Hyatt Hotels Corporation H announced plans to expand its portfolio with more than 50 luxury and lifestyle hotels by 2026. The company highlighted this development during ILTM Cannes, a premier event in the luxury travel industry.

Hyatt aims to strengthen its growth in the luxury and lifestyle segments by refining the company’s brand portfolio. This approach is designed to unlock the full potential of each brand and cater to evolving traveler demands.

Hyatt Expands Luxury and Lifestyle Offerings Amid Growing Demand

Luxury travel demand experienced significant growth in 2023 and continues to rise. Savills has expected a 52.8% increase in Europe’s luxury hotel stock by 2028, indicating strong investor confidence in the segment’s long-term growth potential.

Hyatt is well-positioned to capitalize on this trend, with 70% of its global rooms classified as luxury and upper upscale. The company has added 28 luxury hotels and resorts in the past three years and doubled its luxury room count since 2017. Hyatt has also expanded its lifestyle hotel presence, quintupling lifestyle rooms since 2017 and adding 28 lifestyle hotels in 2024. This growth was further enhanced by acquiring brands from Standard International and forming a dedicated Lifestyle group, headquartered in New York City.

Hyatt’s pipeline includes more than 50 luxury and lifestyle hotels which are set to open globally by 2026. Among these, Miraval the Red Sea is scheduled to debut in late 2025. This project will mark the Miraval brand’s international debut, offering transformative wellness experiences and featuring one of the largest spas in the Red Sea region.

Upcoming openings include Park Hyatt Kuala Lumpur, Park Hyatt Johannesburg, Andaz Miami Beach and Andaz Gold Coast. These properties build on the success of recent launches such as Park Hyatt London River Thames, Alila Shanghai, The Standard Singapore and The StandardX Bangkok.

Hyatt’s Evolved Brand Strategy

The company has followed a strategic growth path for decades, expanding its brands into sought-after destinations and new markets. Hyatt’s portfolio now includes 256 luxury and lifestyle hotels and resorts across 45 countries, with 58 located in EAME. The company is recognized for delivering elevated high-end experiences to its guests.

To build on this growth, Hyatt is launching new portfolios that focus on differentiation. This strategy aims to unlock the full potential of each brand, including its Luxury and Lifestyle portfolio.

2024 has been a strong year for the company in Europe, Africa and the Middle East. The luxury and lifestyle segments have been key drivers of this success, highlighted by the strong performance of properties like Park Hyatt London River Thames and Park Hyatt Marrakech.

Hyatt’s Price Performance

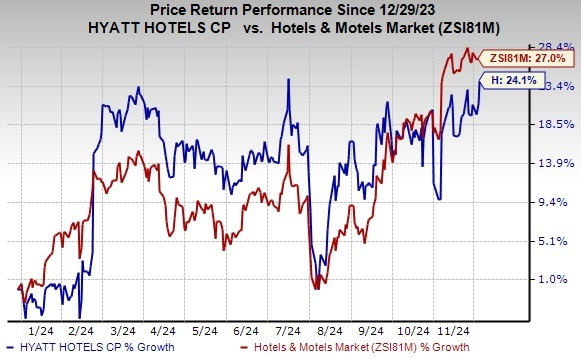

Image Source: Zacks Investment Research

Shares of Hyatt have risen 24.1% in the year-to-date period compared with the Zacks Hotels and Motels industry's 27% growth. Although the company has underperformed the industry in the said period, strong momentum across all group customer segments will help to drive growth.

Increased group bookings and robust recovery of business transient demand are expected to contribute to the company’s optimistic outlook. Also, organic and inorganic growth initiatives, loyalty programs and asset-light business model bode well.

Hyatt’s Zacks Rank & Key Picks

Hyatt currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Zacks Consumer Discretionary sector.

Carnival Corporation & plc CCL currently has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

CCL delivered a trailing four-quarter earnings surprise of 318.1%, on average. The stock has surged 53.2% in the past year. The Zacks Consensus Estimate for CCL’s fiscal 2024 sales indicates growth of 16.7% from year-ago levels.

Norwegian Cruise Line Holdings Ltd. NCLH currently carries a Zacks Rank #2 (Buy). NCLH delivered a trailing four-quarter earnings surprise of 4.2%, on average. The stock has surged 52.2% in the past year.

The Zacks Consensus Estimate for NCLH’s 2024 sales and EPS indicates growth of 10.7% and 134.3%, respectively, from year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently carries a Zacks Rank #2. RCL delivered a trailing four-quarter earnings surprise of 16.2%, on average. The stock has surged 111.3% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS indicates growth of 18.6% and 71.9%, respectively, from year-ago levels.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Carnival Corporation (CCL) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.