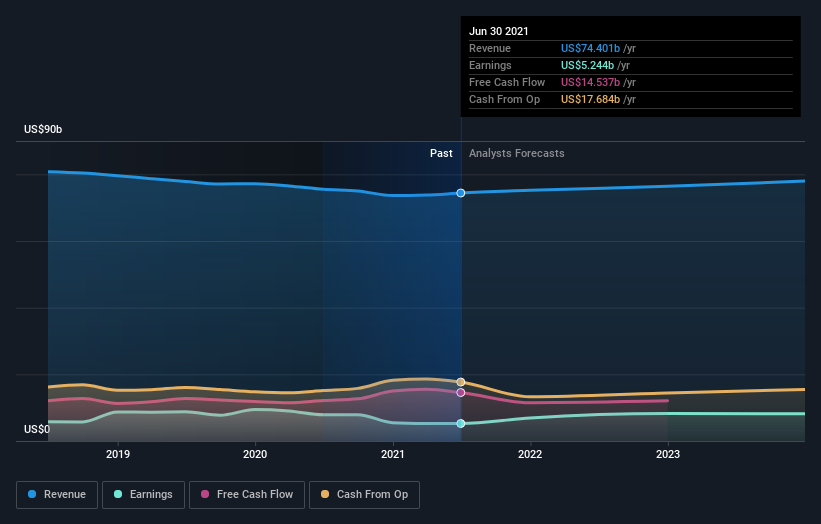

Looking at the bigger picture, analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of.

See our latest analysis for International Business Machines

Taking into account the latest results, International Business Machines' 14 analysts currently expect revenues in 2021 to be US$75.2b, approximately in line with the last 12 months.

Per-share earnings are expected to leap 31% to US$7.72.

It seems that the company is stabilizing, and that is something investors can be hopeful about. Sometimes focusing on stability and profit, rather than growth is the best approach for maximizing value, and IBM seems to fit the profile of a company that needs to look inwards.

In the lead-up to this report, the analysts had been modelling revenues of US$75.2b and earnings per share (EPS) of US$7.92 in 2021. The analysts seem to have become a little more negative on the business after the latest results, given the small dip in their earnings per share numbers for next year.

The average price target held steady at US$149, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future.

Since fixating on a single price target can be unwise, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic International Business Machines analyst has a price target of US$176 per share, while the most pessimistic values it at US$125. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

International Business Machines is forecast to grow faster in the future than it has in the past, with revenues expected to display 2.2% annualized growth until the end of 2021. If achieved, this would be a much better result than the 1.7% annual decline over the past five years.

Our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 15% per year. Although International Business Machines' revenues are expected to improve, it seems that the analysts are still bearish on the business, forecasting it to grow slower than the broader industry.

The Bottom Line

IBM is stabilizing revenues, and shaking off debt. It is also cleaning house from various segments and focusing on value creation.

Looking at the short term, it seems that IBM will be more suitable for traders rather than investors for a while more. Analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following Q2 results.

IBM is earning cash and making profit, it also has the capacity to increase the efficacy of the current operations, however it seems to be burdened by some mistakes of the past and needs bold leadership to make moves that will make some people unhappy.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for International Business Machines going out to 2023, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present specter of investment risk. We've identified 4 warning signs with International Business Machines , and understanding these should be part of your investment process.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.