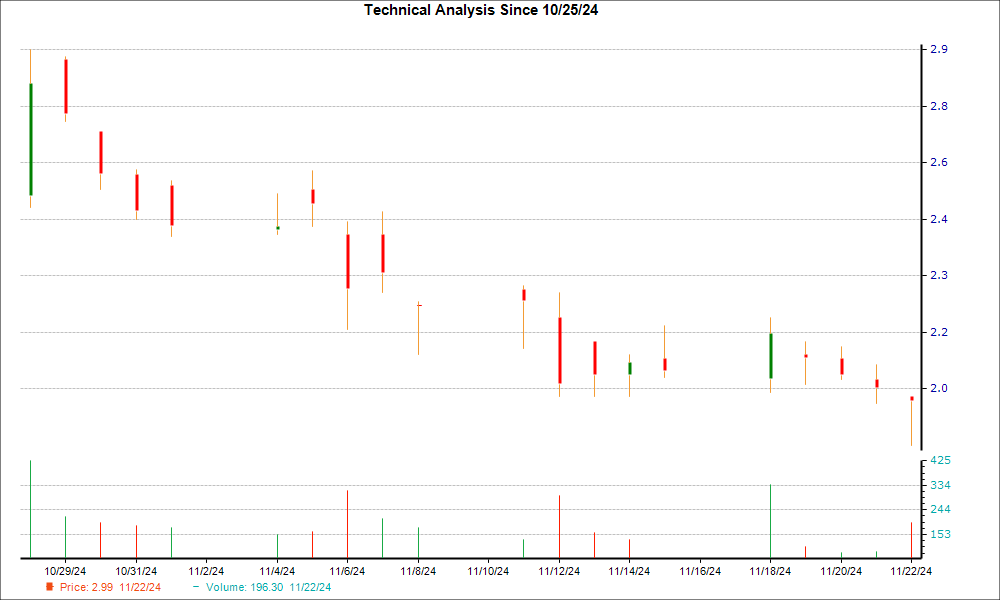

The price trend for HUYA Inc. Sponsored ADR (HUYA) has been bearish lately and the stock has lost 7.1% over the past two weeks. However, the formation of a hammer chart pattern in its last trading session indicates that the stock could witness a trend reversal soon, as bulls might have gained significant control over the price to help it find support.

While the formation of a hammer pattern is a technical indication of nearing a bottom with potential exhaustion of selling pressure, rising optimism among Wall Street analysts about the future earnings of this company is a solid fundamental factor that enhances the prospects of a trend reversal for the stock.

What is a Hammer Chart and How to Trade It?

This is one of the popular price patterns in candlestick charting. A minor difference between the opening and closing prices forms a small candle body, and a higher difference between the low of the day and the open or close forms a long lower wick (or vertical line). The length of the lower wick being at least twice the length of the real body, the candle resembles a 'hammer.'

In simple terms, during a downtrend, with bears having absolute control, a stock usually opens lower compared to the previous day's close, and again closes lower. On the day the hammer pattern is formed, maintaining the downtrend, the stock makes a new low. However, after eventually finding support at the low of the day, some amount of buying interest emerges, pushing the stock up to close the session near or slightly above its opening price.

When it occurs at the bottom of a downtrend, this pattern signals that the bears might have lost control over the price. And, the success of bulls in stopping the price from falling further indicates a potential trend reversal.

Hammer candles can occur on any timeframe -- such as one-minute, daily, weekly -- and are utilized by both short-term as well as long-term investors.

Like every technical indicator, the hammer chart pattern has its limitations. Particularly, as the strength of a hammer depends on its placement on the chart, it should always be used in conjunction with other bullish indicators.

Here's What Increases the Odds of a Turnaround for HUYA

There has been an upward trend in earnings estimate revisions for HUYA lately, which can certainly be considered a bullish indicator on the fundamental side. That's because a positive trend in earnings estimate revisions usually translates into price appreciation in the near term.

The consensus EPS estimate for the current year has increased 3.3% over the last 30 days. This means that the Wall Street analysts covering HUYA are majorly in agreement about the company's potential to report better earnings than what they predicted earlier.

If this is not enough, you should note that HUYA currently has a Zacks Rank #1 (Strong Buy), which means it is in the top 5% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises. And stocks carrying a Zacks Rank #1 or 2 usually outperform the market. You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here >>>>

Moreover, the Zacks Rank has proven to be an excellent timing indicator, helping investors identify precisely when a company's prospects are beginning to improve. So, for the shares of HUYA, a Zacks Rank of 1 is a more conclusive fundamental indication of a potential turnaround.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpHUYA Inc. Sponsored ADR (HUYA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.