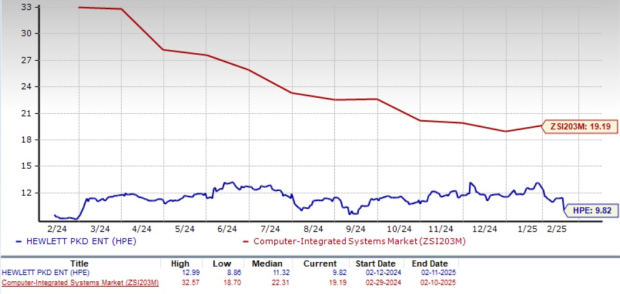

Hewlett Packard Enterprise’s HPE current valuation suggests that the stock is available at a discounted price compared with the industry average. HPE stock trades at a forward 12-month price-to-earnings (P/E) ratio of 9.82, significantly lower than the Zacks Computer – Integrated Systems industry average of 19.19.

Forward 12-Month P/E Ratio

Image Source: Zacks Investment Research

HPE stock has also been on a steady upward trend over the past year. The stock surged 35.7%, outperforming the Zacks Computer and Technology sector and the S&P500 index’s return of 22.2% and 21.8%, respectively, over the past year.

HPE stock has outperformed the Zacks Computer – Integrated Systems industry as well as peers, including Micron MU, Seagate Technology STX and Advanced Micro Devices AMD.

One Year Price Return Performance

Image Source: Zacks Investment Research

HPE Stock Driven by Traction in GreenLake and AI

HPE’s rally over the past year has been supported by strong performance in its key segments, particularly GreenLake and artificial intelligence (AI) systems. There is significant momentum in the adoption of HPE GreenLake as organizations are capitalizing on the flexibility and scalability of this IT transformation solution.

GreenLake’s customer base expanded by approximately 34.5% year over year, reaching 39,000 in the fourth quarter of fiscal 2024. This growth in customer base has driven the annualized revenue run rate, which has increased 48% year over year, exceeding $1.9 billion at the end of the fiscal fourth quarter.

Hewlett Packard Enterprise continues to see robust demand for its AI system offerings. During fourth-quarter fiscal 2024earnings call HPE revealed that it had $6.7 billion in cumulative orders for AI products and services since the first quarter of fiscal 2023. HPE’s new AI orders in the fiscal fourth quarter of 2024 have brought its backlogs to a value of $3.5 billion.

These factors will likely contribute to HPE’s top-line growth. The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $32.4 billion, indicating year-over-year growth of 7.5%. The Zacks Consensus Estimate for fiscal 2025 earnings is pegged at $2.11, indicating growth of 6% year over year.

HPE’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 7.84%.

Hewlett Packard Enterprise Company Price, Consensus and EPS Surprise

Hewlett Packard Enterprise Company price-consensus-eps-surprise-chart | Hewlett Packard Enterprise Company Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Conclusion: Buy HPE Stock Now

HPE’s GreenLake and AI-driven growth signal promising long-term potential. The stock’s attractive valuation, solid positioning in the upper quartile of its industry and past-year return justify that it is prudent to buy this Zacks Rank #2 (Buy) stock now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.