Seven weeks into 2022, and the Nasdaq Composite (Nasdaq) is having quite a different year than its 21% gain in 2021, let alone its 44% gain in 2020.

In fact, the Nasdaq is down nearly 16.5% year-to-date (YTD) as investors digest rising interest rates, ongoing supply chain issues, inflation, valuation concerns, and geopolitical tensions.

Yet as bad as a 16.5% decline is, it's nothing compared to losses we've seen in individual names. To name a few standouts, consider that share prices of Meta Platforms, Netflix, Block, and PayPal Holdings are all down over 39% YTD, while Roku and Shopify are down over 48% and 54% YTD, respectively.

The sharp and swift slide across several tech stocks has erased trillions of dollars in value in a matter of weeks. Let's take a deep dive into the Nasdaq Composite to find out why the index is holding up relatively well.

Image source: Getty Images.

The Nasdaq Composite is top-heavy

When you hear that the Nasdaq is down 16.5%, you may think that this means the average stock in the Nasdaq is down 16.5%. That would be true if all Nasdaq components were weighted the same. But they are not.

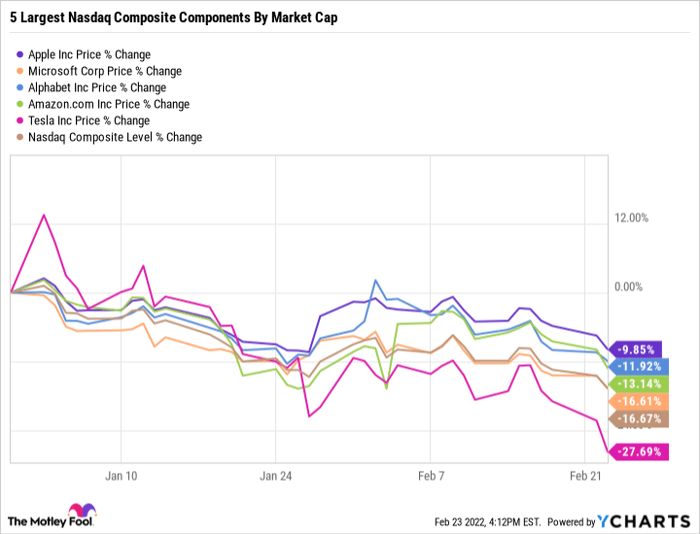

Because of their market cap size, Apple, Microsoft, Alphabet, Amazon, and Tesla make up -- wait for it -- 40% of the Nasdaq Composite. The top 20 holdings make up nearly 57% of the index. Put another way, the performance of those 20 largest components matters more than the performance of the other 3,673 components.

The main reason the Nasdaq Composite isn't down more is that those 20 largest holdings, as a group, have not gone down that much YTD. And the top five holdings are outperforming the Nasdaq Composite, thereby making up for steeper losses by smaller holdings.

AAPL data by YCharts

Aside from the strength of the top five holdings, there are other outperforming companies in the top 20 that offset some of the huge losses. Down 46.6% YTD, PayPal is the worst-performing stock out of the top 20 heaviest weighed Nasdaq components. But that loss is largely offset with just a 4% decline from PepsiCo, or a less than 15% declines from Costco Wholesale and Cisco Systems.

Another point worth mentioning is just five out of those 20 largest components are down over 20% for the year -- Adobe, Intuit, Netflix, Meta Platforms, and PayPal.

The combined market cap of those five companies is less than Apple. So, with Apple being down less than 10% for the year, there's only so much the Nasdaq can go down unless we see catastrophic drawdowns from several medium- to heavy-weighted names.

The Nasdaq has more than just tech

Aside from the importance of component weights, it's also worth understanding that technology stocks make up less than half of the Nasdaq Composite. Just 44% of the Nasdaq is in tech stocks. Other big categories include consumer cyclical at 16%, communication services at 16%, healthcare at 8%, and financials at 6%. The Nasdaq is certainly more concentrated in tech than the S&P 500 or the Dow Jones Industrial Average (DJIA). But it is pretty well-diversified across different subcategories of tech, as well as other sectors too.

This allocation has helped the Nasdaq beat the DJIA in nine out of the last 10 years. It's also why the Nasdaq is currently underperforming both the S&P 500 and the DJIA. But given its diversification, the Nasdaq is only so vulnerable to underperformances by smaller, unprofitable hypergrowth names -- many of which are down significantly YTD.

How the Nasdaq impacts your investments

The Nasdaq being down 13% in just the first seven months of 2022 isn't great. But it's also a manageable loss that is far more muted than the drawdowns we are seeing in individual names.

The Nasdaq's performance teaches us a few important lessons. The biggest lesson is that the equity values of large, profitable companies tend to hold up better than smaller names during a sell-off. It also tells us that it's easy to feel disconnected from the index depending on your particular investment strategy.

Value investors concentrated in consumer staples companies may look at the Nasdaq's 16.5% fall and think it's severe. Investors concentrated in small hypergrowth names may be down 30% or more on the year and wonder why the Nasdaq is only down 16.5%. Unless you own sizable positions in the top five Nasdaq names, your individual performance is likely to vary drastically from the Nasdaq.

One of the best ways to take ownership of your emotions during a sell-off is by knowing what you own and why you own it, as well as being invested in companies you believe in and are comfortable holding for several years. If you can't explain why you own a stock to a friend or family member, then there's little stopping you from selling it at a bad time, or not selling it if it becomes overvalued.

10 stocks we like better than Walmart

When our award-winning analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Walmart wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Stock Advisor returns as of 2/14/21

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Daniel Foelber owns PayPal Holdings and has the following options: long February 2022 $117 calls on PayPal Holdings, long January 2024 $120 calls on PayPal Holdings, long January 2024 $200 calls on PayPal Holdings, long July 2022 $160 calls on PayPal Holdings, long May 2022 $150 calls on PayPal Holdings, long September 2022 $210 calls on PayPal Holdings, short February 2022 $118 calls on PayPal Holdings, short February 2022 $130 calls on PayPal Holdings, short January 2024 $210 calls on PayPal Holdings, short July 2022 $165 calls on PayPal Holdings, short March 2022 $115 calls on PayPal Holdings, short March 2022 $120 calls on PayPal Holdings, and short May 2022 $155 calls on PayPal Holdings. The Motley Fool owns and recommends Alphabet (A shares), Amazon, Apple, Cisco Systems, Costco Wholesale, Meta Platforms, Inc., Microsoft, Netflix, PayPal Holdings, and Tesla. The Motley Fool recommends Adobe Inc., Alphabet (C shares), Intuit, and Nasdaq and recommends the following options: long March 2023 $120 calls on Apple and short March 2023 $130 calls on Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.