Coronavirus is likely the ultimate “gray swan” meaning a risk that investors didn’t see coming but which shouldn’t be a surprise since the SARS scare in 2003.

There are several technology companies in the Nasdaq-100 index which are dependent on China. For example, Apple does much of their manufacturing there and Amazon sources much of their inventory from China. Add yesterday’s disappointing results from Facebook and investors in the Nasdaq-100 index might be looking for option strategies which will provide some protection for the 3.5 percent year-to-date gain the index posted at midday on Thursday, January 30.

In the past we’ve examined buying put spreads for protection and most recently we discussed selling call spreads to generate premium income and take advantage of option skew. If we go back to first principles an investor might want to buy an NDX put option for protection and pay for that protection by selling an NDX covered call option. This structure is called an option collar.

For example, just before midday on Thursday with the Nasdaq-100 index at 9044.00, an investor might buy an NDX put option expiring on March 20 with a strike price of 8800. That put could be purchased for 166.00. But that’s quite a bit of money; that put would cost 1.8 percent of the cost of the index and provide just 49 days of protection. The way to reduce the cost of the trade would be to sell a covered call. An investor who bought that put option could also sell the 9200 strike put option for the same 166.00.

As result our investor would remain long the Nasdaq-100 index, would be long an 8800 strike put option and would be short a 9200 strike covered call option. The option structure would be done for no net cost since the premium received for selling the call equals the premium spent to buy the protective put.

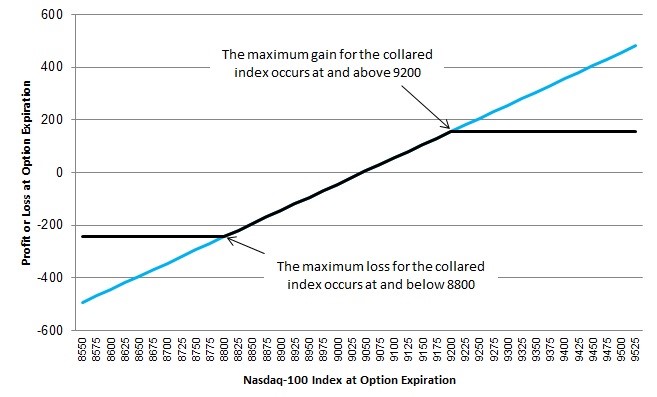

This structure would limit losses in the portfolio below 8800, the strike price of the put option. The cost of that protection is giving up any potential appreciation above the 9200 strike price of the call option. You can see the payoff profile for the collared index here.

Since this option collar is being done for exactly zero net premium the payoff profile for the unprotected index and the collared index are identical. For the collared index the portfolio value cannot drop below 8800 nor can it rise above 9200.

Observant readers will notice that while our investor won’t be paying anything out of pocket, there is a cost to establishing this collar. The Nasdaq-100 index was at 9044.00 when these option prices were available. That means the index would have to drop 244 points, or 2.7 percent before the protection kicked in while appreciation would be truncated after a rally of just 156 points or 1.7 percent. That difference is caused by option skew, the tendency for out-of-the-money puts to be more expensive than out-of-the-money calls. This difference is caused by buying interest for protective puts and the supply of call options from covered call sellers. This is the real cost of using a collar to protect an investment. It doesn’t mean an investor shouldn’t use a collar, it just means there’s a cost involved even if there’s no net outlay for the options.

You can follow Scott on Twitter: @ScottNations

Performance of an index is not illustrative of any particular investment. Index returns quoted represent past performance which is no guarantee of future results.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.