Most parents want to do everything they can to set their children up for future financial success. One way to help is to save money for a college education, since college graduates typically make more money over their lifetime than those without a university degree.

But college is expensive. And saving enough money for a child’s higher education can place a huge strain on a family’s overall finances. This is particularly true for parents with more than one child under their roof.

As a result, parents usually have a lot of questions when it comes to saving for a child’s college education. How much money do I need to save? Where should I store college savings? Can student loans cover all college expenses?

Saving for college is complicated, but we have answers to these questions, and more, in the discussion below.

Related: Tax Credits and Deductions for Education Expenses

The Current Cost of College

Although the inflation-adjusted average for tuition and fees has dipped a bit over the past couple of years, the cost of college still remains high. According to the College Board, the advertised annual tuition and fees for a full-time undergraduate student at a four-year college during the 2022-23 school year averaged out to:

- $10,940 at a public, in-state college

- $28,240 at a public, out-of-state college

- $39,400 at a private nonprofit college

And that doesn’t include room and board. For students living on campus, tack on an average of $12,310 for a dorm room, meal card, and other related expenses at a public college. Private college costs for room and board averaged 14,030 per year.

When you add it all up, the average combined total for annual tuition, fees, and living expenses for a full-time undergraduate student at a four-year college during the 2022-23 school year was:

- $23,250 at a public, in-state college

- $40,550 at a public, out-of-state college

- $53,430 at a private nonprofit college

No doubt these figures caused sticker shock for parents and students alike. A 2021 survey by Fidelity Investments found that about 25% of high schoolers’ parents and 38% of high school students believed a year of college only costs $5,000 or less. So, you can imagine their reaction when they discovered the actual price.

Parents might also be used to college costs from decades ago. However, those costs are way out of date. According to a recent study by Georgetown University’s Center on Education and the Workforce, the average price for undergraduate education—including tuition, fees, room, and board—rose 169% from 1980 to 2019.

Related: Best Investing Apps for College Students to Start Investing

Is College Worth It?

Yes, college costs are high. But don't let that prevent you from saving for your child’s higher education. While there are always exceptions, people with a bachelor's degree still tend to make more money than those without one.

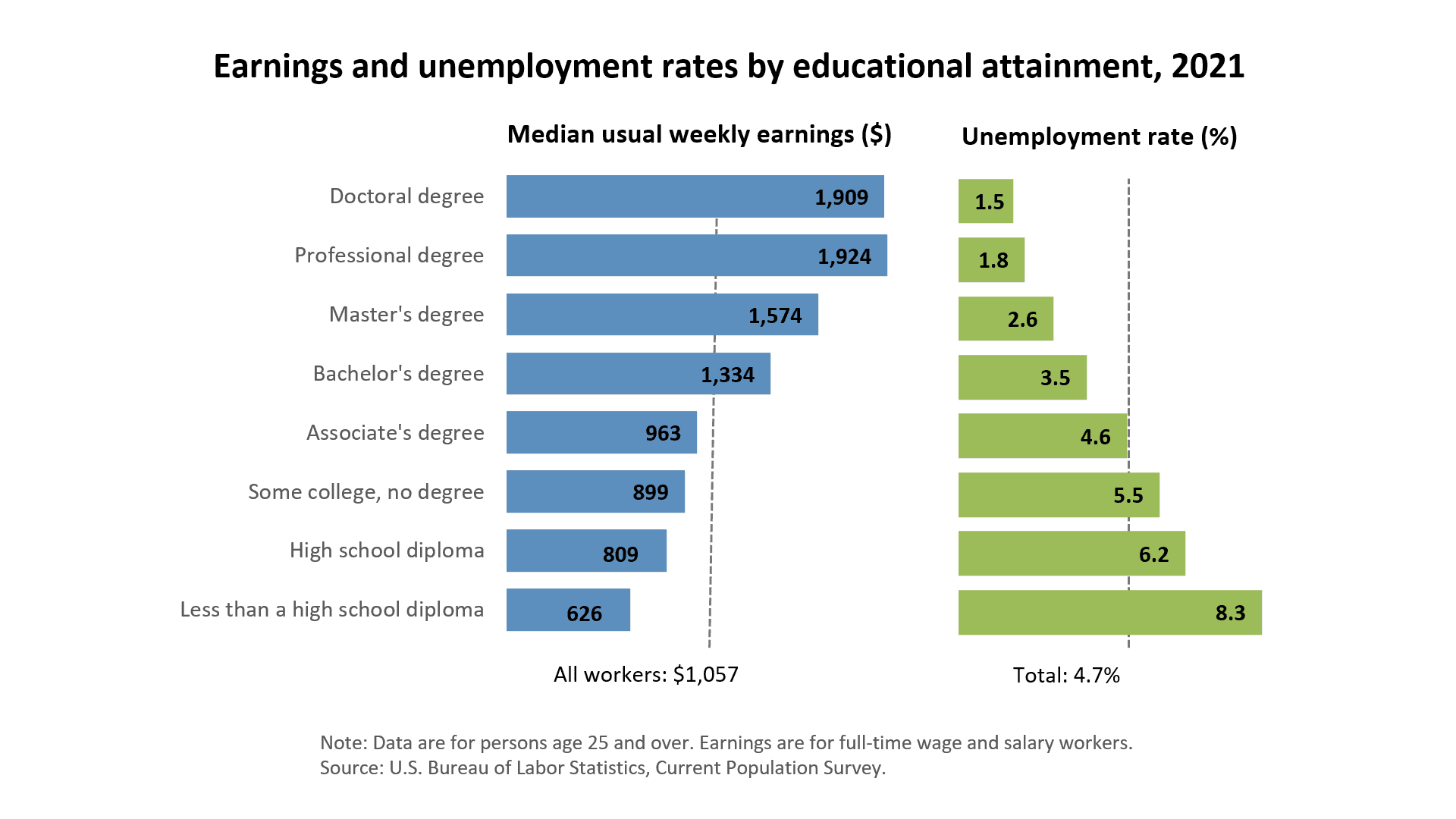

According to the most recent data from the Bureau of Labor Statistics, the median weekly earnings of full-time workers with a high school diploma is $809. By comparison, the median weekly earnings of someone with a bachelor's degree is $1,334. That’s a 65% increase over the wages earned by a high school graduate.

Taking it further, people with a master’s degree have a median weekly paycheck of $1,574, while the mean weekly earnings for someone with a doctoral degree is $1,909. So, in general, the more education you have, the more you're likely to earn.

There are other financial and work-related benefits of a college education, too. For example, as your level of education rises, your chances of being unemployed decrease.

College also opens up a lot of employment opportunities. Even in fields where a degree isn't a hard requirement, connections made at college can help secure a better job down the road.

Many college students also discover unknown passions through classes and end up in careers they didn't even know existed.

As a result of these and other reasons, college is still worth the time and money for most students.

Related: Millennial Spending Habits & Income Statistics to Know

How Much to Save for Your Kid's College Costs

If you start saving for your child's college education early, you can help set them up for a better financial future. But that’s usually easier said than done.

Not only is saving for college difficult, but knowing how much to save can be complicated, too. As a result, parents have many questions when it comes to savings goals. For instance, parents often ask if they should try to save enough all by themselves to cover the total cost to obtain a four-year degree. Knowing exactly how much to save is another head-scratcher for most parents. And whether a child should pay some of the costs is another puzzler.

Let’s take a look at these common questions.

Should You Save to Cover the Entire Cost?

Every family's financial situation is different, so how much of your child's college costs you should cover is a personal decision. It should also depend on how much you’ve saved for your own retirement, since most financial experts recommend that your first priority should be your own financial security in your golden years. (It’s akin to securing your own airplane oxygen mask first before those of your dependent passengers.)

When deciding how much to save, we recommend first determining the likelihood of your child attending college. If you aren't certain about their desire to attend college, squirreling away too much for higher education might not be the smartest choice—especially if you’re contributing to a 529 plan, since you could be hit with a penalty if leftover money in a 529 plan is used for anything other than qualified education expenses.

Next, consider your child’s interest in going to a public vs. private college, and to an in-state vs. out-of-state school. As noted above, college costs vary widely, and an in-state, public college is usually considerably less expensive than a private university.

Based on which type of school and school location your child is most likely to attend, you should be able to come up with a rough estimate of how much everything will cost.

As a general rule of thumb, we suggest aiming to cover about half the total cost of college as an initial savings goal. That leaves some room for potential scholarships or other financial aid to cover part of your child’s college expenses while lowering the risk of having leftover funds in a 529 plan.

Another option is to have your child take on some student loans to cover the remaining costs. It will also give them some skin in the game, which might make them take college more seriously and study harder.

You can also encourage them to take core classes at a junior college near home to complete their basic requirements before attending a public or private four-year college. That will likely help bridge the gap between the amount you’ve saved and the total costs of your child’s college education.

Related: Best Ways to Save Money for Teenagers [With or Without Jobs]

How Much Should Your Child Contribute?

Having your child contribute to his or her own college fund is another way to reach your overall college savings goal. However, how much your child saves for college (if anything) is completely up to you and based on your family’s financial situation and values.

For example, suppose you're in an excellent spot financially and want your child to focus entirely on impressing the college board and participating in extracurricular activities. In that case, you might not ask your kid to contribute anything.

However, if you’re not sure you can reach your savings goal, it's certainly acceptable to ask your child to contribute to their college savings, especially if their heart is set on a particularly expensive school.

Teenagers can have summer jobs, but there are plenty of other ways for teens to make money (including online jobs). Some of the money your kids earn before they’re off to college can be used to pay for college. Student income earned while working during college can also be put toward higher education expenses.

Either way, don't keep college expenses a secret from your child. Explain the cost differences between a private college and a public college as well as the price differences between an in-state college and an out-of-state college.

If you want them to help save for college, make sure you set clear expectations and don't give the impression that you’ll cover everything if you actually won't.

Related: Best Side Hustles for Teens

How Much Should I Be Saving for My Child?

Not every student pays the same amount for college. Some students attend an expensive private school, while others stick to a more affordable public school in their home state. In addition, some kids get scholarships or grants, while others don’t qualify for any financial help.

Plus, not everything always goes according to plan. For instance, a student who expects to get an athletic scholarship might get a severe injury and lose out on the free ride. Therefore, you need to have a backup plan.

To estimate how much you should save for college, try using the "2 for 10" method. With this technique, multiply your child's age by $2,000 for every $10,000 of college costs you plan to cover per year. The exact formula is:

($2,000 x Child’s Age) x (Annual Costs to Cover ÷ $10,000) = Optimal Savings To Date

So, for example, let's say Charlie wants to see if his college savings are on track for his son Greyson, who is 14 years old. Greyson wants to attend a private college that currently costs $50,000 per year.

Charlie plans to cover 60% of the total costs for four years of college with his savings, which comes to $120,000 ($200,000 x .6 = $120,000) ... or $30,000 per year. Charlie expects scholarships and financial aid to cover the rest. To estimate how much he should have saved by now, Charlie first multiplies $2,000 x 14 (i.e., Greyson’s current age), which equals $28,000. He then multiplies that amount by three (i.e., the amount he plans to pay each year divided by $10,000), which equals $84,000. That’s how much Charlie should have saved for Greyson’s college expenses.

Fidelity Investments has a college savings calculator on its website that uses this model. The online tool will also help you come up with a monthly savings goal if you’re behind where you ought to be and need to catch up.

Related: Best Investing Apps for College Students to Start Investing

Tax-Smart Ways to Save for College

If you’re saving for a child’s college costs, the most important thing is to have a savings goal and plan. But if you’re going to the trouble of planning out a savings strategy, you might as well factor taxes into the equation.

You’ll have to put your college savings in some sort of an account. (Please don’t hide it under your mattress!) Fortunately, certain types of investment accounts come with tax benefits that can save you hundreds or even thousands of dollars while you’re saving for college.

Here are three such tax-advantaged investment accounts that you should consider for your education savings.

1. 529 Plans

A 529 plan is designed specifically for college savings (and sometimes K-12 tuition or trade schools). It's a tax-advantaged investment account you fund with after-tax money. Basically, that means you don’t get any federal tax deductions when you put money in a 529 plan, so you ultimately end up paying income tax on the money before you put it in the account.

However, there are two other tax benefits that you do get with a 529 plan. First, you get tax-free growth on the earnings. Second, when it comes time to make withdrawals, you don't pay taxes on any of the money as long as you use it for qualified higher education expenses.

Besides tuition, qualified expenses can include fees, books, room and board (must be at least a half-time student), certain technology (such as a computer), special needs equipment, student loan payments (up to $10,000), and more.

YATI Tip: There are actually two types of 529 plans: investment plans and prepaid tuition plans. With a prepaid tuition plan, you pay tuition and fees at the current rate for college expenses to be incurred years in the future. Our discussion focuses on investment plans, which are by far the most popular type of 529 plan.

You can only use 529 funds for qualified education expenses

Unfortunately, you can only use 529 plan funds for qualified education expenses. If you use the money for anything else, the earnings (not contributions) withdrawn are subject to income tax at ordinary tax rates and a hefty 10% penalty.

There is no way out of the taxes if you use 529 funds for non-education purposes, but the IRS will waive the penalty in some instances. For example, you won't pay a penalty if the child does any of the following:

- Earns a tax-free scholarship or fellowship grant

- Becomes disabled or dies

- Attends a U.S. military academy

- Receives veterans’ educational assistance, employer-provided educational assistance, or any other tax-free payments as educational assistance

The 10% penalty is also avoided if 529 plan funds are included in income only because qualified education expenses were taken into account in determining the American Opportunity or Lifetime Learning tax credit.

Although a 529 account can only be established for one child, you don't have to use all of the money in an account for the education of the child for which the account was created. So, for example, if there’s still some money remaining after the child's education is complete, you can transfer the funds to a 529 plan established for a family member (e.g., a sibling).

When is a 529 plan a bad idea?

Using a 529 college savings plan is a bad idea if you aren't confident your child will attend college. If your kid doesn't go on to a public or private university, you'll have to pay taxes on the gains and a 10% penalty.

529 plans from Backer

- Available: Sign up here

- Price: Flat fee of $1.99 per contribution

A great 529 plan option to consider is Backer. Backer—a hassle-free 529 savings plan where your family and friends can play a role—has helped families save more than $30 million toward college in just minutes.

You can use the 529 plan to put your child on track to afford college; all while remaining invested in an asset class that will grow over time.

Backer allows you to invest in a portfolio of low-cost index funds that track major indexes of large company stocks (S&P 500), small-cap stocks (Russell 2000), international company shares (MSCI EAFE Index), and U.S. government bonds (Barclays Aggregate Bond Index).

Related: Best Alternatives to 529 Plans [Other College Savings Options]

2. Roth IRA Accounts

Roth individual retirement accounts (IRAs)

are designed primarily for retirement savings, but there are other ways to take advantage of the tax-free growth they offer—including saving for college.

Like 529 plans, a Roth IRA investment account is funded with after-tax money and the earnings grow tax-free in your account. You can take the contributions out at any time, but withdrawing earnings before age 59½ or before you've had a Roth IRA for at least five years typically results in a 10% penalty.

However, there are a few exceptions to the penalty rules. One of them allows you to withdraw any amount from a Roth IRA to pay higher education expenses for yourself, your spouse, your child or grandchild, or your spouse’s child or grandchild. For this reason, Roth IRAs are sometimes used to save for college.

As with 529 plans, money from a Roth IRA can be used penalty-free for such things as college tuition, fees, books, room and board (must be at least a half-time student), certain technology (such as a computer), and special needs equipment. It can’t be used for student loan payments or K-12 tuition.

Roth IRA contribution limits

There are limits on how much money you can put in a Roth IRA each year.

First, contributions for the year can’t exceed the account holder’s “earned income” for the year. According to the IRS, earned income includes “wages, salaries, tips, professional fees, bonuses, and other amounts received for providing personal services.”

There’s also an annual contribution limit based on your age (the limit is adjusted annually for inflation). For 2023, the most you can put in a Roth IRA is $6,500 if you’re under 50 years old at the end of the year. If you’re 50 or older by Dec. 31, 2023, you can put in up to $7,500 for the year.

When is a Roth IRA better than a 529 plan?

If you’re not sure your child will attend college, then saving for college with a Roth IRA might make more sense than with a 529 plan. That’s because you can just keep the money in the account and let it continue to grow tax-free for retirement if you don’t end up using the money you saved for your child’s college education.

E*Trade Roth IRAs

- Available: Sign up here

- Price: $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, and Treasuries

Most people know E*Trade as one of the leading providers of brokerage accounts, but you can also put the powerful platform to work saving for retirement … or for your child’s education.

Within an E*Trade Roth IRA, you can build a personalized portfolio through thousands of stocks, bonds, ETFs, and mutual funds, or you can have E*Trade select your holdings for you through its Core Portfolio robo-advisory service ($500 minimum investment).

Just like with its individual brokerage accounts, E*Trade Roth IRAs offer zero-commission stock, ETF, Treasury, and options trading. It also has a leg up on some platforms by offering $0-commission mutual fund trading.

And if you want to learn more about investing, E*Trade also boasts educational resources, including articles, videos, classes, monthly webinars, and even live events.

Visit E*Trade to learn more or sign up today.

Related: Roth IRA vs. 529 Plan: Which Is Better For College Savings?

3. Custodial Accounts

Custodial accounts

are run by an adult custodian (often a parent) for a beneficiary (usually a child). While the custodian can invest the money in the account, the funds legally belong to the child. The child gains control of the account once he or she reaches the age of majority for their state, which is typically when they turn 18 or 21 years old.

Withdrawn money must be used in ways that benefit the child, but there are many, many possible uses. One popular use of funds is for the child’s college costs.

However, if the funds don't go toward paying for college, that's fine too. There are no penalties for using the money in a custodial account for something else that benefits the child. Then, once the child takes over the account, the funds can be used for any purpose at all.

There are no limits on how much you can contribute to a custodial account, but you might not want to exceed the annual federal gift tax limit. For 2023, the limit is $17,000 ($32,000 for married couples filing a joint tax return). If you exceed the limit, you need to tell the IRS and you might have to pay gift tax on the amount (although in most cases you won’t owe any tax at that time). The IRS will also deduct the excess amount from your lifetime estate and gift tax exemption, which is $12.92 million ($25.84 million for married couples).

YATI Tip: Both the annual limit and lifetime exemption are adjusted annually for inflation.

You’ll also have to pay capital gains taxes on any assets held in a custodial account if those assets are sold.

Tax benefits for using a custodial account

While money in a traditional custodial account doesn’t grow entirely tax-free, some of the earnings aren’t subject to income tax and another portion is taxed at the child’s tax rate, which is usually lower than the parent’s rate. Unfortunately, thanks to the “kiddie tax,” the rest is taxed at the parent’s rate.

For the 2023 tax year, earnings in a custodial account are taxed as follows:

- $0 through $1,150 is tax-free

- $1,151 through $2,300 is taxed at the child’s marginal tax rate

- $2,301 or more is taxed at the parents’ marginal tax rate

You can also open a custodial Roth IRA or custodial 529 plan. The tax benefits generally associated with Roth IRAs and 529 plans will generally be available with the custodial versions of those accounts.

Custodial account’s impact on financial aid

Be warned, however, that using custodial accounts to save for college can have a negative impact on your child’s financial aid eligibility. When applying for financial aid, custodial accounts are considered assets of the child, while 529 plans are typically considered assets of the parent and Roth IRA funds aren’t included in financial aid calculations.

Since students are expected to use a higher percentage of their assets to pay for college (20%) than what their parents are expected to pay (up to 5.64%), the student’s overall expected family contribution will be higher with a custodial account than with a 529 plan or Roth IRA. And as the amount your family is expected to pay rises, the financial aid your child is likely to receive drops. (We discuss expected family contributions in more detail below.)

When does a custodial account make sense for college savings?

There’s a great deal of flexibility when it comes to spending money in a custodial account, which makes it a good choice for educational savings if you’re not sure college is in your child’s future and you can handle the potential negative impact on financial aid.

For example, suppose your child doesn’t need money for college, but does need it for something else—like braces or a car. Unlike 529 plans, there’s no penalty if money in the account is used for something unrelated to education. And unlike Roth IRAs, there are no early withdrawal fees if you take money out of a custodial account for non-educational expenses before a certain age.

Custodial accounts with EarlyBird

- Available: Sign up here

- Price: $2.95/mo. for one child, $4.95/mo. for families with 2+ children

EarlyBird

is a mobile app that allows parents and guardians to set up a custodial account, where they can quickly start investing for their children.

This app provides a convenient and inexpensive way to gift money to a child, with funds available to go toward any expenses that benefit the child.

When parents or guardians set up a new custodial investment account through EarlyBird, they must start with a $15/month recurring contribution minimum. However, you can change that recurring contribution amount higher or lower as your budget allows or necessitates.

Consider opening an EarlyBird account today and receive $15 to get you started after opening your account. Also, EarlyBird currently is in the “early access” stages of a cryptocurrency offering. Through a partnership with Gemini, one of the world’s largest and most secure crypto exchanges, EarlyBird also offers a crypto wallet that can hold Ethereum and Bitcoin when you sign up for an investment account. You will receive $25 when you open your wallet to invest in Ethereum or Bitcoin, and you can also earn a $50 referral bonus, which you can invest in the same token of choice, when you refer three other families.

Related: Coverdell ESA vs. 529 vs. Custodial Account [College Savings + More]

What Is the Best Way to Save for Your Child's Future?

The best way to save for your child's future is to save early, save regularly, and have the proper amount of risk for your investments.

The earlier you start to save for your child, the more money you can accumulate. The same amount of money saved a few years earlier can be worth far more than saved later because of the power of compounding.

Setting aside money for your child's future as part of your regular monthly budget helps make saving for college more manageable and steadily raises the funds needed for a college education.

It's also important to invest some of the savings in ways that will help it grow. Funds sitting in a standard savings account can actually lose value when you factor in inflation. On the other hand, money in high-yield savings accounts or brokerage accounts that are invested in ETFs, mutual funds, or blue-chip stocks have the potential to grow significantly.

Related: Investing for Young Adults: Best Investments to Make

Make College Savings Part of Your Overall Financial Planning

Households function better financially when there’s a budget in place and a plan for covering upcoming major costs, such as the cost of college after your child graduates high school.

The easiest way to save for your child's college is to make it part of your overall financial planning. To do this, you'll need to find out approximately how much your child's education will cost.

As noted earlier, the cost of college can vary greatly depending on whether your child is looking at private schools or public schools, and if he or she is interested in attending an in-state or out-of-state school.

Once you have an estimated total cost in mind, consider how much you can realistically contribute on a regular basis to put toward college expenses.

While completely covering the cost is ideal, it might be financially wiser for you to cover 50%, for example, and have the other half be paid through a combination of scholarships, financial aid, and money your child has saved.

Then, you can calculate a monthly contribution and put that cost in your budget with all of your other usual monthly expenses. Preferably, set up a direct deposit to a 529 account, Roth IRA, or custodial account.

Related: Simple Steps for Making a Budget in Excel [Free Template]

Related Questions on How Much to Save for Kids' College

Still have a few questions? Here are answers to more questions parents often have.

How Much Should I Save Each Month for My Child's College?

Before calculating the monthly contribution you should make toward your child's future education, you need to decide how much you'll be saving for college overall.

Look at the expected tuition cost as well as other expenses, such as housing. Subtract how much you expect to come from financial aid, scholarships, and the amount your child can contribute through working or student loans.

See how much time you have to save. For example, if you started saving when your child's age is five and they just entered kindergarten, you might have 13 years (156 months) to save.

Now that you have an estimated lump sum college savings figure and know how much time you have to save, you can reverse engineer that amount with a moderate return expectation (7% per year) and break it into monthly contributions.

You aren't just dividing by the number of months because the money is invested and expected to grow. Make sure to add in a return, but be reasonable.

If possible, consider "superfunding" a 529 plan. Superfunding a plan means you can front-load five years of contributions at once without needing to pay gift taxes. Superfunding allows your funds to compound over several years and can lead to much more overall growth.

How Much Should I Have Saved for College by Age?

The earlier you start saving for your child's college expenses, the more compounding works in your favor, and the less you'll need to contribute overall.

Let's pretend you estimate your child's college will cost around $22,000 annually ($88,000 total), and you plan to cover half of it with savings. As a result, your savings goal is $44,000 in total. You also expect moderate investment returns of 7% per year.

In scenario one, you start contributing to a college fund when your child is born. That gives you 18 years to save. To make your goal, you would need to save and invest about $108 each month.

Now, pretend all of the above conditions are the same, but you don't start making monthly contributions until your child is 10 years old. You will then have to contribute about $357 each month to reach your goal.

In scenario one, you will have to contribute a total of $23,328 ($108 x 12 months x 18 years). In scenario two, you will have to contribute a total of $34,272 ($358 x 12 months x 8 years). So, as you can see, the earlier you start saving, the less you need to save.

YATI Tip: Try investor.gov's savings goal calculator to see how much you need to save each month to reach your college savings goal.

Related: Best Bar Mitzvah Gift Ideas [Financial Gift Ideas That Last]

Should You Count on Financial Aid to Fund Your Child's College Education?

If your child meets the basic eligibility criteria to receive federal student aid, the aid office at their college of choice will calculate how much assistance your child is eligible to receive. They determine that amount by looking at the cost of attendance (COA) and your expected family contribution (EFC) to the COA.

The COA estimate includes:

- Tuition & fees

- Room & board

- Books, supplies, and miscellaneous expenses

- Child care cost (if applicable)

- Disability-related costs (if applicable)

- Study-abroad program costs (if applicable)

There are many factors that go into your EFC, including your family’s:

- Taxed and untaxed income

- Assets

- Benefits (such as Social Security or unemployment)

- Size

- Number of family members attending college

The aid office will take the COA and subtract your EFC to find how much need-based aid your child can get. As a result, a higher EFC typically means less in financial aid.

Unfortunately, the EFC is often higher than what families can actually afford to pay. Therefore, even if you reasonably expect to receive some financial aid, it's wise to save for some of your child's college expenses if you can, since they might not be able to get enough aid to cover all the costs.

How Do I Start a College Fund For a Baby?

There are several ways to start a college fund for a baby. One option is to open a 529 plan. You purchase these directly through a state or organization that sponsors 529 plans.

Once set up, you choose an investment plan (there are usually just a few options) and set a monthly contribution amount. Lump-sum payments work as well.

Another option is to open a Roth IRA, if you don't already have one. This account must be in your name, rather than your baby's name, because you must have earned income to contribute to a Roth IRA and few infants have a job. You can open a Roth IRA with any major brokerage firm.

A custodial account is another popular way to save for the cost of college. This type of account is in the baby's name and the funds legally belong to the child as soon as they are deposited into the account. You can open a custodial account with a brokerage firm or finance app like EarlyBird.

All three of these accounts are funded with after-tax money and are investment accounts. Investment accounts can accumulate far more money than a traditional savings account.

What Happens to Money Left in a 529 Plan?

You have several options if money is left in a 529 savings account after your child has completed college. If there’s a chance your child will attend grad school, you can keep the money in the account until that decision is made.

One of the most popular ways to use leftover money is to transfer money in the account to another family member. It doesn't have to be an immediate family member, like a sibling, though that is a popular choice.

Changing the beneficiary to a family member doesn't count as a distribution. Therefore, you don’t have to pay income tax on the money and the 10% penalty is avoided.

Up to $10,000 can also be used to pay off student loans for the beneficiary or a sibling.

In addition, you can also transfer leftover 529 funds to a family member's ABLE account, which is a savings account for people with disabilities. Money from a 529 plan can also be transferred to an ABLE account set up for the same beneficiary as the 529 plan. If moving money to an ABLE account, just make sure the transfer doesn’t exceed the ABLE account’s annual contribution limit.

Starting in 2024, a beneficiary can also transfer up to $35,000 of leftover money in a 529 plan into a Roth IRA in his or her name. Any rollover is subject to annual Roth IRA contribution limits, and the 529 account must have been open for at least 15 years.

Of course, you can always withdraw the extra funds and use them for non-qualifying expenses if you're willing to pay taxes and the 10% penalty on the earnings.

Related:

- How to Get Free Stocks: Investing Apps w/Free Shares

- Allowance for Kids: How Much to Give [Age Appropriate Amounts]

- Does My Child Have to File a Tax Return?

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.