It’s one thing to expect volatility, but it’s another to actually prepare for violent swings.

Investors are constantly searching for tools, research, resources; anything that can help them mitigate — or capitalize on — the ups and downs of today’s market.

In an age where there’s more information available at our fingertips than ever before, you have to be careful and remember to honor your own perspective above everything. Your time horizon, trading styles, and portfolio makeup and financial situation could all impact your investing approach.

Here’s how to devise your own plan for a volatile market.

Step 1: Understand your view

Most investors have some sort of view or bias on the market, even if they don’t realize it. And when you’re making portfolio decisions, it’s important to start with your own view.

Your view isn’t just your opinion of where prices go next, it’s actually an evaluation of what you’re trying to achieve in your portfolio. Arguably, the most important factor to consider is your timeframe. If you’re a long-term investor contributing a set amount of money to the market for a goal years down the road, your best plan may be to stay the course.

But if you’re a more active trader looking for opportunity over days and weeks, you might want to ask yourselves these questions:

- What asset classes am I interested in?

- Am I bullish (expecting prices to go up) or bearish (expecting prices to go down)?

- How far do I think prices will rise or fall?

- What kind of move can I handle financially?

- How long will it take for that move to play out?

Step 2: Evaluate your options

Once you’ve determined your view, it’s time to put your plan into action. To do so, you need to consider which markets act as good hedges against a stock portfolio. There are several investments that often fit this bill — like bonds, gold, and crypto. Or there’s the most versatile of them all: options.

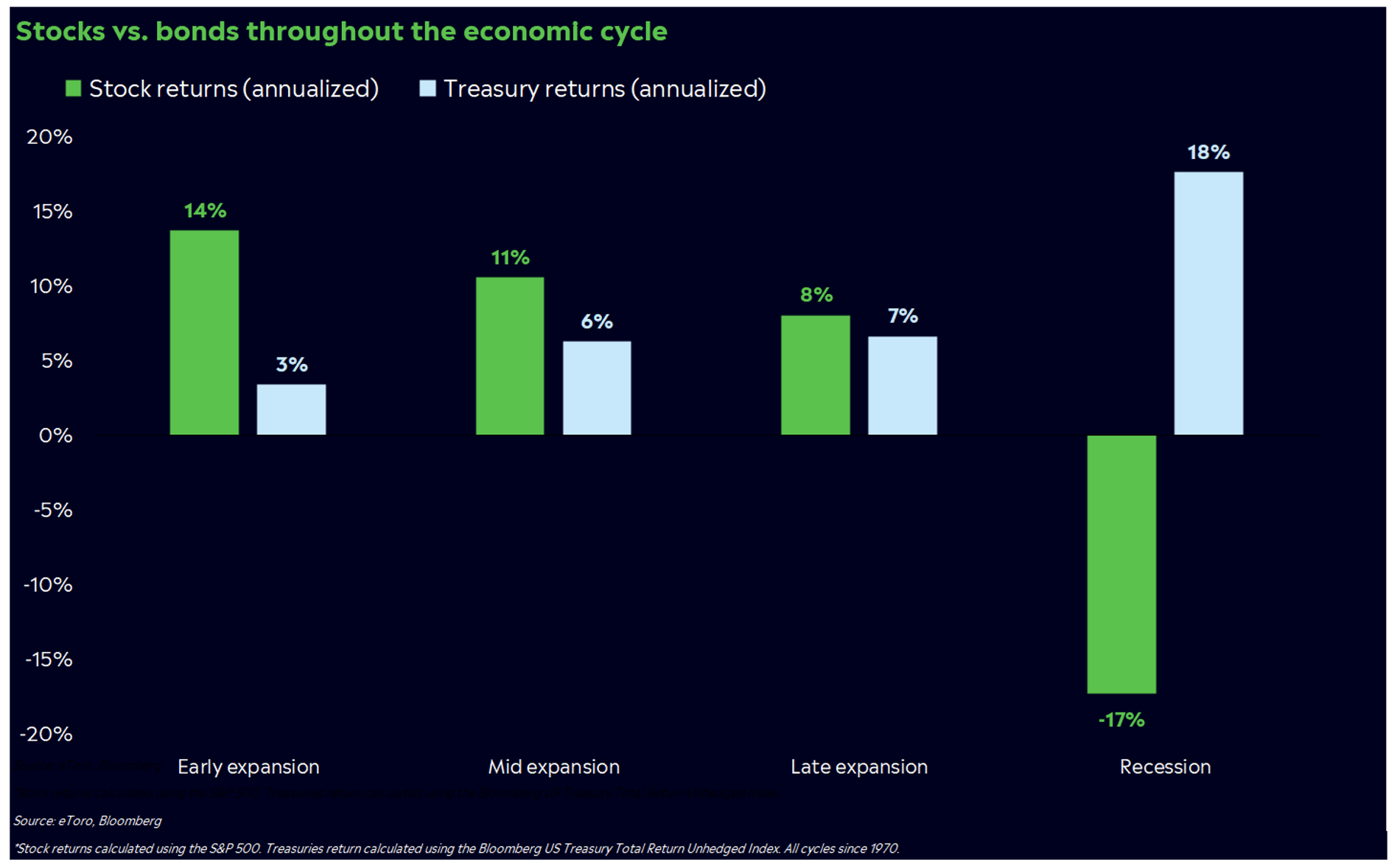

Picking the right tool requires you to look inward again. If you’re just looking for an investment that helps cushion your portfolio during crises, history shows that Treasuries could soften the blow during recessions.

If you have a high appetite for risk and a sense of adventure, you might find options useful in a moment with so many moving parts and risks to consider. When used correctly and responsibly, options can act as a unique tool that delivers controlled bursts of leverage for a reasonable cost.

For instance, slightly more aggressive positioning — like long calls, puts, or debit spreads — can help you create a complex trade. Being long these positions does come with the risk that they can go to zero. However, they could end up being worth several times — or in some cases, many times — the original investment.

And if you use multi-leg options strategies, you could cut costs even more or express a multi-dimensional view. Are you stressed about the next month, but optimistic about the year ahead? You can set up a trade like that with options.

No matter the tool you use, though, it’s important to define the risks you’re taking. If you like to pick stocks, you have to consider two types of risk – system-wide and company specific risk. Your Tesla shares, for example, could be impacted by a recession that brings the market down, or Elon Musk leaving the company. If you have a broad portfolio with different types of stocks, you’re more protected against stock-specific risk.

This matters when you’re planning for swings ahead. A broad-market hedge like Treasuries may not work well if your biggest worry is a disappointing product announcement from your biggest stock holding.

Step 3: Learn to live with swings

You’ve picked your tools. Now, you buckle up for market storms.

Ups and downs are par for the course — no matter if you’re focused on the bigger picture or individual companies. Economies change, companies release new products, unexpected crises pop up. You have to be ready for everything the market gods throw your way, even when your emotions are running wild. And they will — we’re human, after all.

Here’s an example. You invested in Tesla because you’re a fan of Elon Musk and electric vehicle technology. And it helps that the stock has turned $1,000 into nearly $240,000 in just 13 years. But being a Tesla investor hasn’t been easy, even if it’s been wildly profitable for some. Tesla stock has gone through three selloffs of 50% or more since going public in 2010. That’s difficult to stomach.

Luckily, you don’t just have to grin and bear it through vicious selloffs. The best investors have a plan in place in case volatility happens at any moment.

Setting numbers-based targets on your investments can help you make level-headed decisions when markets are moving against you. Think about what return, share price, or investment value seems reasonable for you, and stay focused on that target above anything else.

So what does this mean for me?

Set some goals. If you’re feeling stuck, it might be time to re-assess exactly why you’re investing. Set goals for your portfolio and pick the investments you need to get there, while remembering there’s often a tradeoff between risk and reward.

And if you’re not ready to make money moves, commit to learning more about a new investment or strategy. The eToro Academy has a number of resources to help you add some investing knowledge to your repertoire, and Virtual Portfolio and Draft Trading are tools that can help you practice new strategies before you commit.

Remember the moment we’re in. Interest rates are high and the economy may slow from here. Nobody knows what the future holds, but the environment seems to be especially fragile. Now may be an especially good time to make a plan for a volatile market.

If you want to read more research and analysis from eToro, check us out here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.