Investors often choose U.S. defense stocks because they are attached to relatively safe companies. The U.S. government is a reliable customer, and there's no shortage of geopolitical tensions driving increased demand for defense spending around the globe. Moreover, stocks like Lockheed Martin (NYSE: LMT) tend to pay growing dividends.

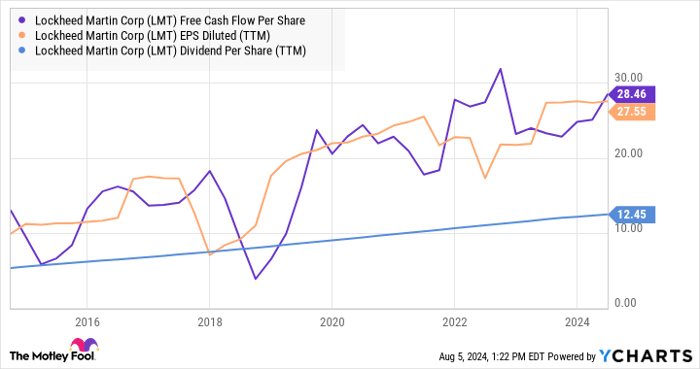

The chart below shows the stock's dividend-per-share, earnings-per-share, and free-cash-flow-per-share ratios so you can see just how well covered its dividend is.

LMT Free Cash Flow Per Share data by YCharts

Dividend payout in 2024

That healthy coverage will continue in 2024. The defense company's currently quarterly dividend is $3.15 per share, and the dividend currently yields about 2.3%. The midpoint of management's earnings-per-share guidance for 2024 is $26.35, and the dividend per share in 2024 will be $12.60. This year's payout will be about $3.04 billion, and management expects $6 billion to $6.3 billion in free cash flow in 2024.

In other words, Lockheed Martin plans to pay slightly less than 50% of its earnings and cash flow in dividends. This payout ratio allows room for growth, particularly if Lockheed Martin can continue growing earnings and cash to follow historical norms.

That seems likely, although investors shouldn't be too quick to assume that the increased defense orders will translate into rapid earnings and cash-flow growth. As previously discussed by me, many defense companies, including Lockheed Martin, are struggling with margin expansion due to problematic fixed-price programs secured in less inflationary times.

As such, Lockheed Martin is likely to be a solid rather than spectacular dividend grower, which might suit many investors.

Should you invest $1,000 in Lockheed Martin right now?

Before you buy stock in Lockheed Martin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lockheed Martin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.