How Much Does Trading Cost the Buy Side?

One of the things that is hard to appreciate about U.S. stock markets is just how huge they are.

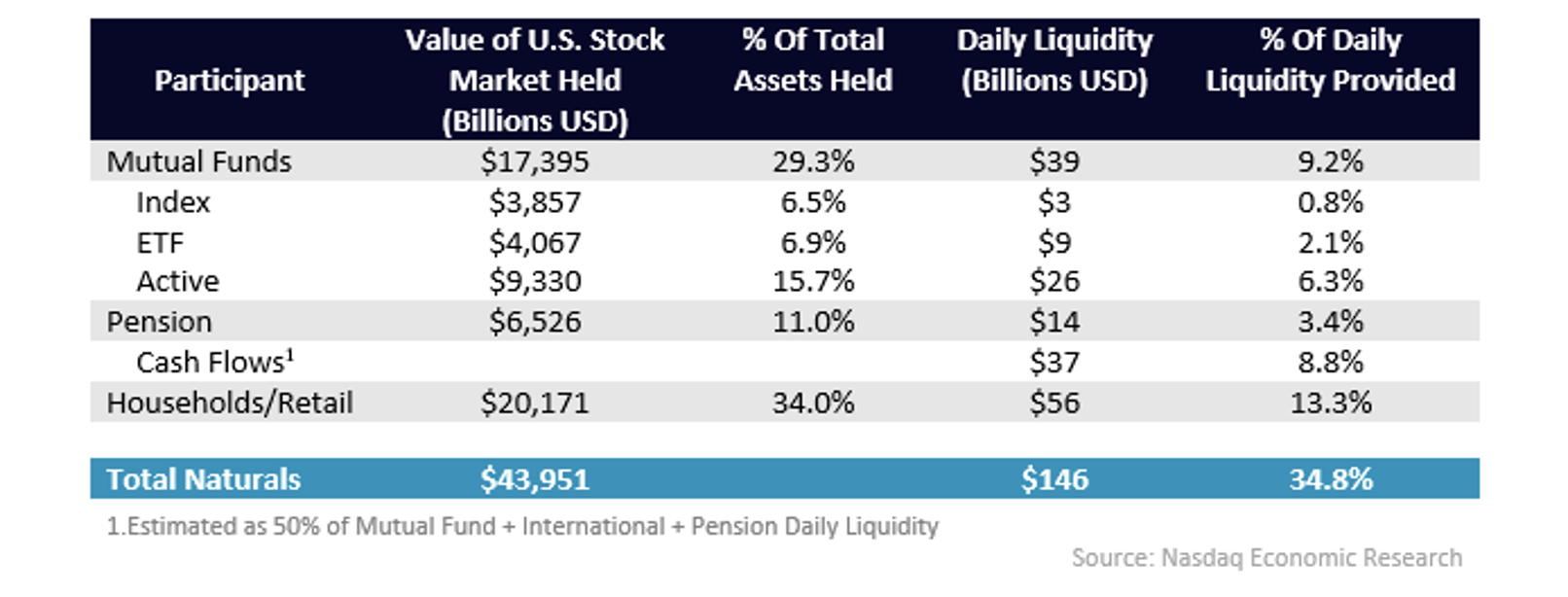

The U.S. has the largest market cap (representing $59 trillion of market cap). Based on our estimates, U.S. households own around three-quarters of all stocks via pension and mutual funds ($24 trillion) as well as direct holdings ($20 trillion), adding to around $44 trillion in investments at current market levels (Table 1).

U.S. stocks are also the most liquid (trading $106 trillion in 2021). But how much trading do investors do, and what are the implicit costs of the liquidity they demand?

How much trading do investors do?

As we’ve seen in the past, markets are an ecosystem of different participants, with different ways to invest. Products like futures and exchange-traded funds (ETFs) often trade a lot on their own but affect stocks less than you might think.

Using multiple sources, we previously estimated how much trading different participants did. This showed that market makers and arbitrage strategies, whose purpose in the market is to keep process efficient and spreads tight, likely trade even more than real investors. However, most of that trading is important to reducing trading costs and mispriced liquidity for real investors.

Chart 1: In 2019, we estimated institutional and retail add to a much smaller proportion of trading than the share of assets they represent

How much trading do U.S. investors do?

Today we focus on real U.S. investors (U.S. pensions, mutual funds and direct holdings).

We start by marking-to-market our 2019 estimates of trading and assets using newer 2021 prices and data.

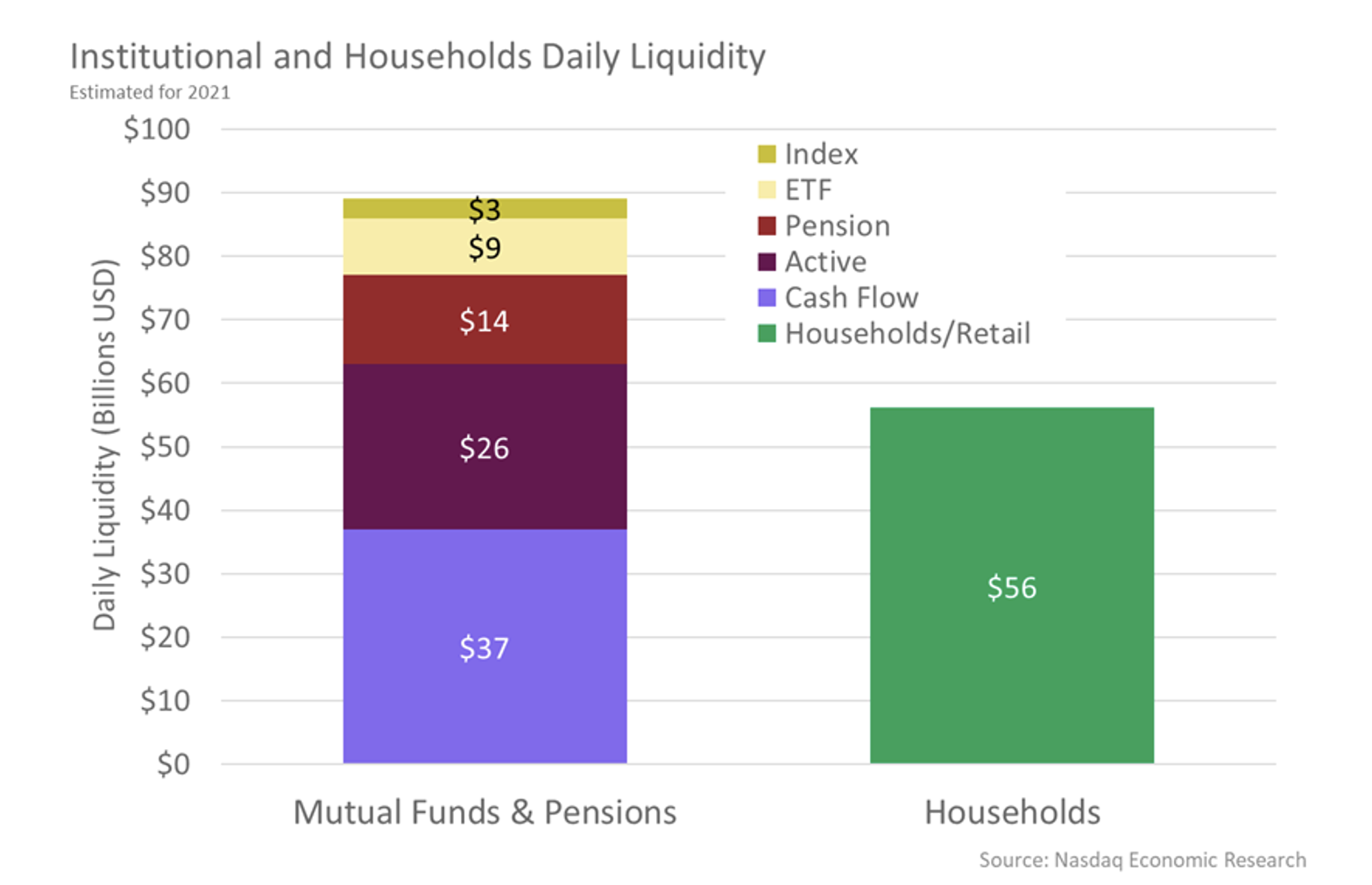

We adjust institutional trading (mutual funds and pension funds) for stock price appreciation. We calculate that their trading, including cashflows, likely adds to around $90 billion each day, or 21% of all buying and selling of stocks in the market. Over a year, that adds to around $23 trillion in trading.

Many recent studies suggest retail trading has increased over the past two years. We have reestimated retail trading to account for this as well as stock prices rising, to be likely closer to $56 billion each day, or 13% of all daily buying and selling.

We note that this is higher than our retail activity tracking estimates. That’s likely due to additional retail trading using limit orders, which are unable to be distinguished on the consolidated tape as they mostly rest on exchange and happen at full ticks.

However, it is closer to Rosenblatt’s estimates, done using monthly 606 data, which suggest retail accounts for 18%-24% of all shares traded once you account for both sides of each trade. However, we note that because retail tends to focus on smaller-cap stocks, they account for much less of the value traded (which is what we are comparing here).

Table 1: We reestimate U.S. investors new assets and trading contributions using 2021 data

Importantly, breaking out index and ETF funds from active funds highlights their different portfolio turnover and shows how little trading index funds tend to do. Moreover, as we’ve previously shown, index funds tend to concentrate their trading on close on index rebalance days.

That means active funds (and hedge funds), who spend resources analyzing stock fundamentals, are also much more important to price discovery.

Chart 2: Breakdown of U.S. investor assets and trading

Trading costs include more than commissions

All traders have a mix of explicit and implicit costs to trade, including:

- Commissions: Most institutional traders pay commissions to their brokers. Although for many retail investors, since late-2019, trades have been commission-free.

- Spread costs: All investors have to decide whether to try to capture spread or capture liquidity when they trade. However, those trying to capture spread won't always get a trade at that price. When that happens, they need to adjust limits higher as prices move up, paying the spread or more just to complete a trade.* In fact, research suggests even sophisticated broker algorithms cross spread 20% more often than they capture it. In short: spread costs are hard to avoid.

- Market impact: larger traders, like mutual funds, also need to “work” their orders. Over time, their buying demand shifts the equilibrium price of the stock higher. That “drift,” caused by the changes to supply and demand, is known as market impact.

There is also an opportunity cost for those who didn’t finish a trade and missed the subsequent price appreciation.* But they are much less obvious, harder to measure, and something there is little public data on.

Mutual fund trading costs could add to around $70 billion a year

We know that mutual funds do the most trading for investors and have the largest trades, so it’s interesting to consider what their trade costs are.

According to Bloomberg, mutual fund commissions add to around $9 billion each year. Commissions essentially include all the fees covering access to broker research, their sophisticated algo software and router hardware, as well as the fees exchanges charge to brokers for trading and data and colocation.

Data on market impact and spread costs are harder to find. However, one of the industry experts in institutional trading costs is Virtu’s institutional trading business. They have been tracking mutual shortfall from real trades around the world for years.

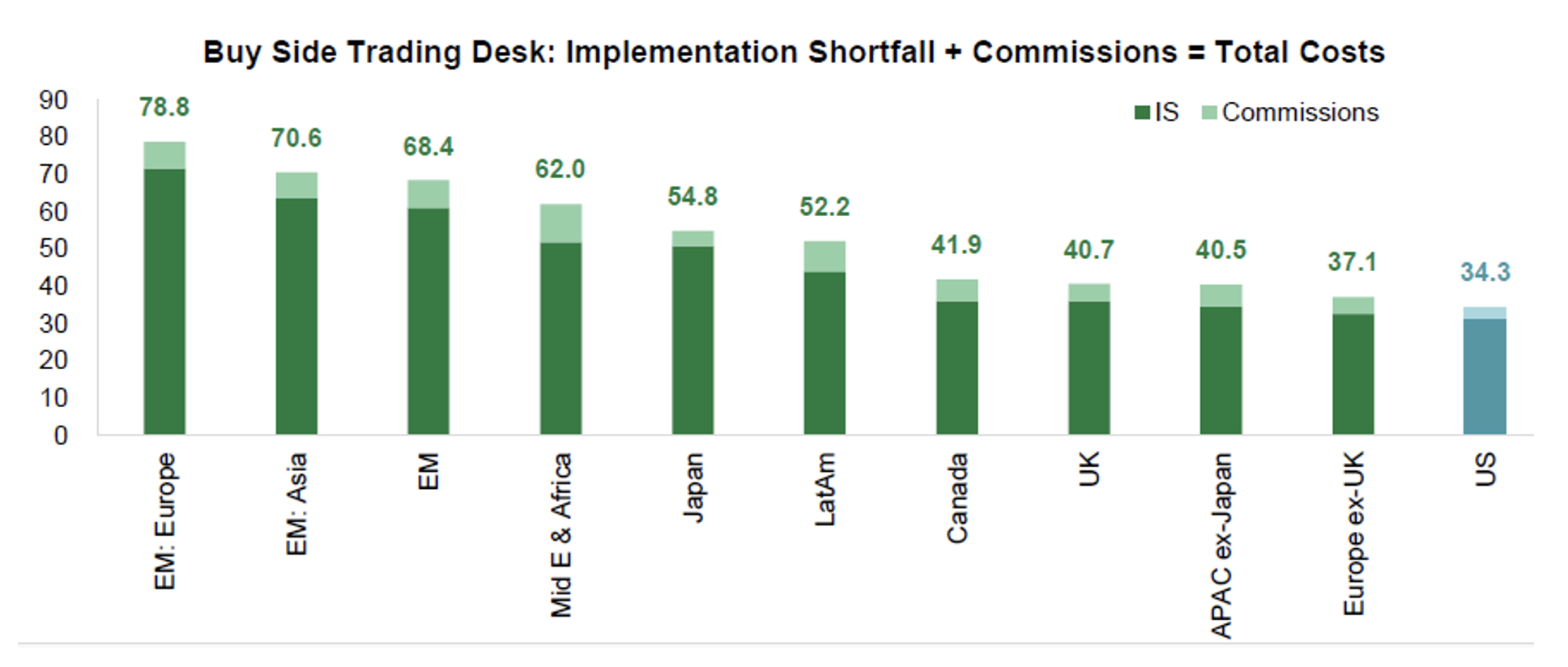

According to their data, the U.S. has the lowest trading costs in the world. Even after adding commissions, in a recent SIFMA study, total costs added to less than 0.35% per trade. They also estimated that shortfall made up almost 92% of this total or 31.5 basis points.

Chart 3: U.S. trading costs are the lowest in the world

Source: SIFMA Global Equity Markets Primer (2021)

The shortfall includes a combination of spread and impact costs, although it is often measured from the mid-point between the bid and offer when the full (parent) order is first created. Breaking out spread and impact costs requires knowledge of how wide spreads are for different stocks and how much an algorithm needs to cross spreads to complete an order – which itself is driven by how fast an investor wants to trade.

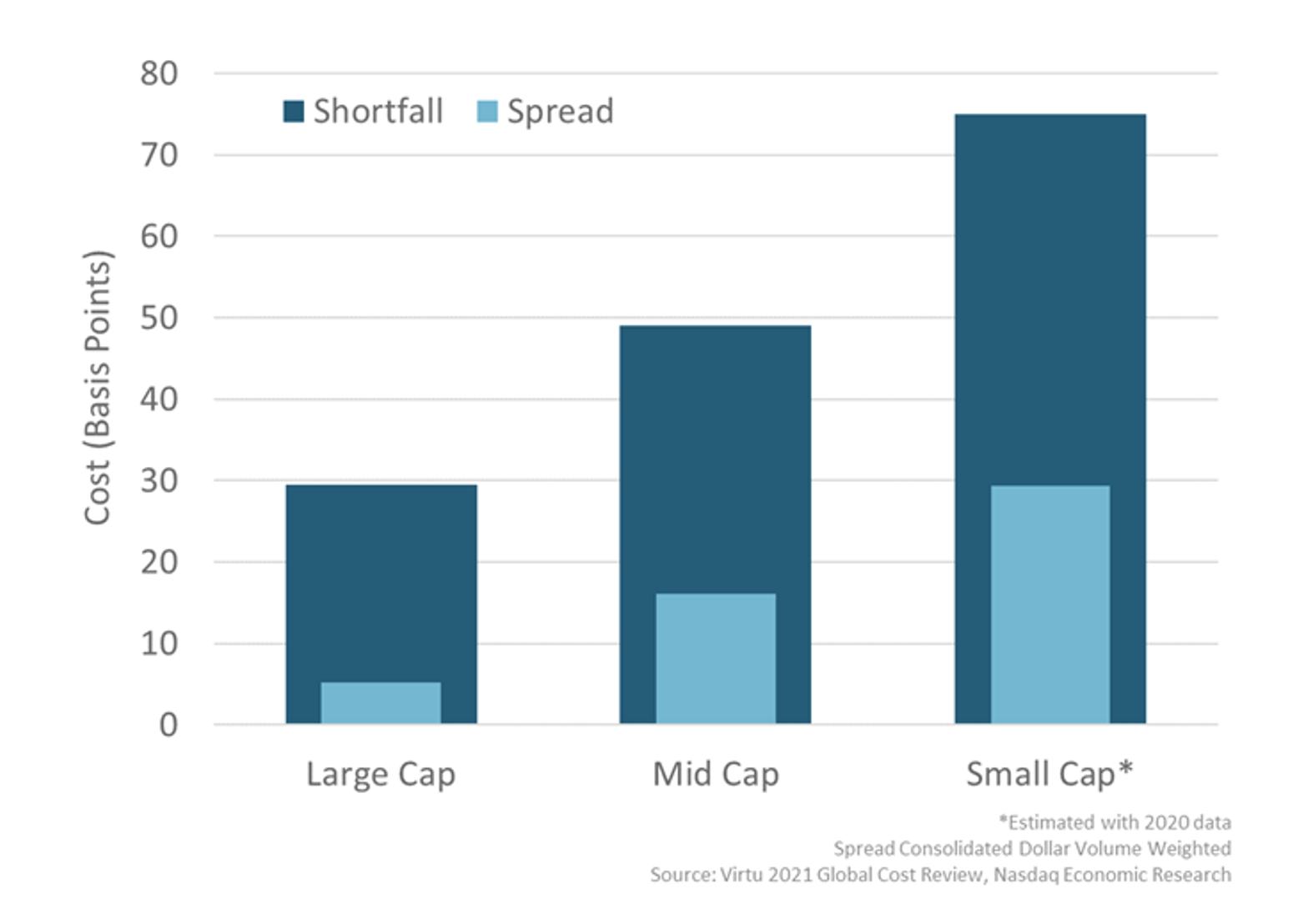

However, we can see that wider spread stocks cost more to trade than tighter spread costs by comparing shortfall cost and spreads in U.S. large and small-cap stocks. That’s confirmed by how most industry TCA forecasting models work, as well as results from the U.S. Tick Pilot. Wider spreads increase costs to trade.

Importantly, turnover is surprisingly consistent across most stocks in the Russell 3000 – so building a similar “sized” position, representing 1% of shares outstanding in a large-cap or a small-cap stock, should take roughly the same time and signal demand to the market in the same proportions.

Chart 4: Small-cap costs and spreads are both higher

So, now we understand all this, we can get back to estimating the original question. Over a whole year, what does it cost investors to trade? Here is some back-of-the-envelope math:

- Mutual and pension funds trade around $90 billion each day, including cashflows

- That adds to around $23 trillion over a year

- If the average trade costs 0.31% in shortfall, that adds to around $70 billion each year

Clearly, these are big numbers, and this is just for U.S.-based institutional (managed) assets.

As we said at the beginning, U.S. stock markets are so huge sometimes it’s hard to put large totals into perspective. For an investor, this represents frictions of just 0.33% of all institutional assets. So, although trading costs impact returns, it affects outperformance and income less than it might seem.

Efficient markets are important

The reason this is important is because the scale of the number shows how much of a difference efficient markets make. Every basis point of shortfall adds to around $2.2 billion in trading impact costs. That’s why we think tight spreads and actionable liquidity is also important.

Small improvements in trading could easily generate large economic savings for U.S. mutual fund investors, which should also improve costs of capital for issuers. It’s why we spend so much time here looking at trading microeconomics.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.