Satoshi Nakamoto is the mythical founder of the world's first and largest cryptocurrency and network, Bitcoin (CRYPTO: BTC), which now has a market cap of over $1.25 trillion.

Of course, no one knows Nakamoto's true identity. This could be a single person or a group of people. Either way, the identity remains a successfully guarded secret.

However, there have been many guesses over the years, and HBO has a new Bitcoin documentary premiering this week that claims to have discovered who Nakamoto is. Regardless, one thing is certain: Nakamoto owns a boatload of Bitcoin, which he or she supposedly mined in the early days of the network. The amount of Bitcoin tokens Nakamoto owns will truly blow your mind. Let's take a look.

Nakamoto is one of the richest people in the world

That's right, the number of Bitcoins owned by Nakamoto makes him one of the richest people in the world. It's a pure paper profit, of course, until the Bitcoin holdings are converted into traditional fiat currencies. Still, there's no denying that Satoshi Nakamoto's Bitcoin-based wealth is impressive.

Now, you might wonder how people can know how much Bitcoin Nakamoto owns if the world doesn't even truly know the founder's identity. That's made possible by the decentralized Bitcoin network and its ledger containing all Bitcoin addresses that can't be altered.

While it's impossible to know just how many addresses Nakamoto owns, several have been traced back to Nakamoto, including the first-ever address, which received an award of 50 Bitcoin by mining the first-ever block. It is referred to as the "genesis block." Estimates suggest that Nakamoto owns 600,000 to 1.1 million Bitcoin tokens. Based on Bitcoin's current price of roughly $63,100 (as of Oct. 8), that's a total value of $37.86 billion to $69.4 billion.

That would potentially make Nakamoto one of the 30 richest people in the world if he owns 1.1 million Bitcoins, and it's certainly possible Nakamoto owns more.

Here are a few other large whale holders of Bitcoin:

- Roger Ver ("Bitcoin Jesus") -- 131,000 Bitcoins ($8.27 billion).

- Tyler and Cameron Winklevoss -- about 70,000 Bitcoins ($4.42 billion).

- Tim Draper -- 29,656 Bitcoins ($1.87 billion).

- Michael Saylor (personal holdings) -- 17,000 Bitcoins ($1.07 billion).

Long-term investors

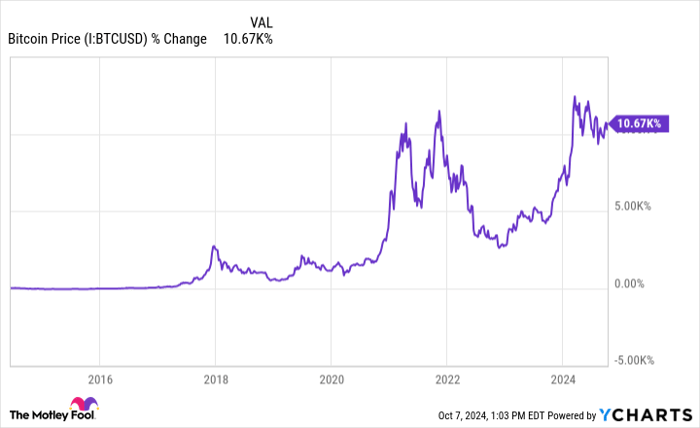

Bitcoin launched as a very speculative investment. The cryptocurrency has also been an extraordinarily lucrative investment since its launch in 2009.

Bitcoin Price data by YCharts

Say what you will about Bitcoin, but the largest investors have been longtime holders. None of Nakamoto's suspected wallets have ever sold or moved Bitcoin. And longtime enthusiasts remain convinced that it will gain more value over time. Large Bitcoin holders like Draper have predicted that Bitcoin could hit $250,000 over the next few years. Saylor has said he thinks Bitcoin will hit $13 million over the next two decades.

I certainly have no price target for Bitcoin, but I do believe it's a compelling investment due to its finite supply of 21 million tokens. Investors have viewed Bitcoin as a hedge against inflation and essentially a form of "digital gold." Additionally, spot-traded exchange-traded funds have also helped make Bitcoin more liquid and mainstream. The new class of digital assets is building a toolbox of traditional finance systems.

All things considered, Bitcoin has hung in pretty well in the face of intense interest rate hikes and a strengthening dollar over the last few years. At some point, perception becomes reality. I think Bitcoin has real staying power at this point and that investors can certainly have some exposure to Bitcoin in their portfolios.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Bram Berkowitz has a position in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.